- The Intrinsic Value Newsletter

- Posts

- 🎙️ Salesforce: Agentforce vs. AI

🎙️ Salesforce: Agentforce vs. AI

[Just 5 minutes to read]

If you work at a large American company, there’s a good chance you use this company’s software every day. If you’re not in the corporate world, there’s an equally good chance you have no idea what this company does.

Salesforce is a customer relationship management (CRM) software company. Whenever a salesperson updates a deal, a support agent resolves a ticket, or a marketing email reaches a customer, Salesforce’s software is often running in the background.

What began as a straightforward idea to manage customer relationships in the cloud has grown into a 250-billion-dollar software company used by more than 90% of the Fortune 500. I’ll repeat this fact a couple of times today, because few other data points show how deeply entrenched Salesforce is in corporate America.

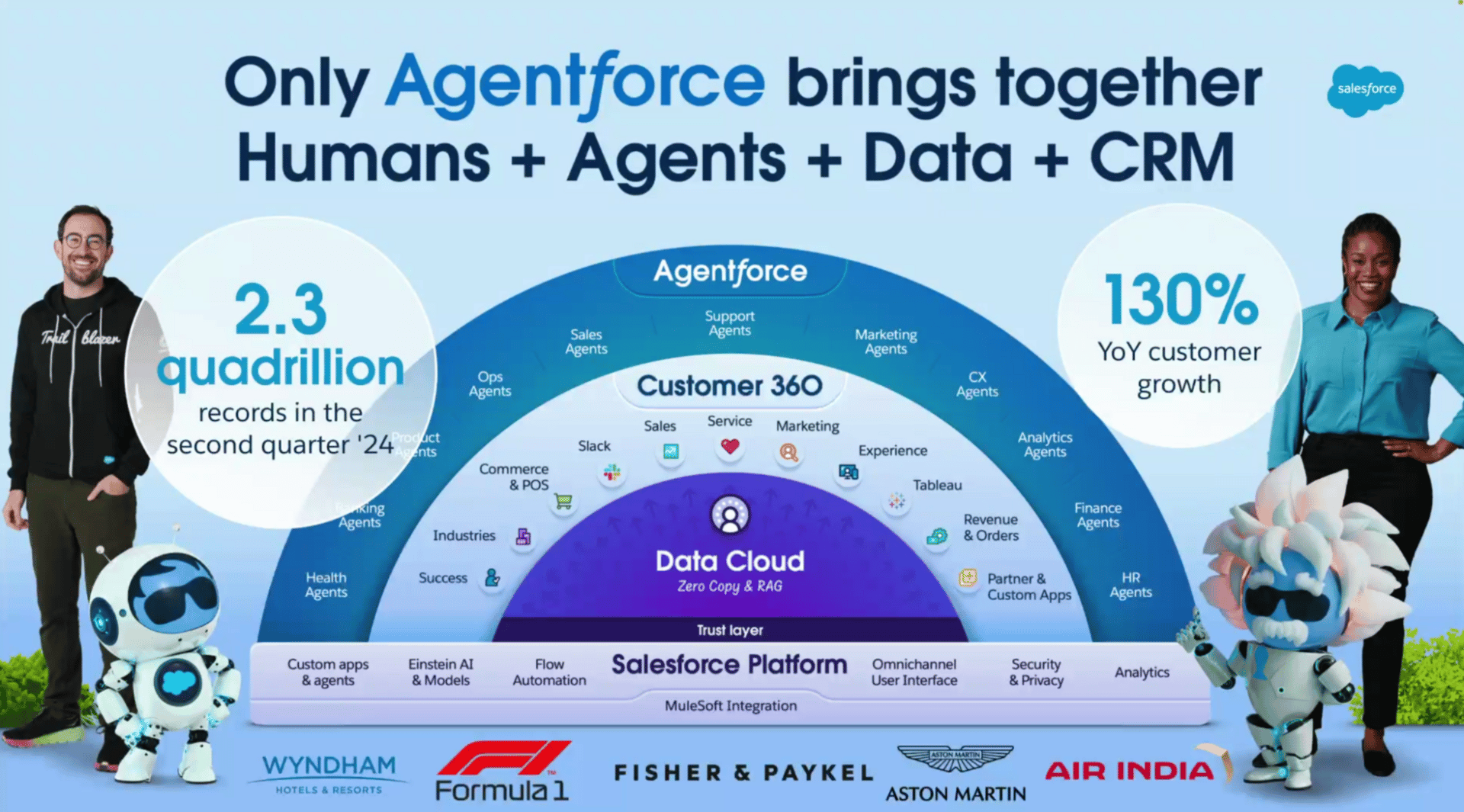

Now the company is entering a new phase with Agentforce, an AI platform designed to bring digital coworkers into everyday business workflows.

The question is whether this will be enough to fight off the “Software is dead” narrative. The market seems to bet on AI-native companies.

Let’s see if we agree!

— Daniel

Salesforce: Revolutionizing CRM

What Salesforce Actually Does

Before diving into Salesforce, I realized how little intuitive understanding most people, myself included(!), have of what the company actually does. That’s not often the case with America’s big tech companies. SpaceX builds rockets, Tesla makes cars, Amazon runs e-commerce and cloud services, and Google organizes the world’s information. But Salesforce?

It’s not surprising that people struggle to explain what Salesforce does. Salesforce isn’t a consumer-facing company. It doesn’t sell products or apps that people see or use every day. Its customers are businesses, and its software operates entirely behind the scenes. Yet it powers some of the most essential functions in the corporate world, managing how companies track, analyze, and interact with their customers.

At its core, Salesforce is a system designed to help companies understand who their customers are and how they interact with them. The company’s name gives away that Salesforce started by building tools for sales teams. It helped them to track leads, manage deals, and stay on top of client relationships. But over time, it expanded its product portfolio to cover every part of a company’s workflow.

Today, it powers the workflows, marketing campaigns, and customer service operations of hundreds of thousands of organizations, from start-ups to the U.S. government.

To put it in perspective, more than 90% of Fortune 500 companies use Salesforce. I told you I would repeat this fact! We’ve talked before about Adobe’s deep integration across enterprises, but Salesforce operates on an entirely different scale, embedded into nearly every part of how those companies function.

The foundation of this data empire is Salesforce's Data Cloud. It collects information from every possible source — websites, apps, emails, customer calls, and transactions — and brings it together in one place. The idea is to never have to deal with the incredibly annoying back-and-forth with service agents from different departments to get all your information. If you listened to our podcast on Salesforce, you might remember that I’ve had this experience one too many times…

Let’s take Disney, one of Salesforce’s CEO Marc Benioff’s favorite companies and customers, as an example of the services and products Salesforce offers.

Imagine you book a family trip to Walt Disney World, buy a pair of Mickey ears online to come properly dressed, and later call customer service because something went wrong with your park tickets. All those interactions end up in a single unified profile in Salesforce. When you call again six months later to plan your next vacation, the agent already knows who you are, where you stayed, and what happened during your last visit.

For companies the size of Disney, all those data points are incredibly valuable when managed effectively. And without a system that can collect, organize, and share information across departments, creating that kind of seamless customer experience would be impossible.

The original Sales Cloud helps companies manage their pipelines and close deals. At Disney, this could mean tracking advertising partnerships across its TV networks and streaming platforms, showing every interaction between a Disney sales rep and a brand like Coca-Cola, from the first email to the final contract.

The Service Cloud powers Disney’s customer support centers. When a guest calls because a hotel reservation didn’t sync with their park tickets, the agent can instantly access all relevant information, such as past visits, bookings, and prior messages, in one place.

The Marketing Cloud handles personalized campaigns and automated emails. After booking a trip, guests might receive tailored park tips, ride suggestions based on their children’s ages, or follow-up offers for Disney+ subscriptions once they return home.

Together, these products form the backbone of modern customer management for thousands of enterprises worldwide.

The Business Model – A Subscription Machine

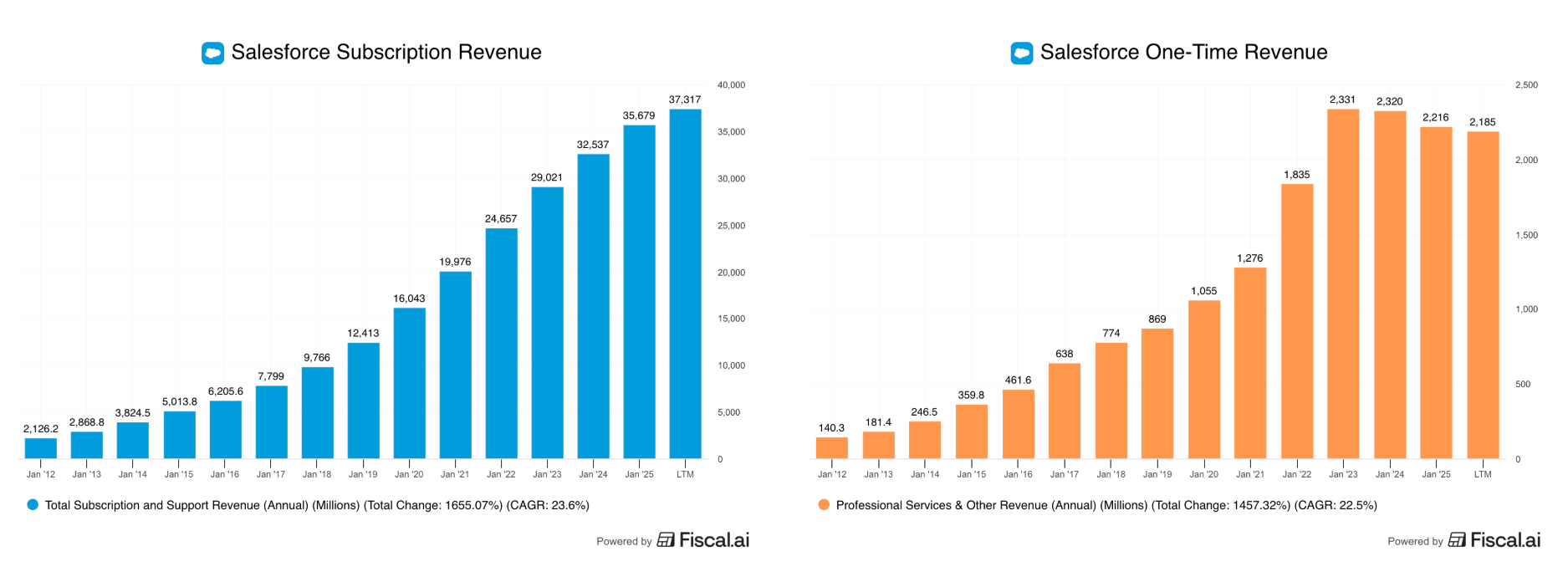

Few companies have built a more predictable business model than Salesforce. About 95% of its revenue comes from subscriptions, and its products are deeply embedded in the operations of most large U.S. corporations. These are customers unlikely to change their CRM systems anytime soon.

Replacing Salesforce would require retraining employees, transferring massive amounts of customer data, and risking disruptions in critical systems. This is why most customers stay for years, even if they occasionally complain about cost or complexity.

The remaining 5% of Salesforce’s revenue comes from one-time services, such as consulting, implementation support, and product customization. This part of the business is relatively small and not particularly profitable. In fact, it operates at a slight loss, but it serves an important strategic purpose.

Setting up Salesforce’s systems can be complex, and these professional services help new customers get onboarded and existing ones tailor the software to their specific needs. In that sense, the segment serves as an enabler for the much larger subscription business, lowering barriers to adoption and strengthening long-term customer relationships.

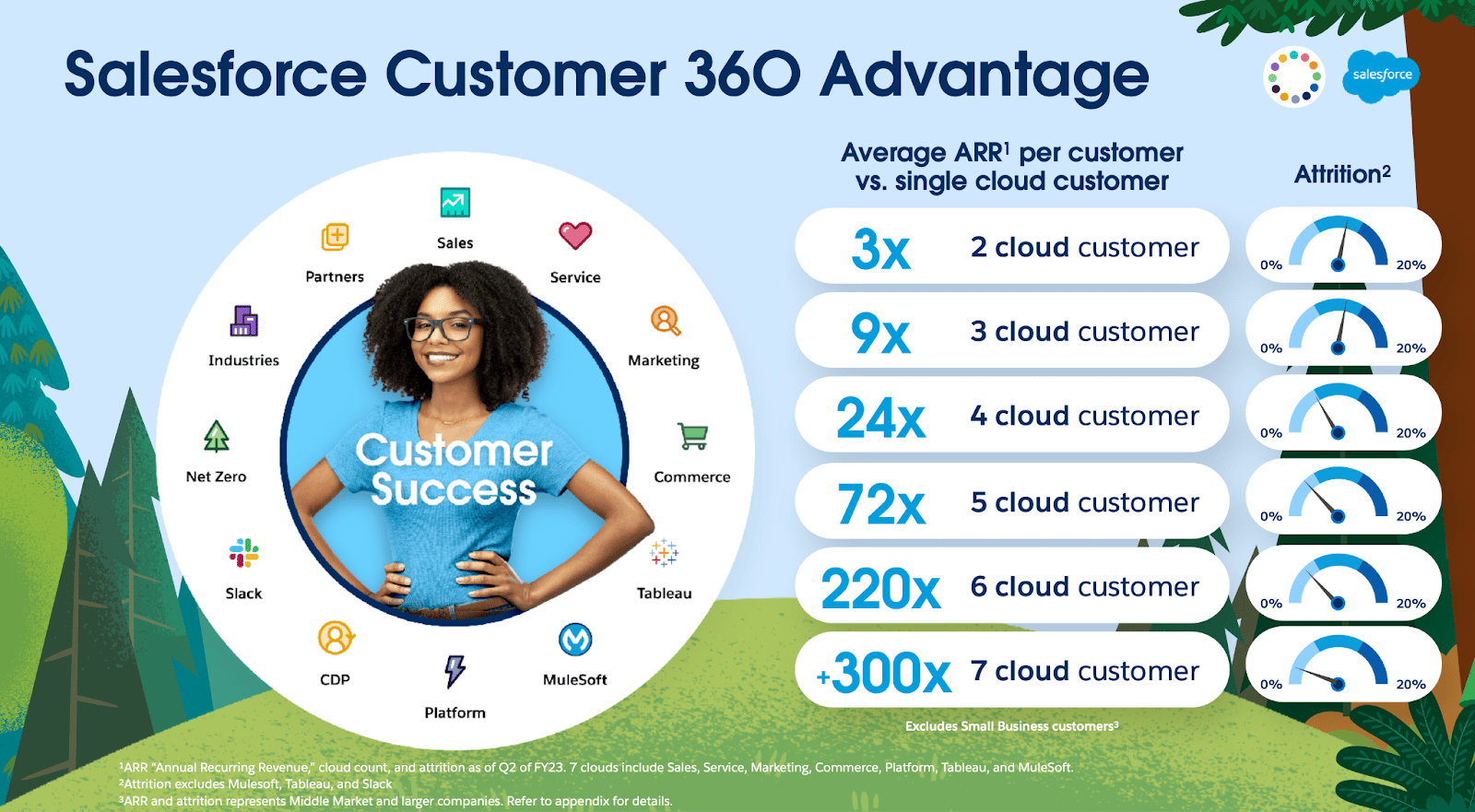

The retention data show just how sticky Salesforce’s products are. The company keeps about 92% of its customers, and the longer they stay, the more products they tend to use. That, in turn, drives higher revenue per client. A customer using two Salesforce Clouds generates roughly three times as much recurring revenue as one using only one Cloud.

For customers using four Clouds, that figure jumps to about 24x more ARR. And the numbers get exponential when you reach more Clouds than that. We are talking 220x more average ARR per customer when they use six clouds instead of one. These economics explain why Salesforce has grown its annual recurring revenue every single year since 2004, increasing from just over $500 million to around $40 billion today.

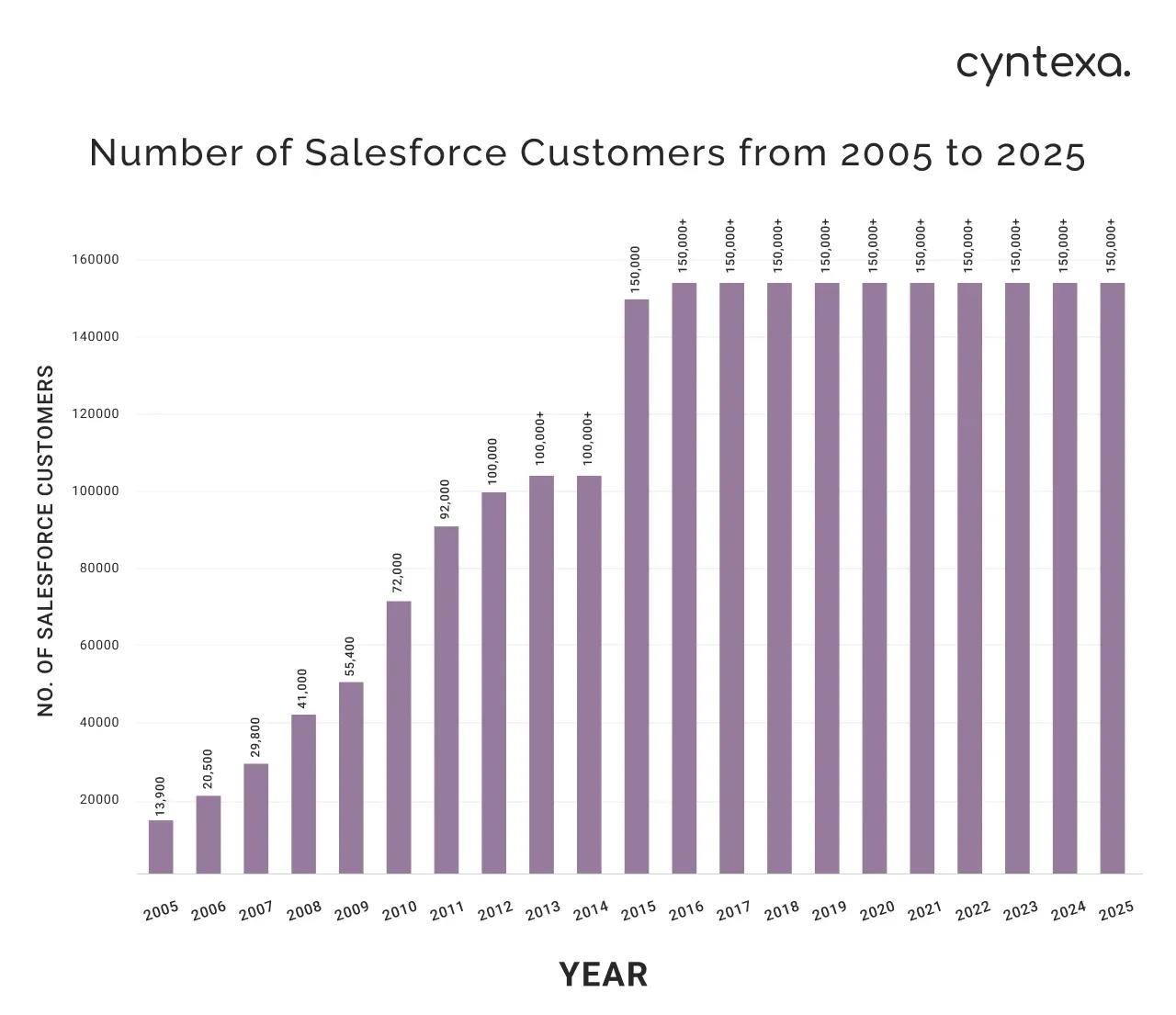

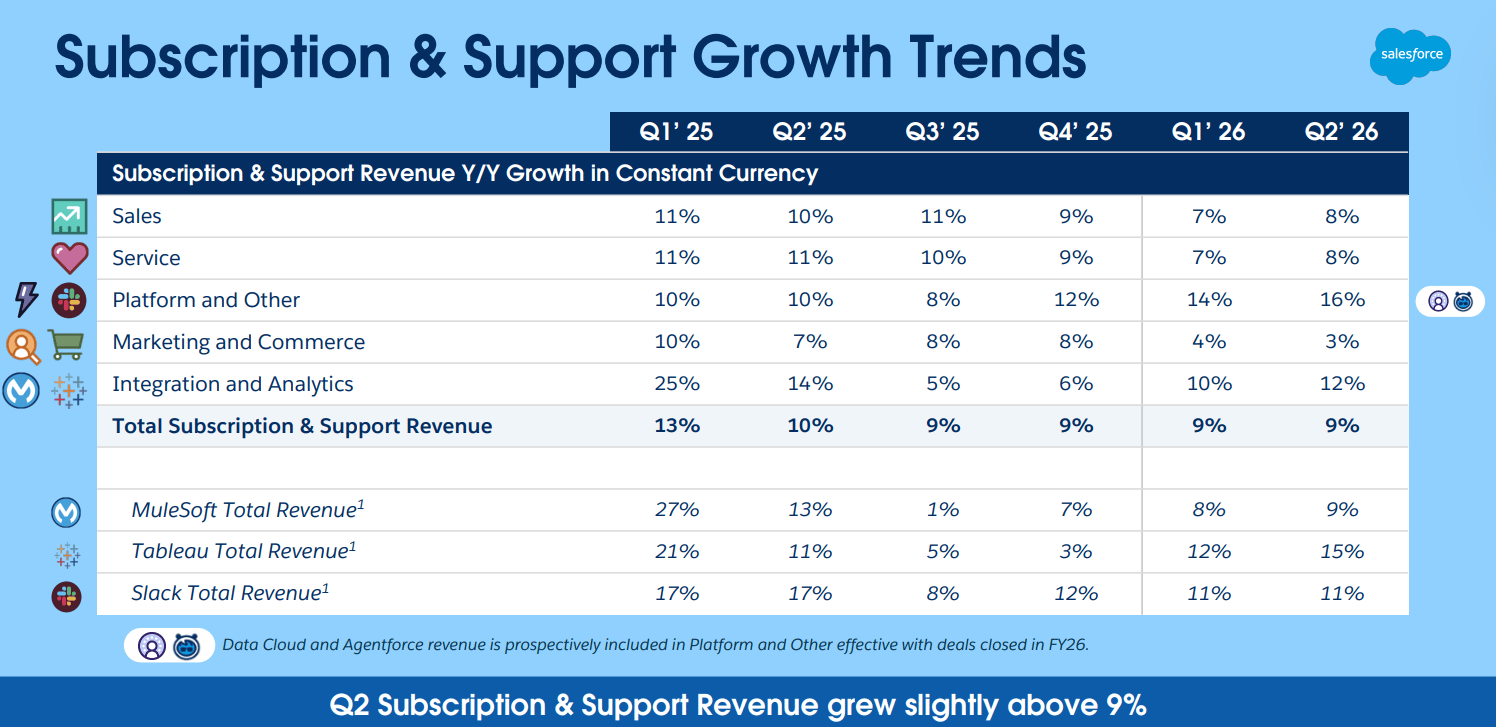

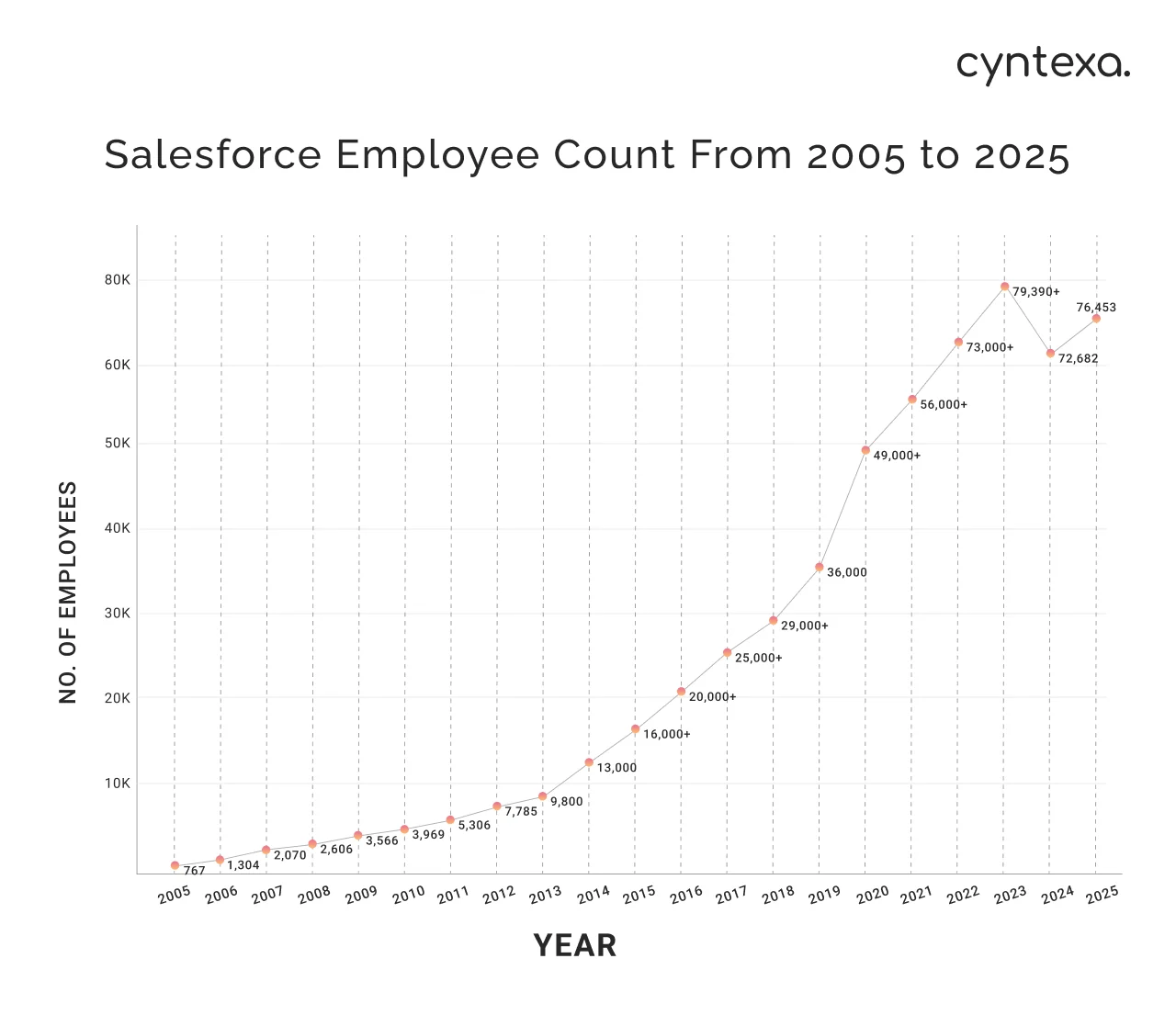

But growth has slowed in recent years, with revenue now increasing at around 9%. Part of that is simply the law of large numbers. It’s much easier to double revenue from one to two billion dollars than from forty to eighty. But Salesforce has also seen limited customer growth for several years, and there are even signs that its customer base may have declined.

The figures you can find online have been inconsistent. Some sources still show the customer count at around 150,000, while Marc Benioff recently mentioned 135,000 in an interview.

Whatever the exact number, it’s clear that Salesforce’s next phase of growth won’t come from signing up a wave of new customers. As I mentioned, Salesforce’s products are increasingly focused on large enterprises, and more than 90% of the Fortune 500 already use Salesforce in some form.

Because of that, Salesforce has focused on expanding within its existing customer base. It has raised prices, with the Sales Cloud Enterprise plan now about 15% more expensive than two years ago, and introduced higher-value products such as Agentforce, which sells for around $550 per user per month.

This might be the right moment to take a closer look at Salesforce’s new flagship product before diving deeper into the company’s business and moat.

Agentforce — Buzzword or Breakthrough?

Agentforce is at the center of Salesforce’s current transformation. Officially, it’s described as a “digital labor platform” that enables companies to create AI agents capable of handling specific tasks within the Salesforce ecosystem. In simpler terms, it’s the company’s attempt to bring artificial intelligence directly into everyday workflows, not as a separate chatbot or assistant, but as a built-in part of its existing tools.

In theory, Agentforce can automate a wide range of processes. A sales agent can analyze CRM data, identify promising leads, and send personalized outreach messages. A customer service agent can monitor support tickets, generate responses, or handle basic customer inquiries autonomously.

Each of these agents operates within Salesforce’s secure environment, with full access to company data, but without exposing that data to external large language models such as ChatGPT (although, like nearly every other tech company, OpenAI and Salesforce recently announced a partnership). That is an important distinction. For many large enterprises, especially in sectors like finance, healthcare, and government, data security and compliance make Salesforce’s closed approach far more appealing than public AI systems.

But the Agentforce story is a mixed bag. Within a year of launch, the company reported more than 12,500 Agentforce deals, although only about half of those customers are paying, and 120% year-over-year growth in its Data Cloud and AI-related revenue. Still, these numbers tell only part of the story. The Agentforce segment accounts for roughly 10% of total revenue, meaning it is not yet large enough to move the needle for a $250 billion company.

And many observers argue that Salesforce’s value proposition could come under real pressure in the age of AI. Unifying and organizing data is exactly what AI excels at. In that sense, the race may come down to Agentforce versus AI itself. If Salesforce delivers on its promises and Agentforce proves genuinely useful, customers are unlikely to risk disrupting their workflows by switching to an AI-native alternative.

However, if Agentforce can’t compete with the seemingly endless number of AI tools, then Salesforce could be disrupted over time. So far, top-line growth has remained far below the double-digit acceleration investors had hoped for when the product was first introduced.

Some of that disappointment comes down to timing. Even if Agentforce is as good as hoped, implementing new AI systems at the enterprise level takes time. It requires training models on proprietary data, rethinking internal processes, potentially letting go of many people, and often redesigning workflows entirely. Anyone who has ever worked in a large organization knows that this doesn’t happen in weeks but over multiple quarters, if not years.

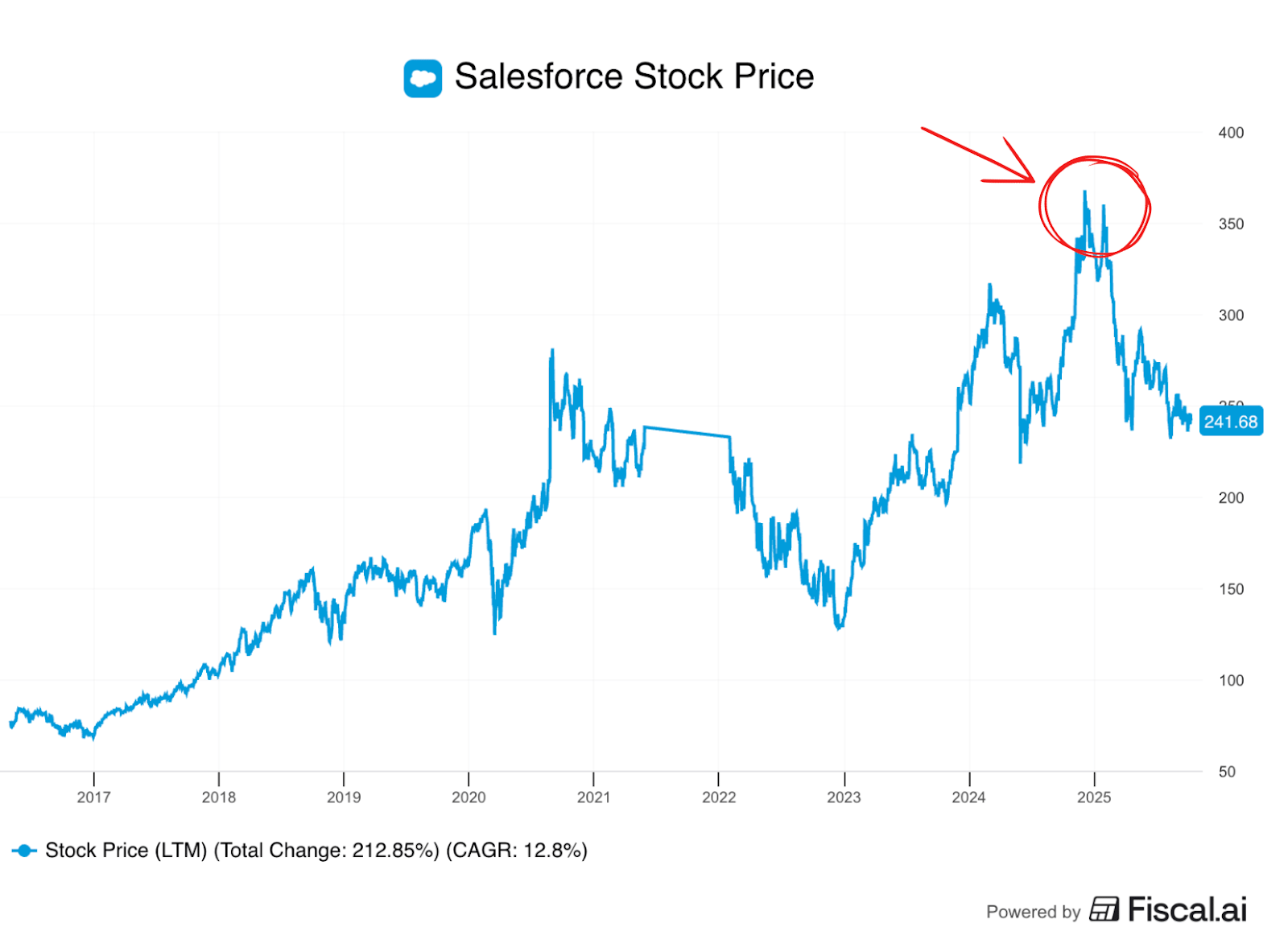

Apparently, the market isn’t that patient, though. When Agentforce was announced, the stock rallied, with investors applauding the company for acting early rather than waiting to be disrupted.

However, that enthusiasm has faded since. Benioff’s announcement that 2025 would be “the year of Agentforce” did not turn out as expected, at least not yet.

Despite that, there are signs that the early adoption cycle could create a strong upselling dynamic over time. Roughly half of new Agentforce bookings come from existing Salesforce customers, and management notes that once companies start experimenting with these AI agents, they tend to expand usage quickly. If the adoption curve follows anything like what we’ve seen with the various Salesforce Clouds, that could be encouraging.

For now, though, only 5% of customers have started using Agentforce. That can be interpreted both positively and negatively. On one hand, if the product were truly as revolutionary as advertised, adoption would likely be broader by now. On the other hand, the relatively low penetration leaves plenty of room for expansion within the existing customer base.

I find it still difficult to assess how well Agentforce is actually performing or how much tangible value it creates for users. Marc Benioff has claimed that Salesforce itself already uses the platform to automate between 40% and 50% of its internal workflows and that this shift has reduced, or even eliminated, the need to hire for roles in customer support and software engineering.

If that were true, then why haven’t more Salesforce customers signed up for Agentforce? Salesforce is a huge company with complex workflows. If they could do it, so should many of their customers. The fact that they haven’t makes me doubt the validity of Benioff’s claims.

Salesforce’s own job postings still list dozens of engineering roles, and the company’s total headcount has actually increased rather than declined. Benioff has said that this is due to hiring more salespeople to sell Agentforce, but it seems unlikely that Salesforce has meaningfully slowed its technical hiring.

Competitive Position and Moat

Despite the apparent challenges with Agentforce’s rollout, there is no company better positioned than Salesforce to benefit from the agentic revolution in CRM software.

The company holds more than 20% market share, larger than the next four competitors combined. And from conversations with users who rely on it daily, it’s clear that frustration with the product’s complexity and cost rarely translates into switching. For large organizations, the cost and disruption of switching outweigh the frustrations that Salesforce's complexity and pricing can cause from time to time.

Replacing Salesforce would mean migrating data accumulated over many years, retraining employees, and risking downtime in critical sales and service systems. That would be a massive undertaking. These switching costs, rather than traditional brand loyalty, are what keep Salesforce’s retention rates above 90%.

Competition does exist, but mostly at the lower end of the market. HubSpot, for instance, offers simpler and cheaper tools that appeal to smaller businesses with fewer customization needs. As one user put it, “The floor is higher with HubSpot, but the ceiling is higher with Salesforce.” I guess that captures the trade-off pretty well. Salesforce is complex, but its capabilities are unmatched once implemented at scale.

And the more complex the product, the less likely AI-native companies are to develop simpler and cheaper solutions.

I don’t have data to back it up, but if we assume Salesforce has actually lost some customers in recent years, those departures probably came from the lower end of the market. An indication for this thesis is that Salesforce has recently introduced a $25-per-month “Starter” plan aimed at small and mid-sized businesses that previously found the platform too expensive or cumbersome.

While it would obviously be beneficial to regain and attract new customers in that segment, I believe that entrepreneurs and SMBs will benefit the most from AI-native tools that are simple to use and relatively inexpensive. AI disruption is more likely among customers who do not need Salesforce’s entire product suite and ecosystem and are more price-sensitive.

Therefore, I believe that Salesforce’s strength in the large-enterprise space is a significant advantage for them in AI. Both for implementing AI and agents themselves, as well as creating switching costs to prevent customers from leaving for AI-native tools.

Capital Allocation – Lessons Learned (Maybe)

One reason for the stock's drawdown is that the market hasn’t yet bought the Agentforce story. Another is Salesforce’s mixed record on capital allocation. Salesforce has built an incredible business, but it has also relied on acquisitions to expand its ecosystem.

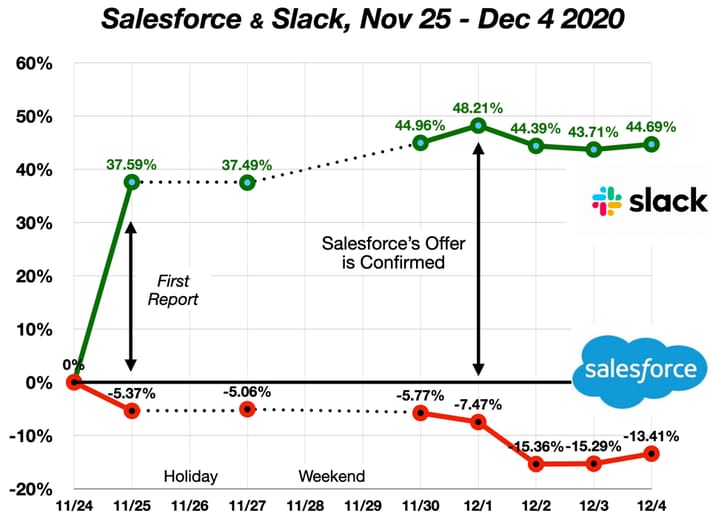

Many of them made sense for expanding the ecosystem, but were, let’s say, financially questionable. The most obvious example is Slack. Slack is a cloud-based communication platform. Shawn and I use it daily. It’s a great product. But Salesforce paid $28 billion for it in 2020. That was almost 30 times revenue for an unprofitable company that, in my view, lacks the potential to ever monetize in a way that makes this a good deal.

Judged by the market’s reaction, it agreed with this assessment. It was the second-largest software merger ever and wiped out billions in shareholder value.

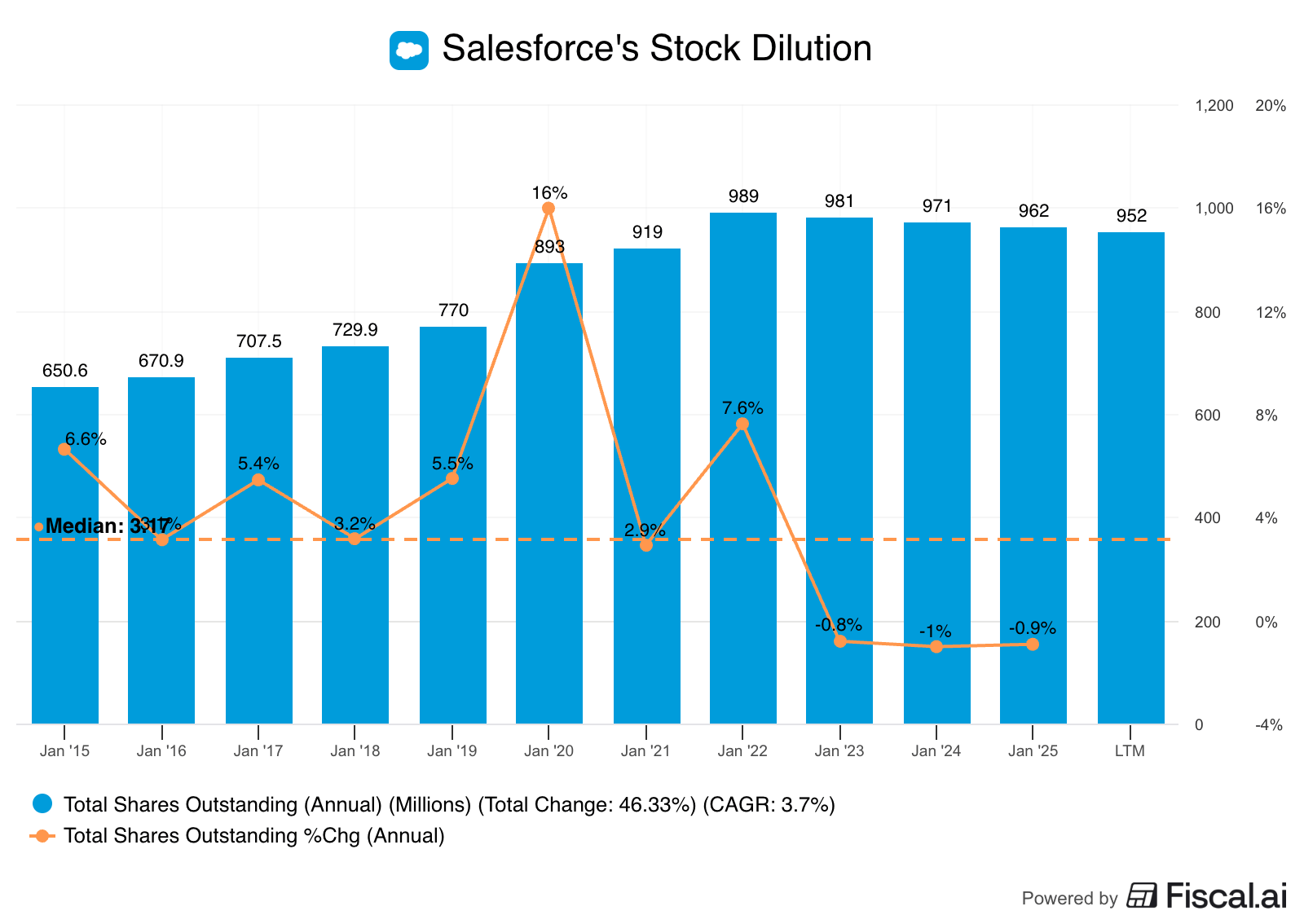

The deal was justified as a way to strengthen collaboration across Salesforce’s ecosystem and embed the company more deeply inside its customers’ daily operations. While Slack has since grown by double digits every year and become an integral part of Salesforce’s workflow suite, it’s hard to argue that the acquisition price was rational. To make matters worse, about half of the deal was paid in stock, diluting Salesforce shareholders by roughly 5%.

That pattern of large, expensive acquisitions has long frustrated Salesforce investors, which is why the market welcomed Benioff’s 2023 announcement that Salesforce would shift its focus away from M&A and prioritize organic growth, buybacks, and profitability. But that promise didn’t last long. Earlier this year, Salesforce agreed to acquire Informatica for about $8 billion in cash. Let’s just say the timing and inconsistent messaging didn’t exactly boost investor confidence.

To Benioff’s credit, Informatica had been on Salesforce’s radar for some time, and this acquisition appears far more disciplined than his earlier ones. The purchase price represented a roughly 30% premium over Informatica’s share price, a far more reasonable multiple than what Salesforce paid for Slack.

And the deal is being funded entirely with cash rather than stock. Given Salesforce’s balance sheet strength and growing free cash flow, the acquisition is unlikely to strain the company’s finances. The broader question is whether Salesforce has truly changed its approach to capital allocation or is simply repeating old habits.

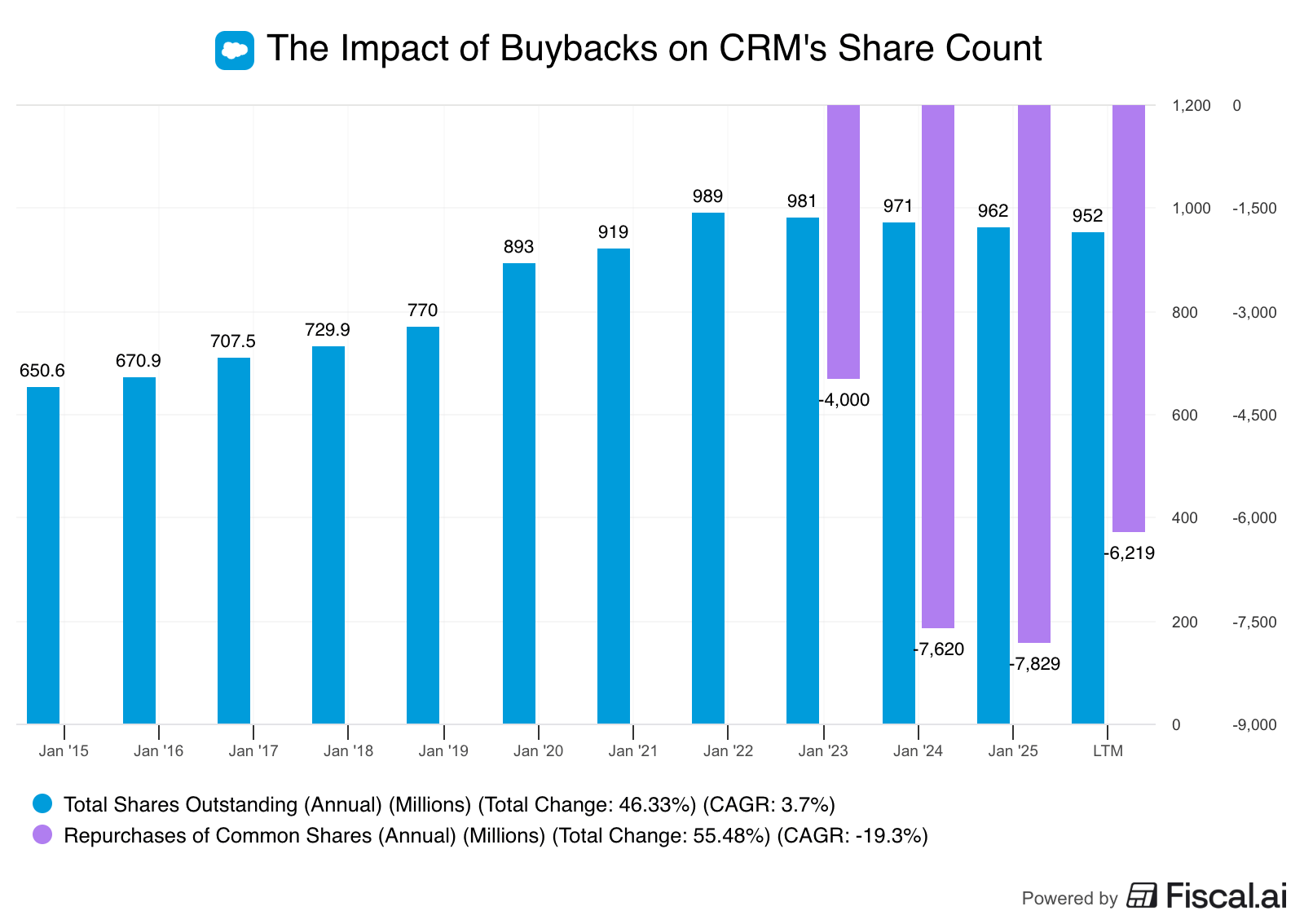

Share-based compensation remains another area of concern. Even with improved margins and record buybacks, stock grants still account for about 8% of revenue. Over the past two years, Salesforce has spent roughly $25 billion repurchasing shares, yet the total share count has fallen by only about 1% per year. The buybacks have largely just offset dilution rather than meaningfully reducing it.

If we assume that growth will continue to slow, it’s important that management follows through on its commitment to prioritize free cash flow generation and shareholder returns, keeping buybacks ahead of acquisitions in its capital hierarchy.

One potential tailwind is valuation. With Salesforce’s share price down meaningfully from prior highs, buybacks have become a far more effective way to create value for shareholders.

Financials — From Growth to Cash Flow

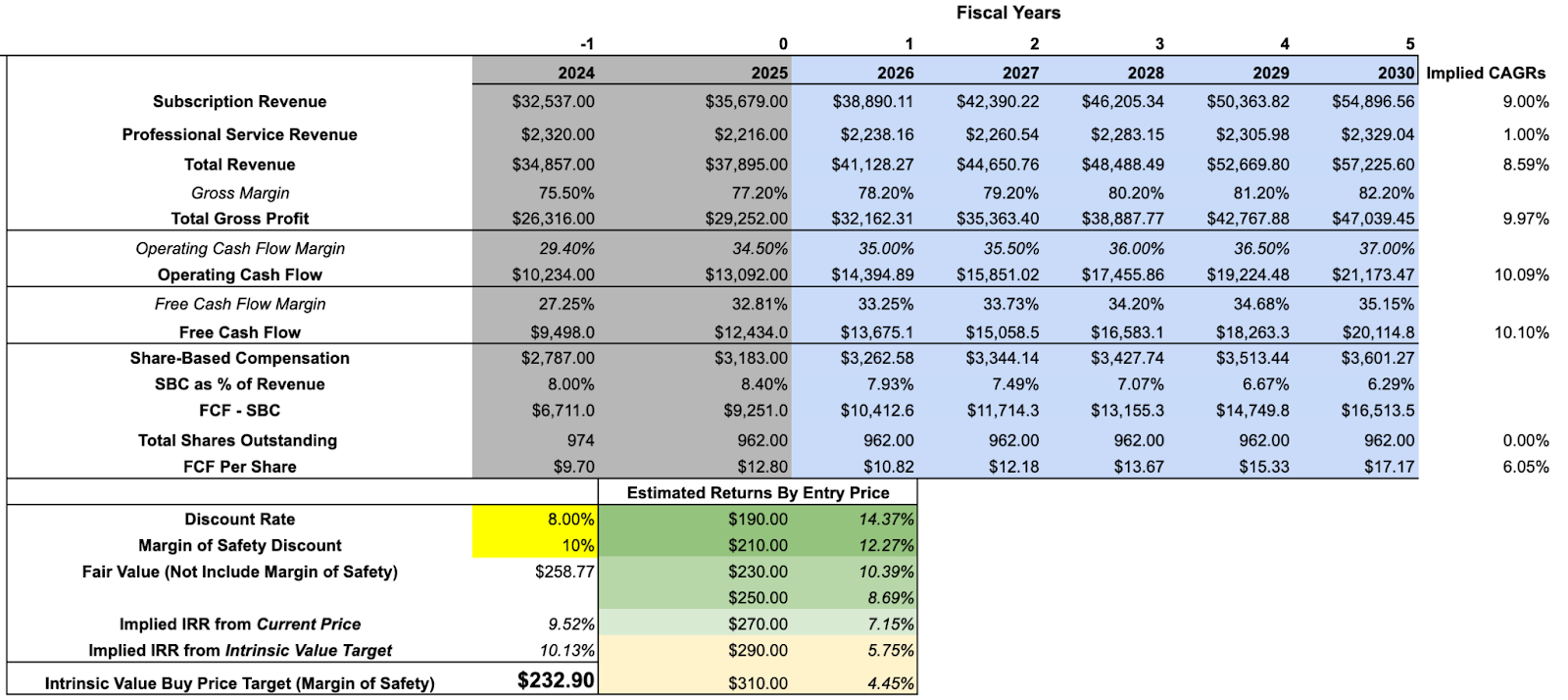

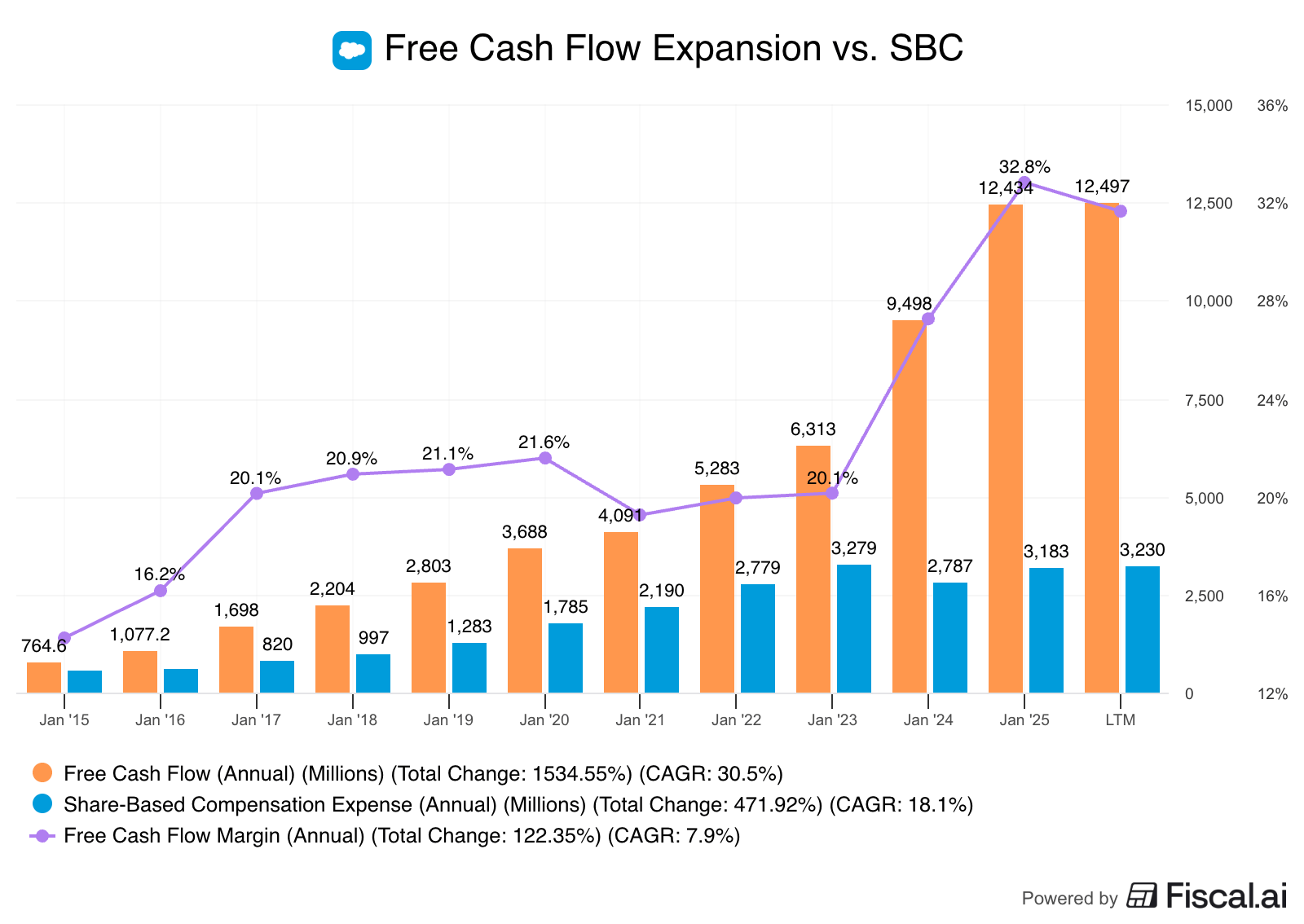

Salesforce’s financial profile has changed meaningfully over the last few years. The company that once prioritized rapid expansion now focuses on efficiency, profitability, and cash generation. After years of double-digit revenue growth, the top line has settled at around 9%, but free cash flow margins have risen from about 20% in fiscal 2023 to over 30% this year, driven by tighter cost control and greater pricing power across the product suite.

Adjusting for stock-based compensation, which remains substantial at around $3–$3.5 billion per year, free cash flow would fall closer to $9 billion. That implies an adjusted free cash flow yield of around 4%. The highest FCF yield Salesforce ever traded at.

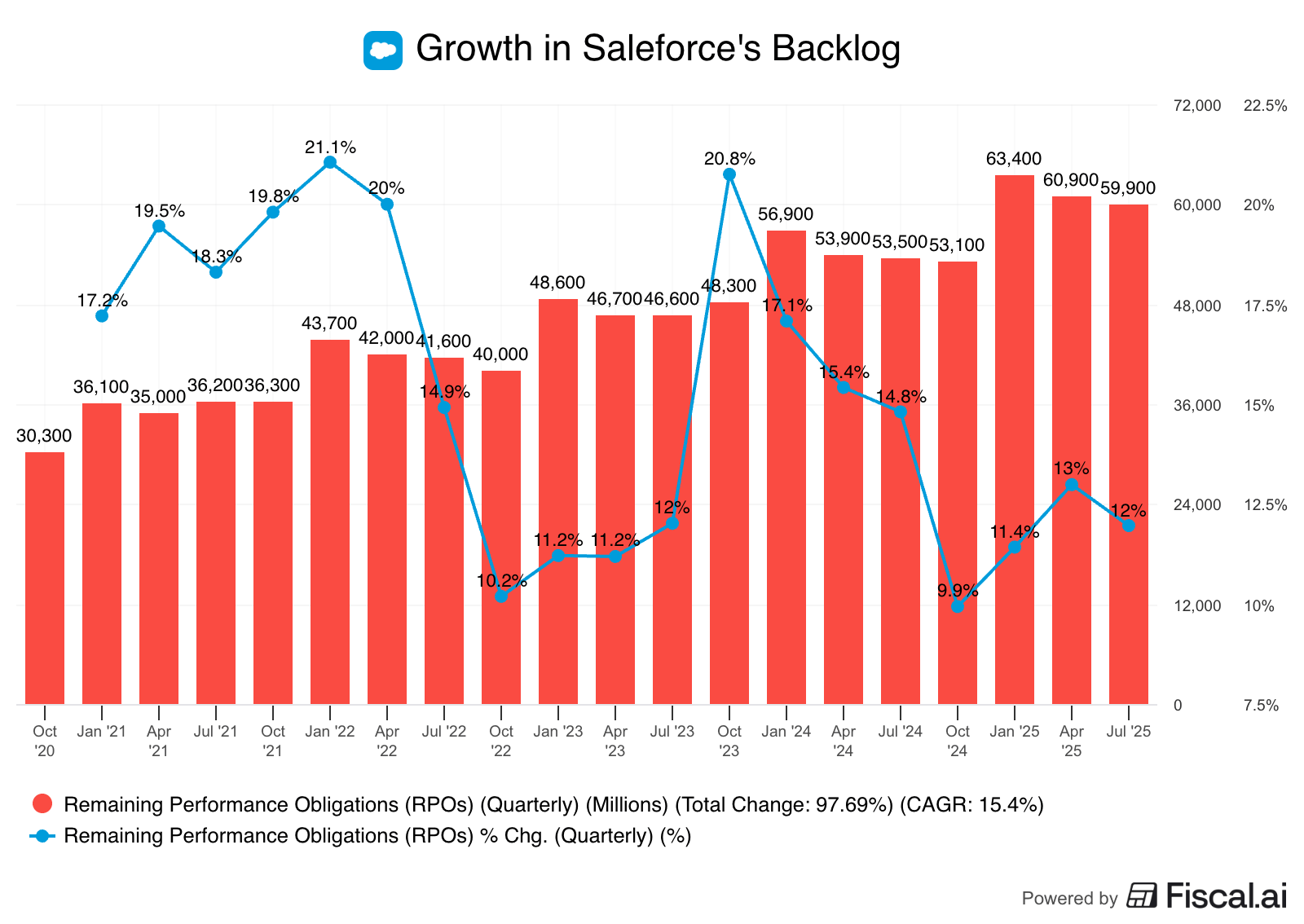

The best-case scenario for Salesforce would be a reacceleration of the top line while maintaining cash flow discipline. The best indicators of Salesforce’s long-term demand are its Remaining Performance Obligations (RPOs) — the total value of contracted revenue not yet recognized — and the subset due within 12 months, known as cRPOs.

These figures function as a backlog and give an early signal of future growth. After bottoming in fiscal 2024, RPO growth has reaccelerated into the low double digits. It’s still well below the levels of 2021 and 2022, when the pandemic-driven digitalization wave lifted all software companies, but it marks a clear stabilization in demand after a slower period.

At Salesforce’s latest Dreamforce conference, it outlined a goal of 10% revenue growth throughout 2030, indicating $60 billion in revenue at the end of the decade. If this goal can be achieved and we see buybacks at the rate of the last two years, Salesforce will be a very successful investment.

I’m pretty sure, though, that this guidance is based on a considerable Agentforce success. And while that’s possible, this story isn’t told yet.

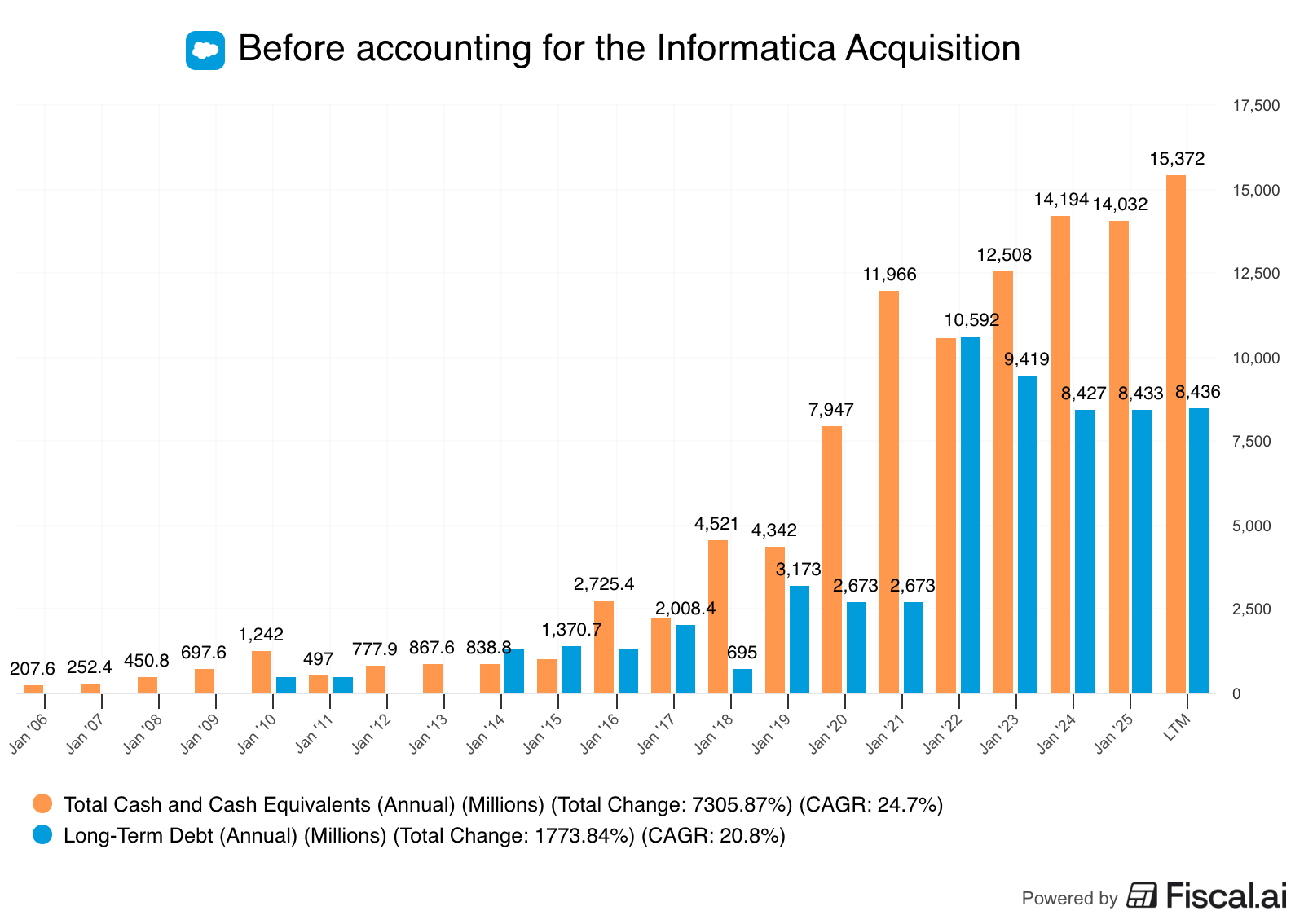

Given the uncertainty about future growth, it's reassuring that Salesforce’s balance sheet is more than solid. Even after accounting for the pending $8 billion Informatica acquisition, Salesforce will remain in a leverage-neutral position, with enough cash to pay off all long-term debt.

Over the past decade, cash holdings have compounded at roughly 30% per year, giving the company ample flexibility to fund buybacks, product investments, or, if necessary, acquisitions.

Valuation and Investment Decision

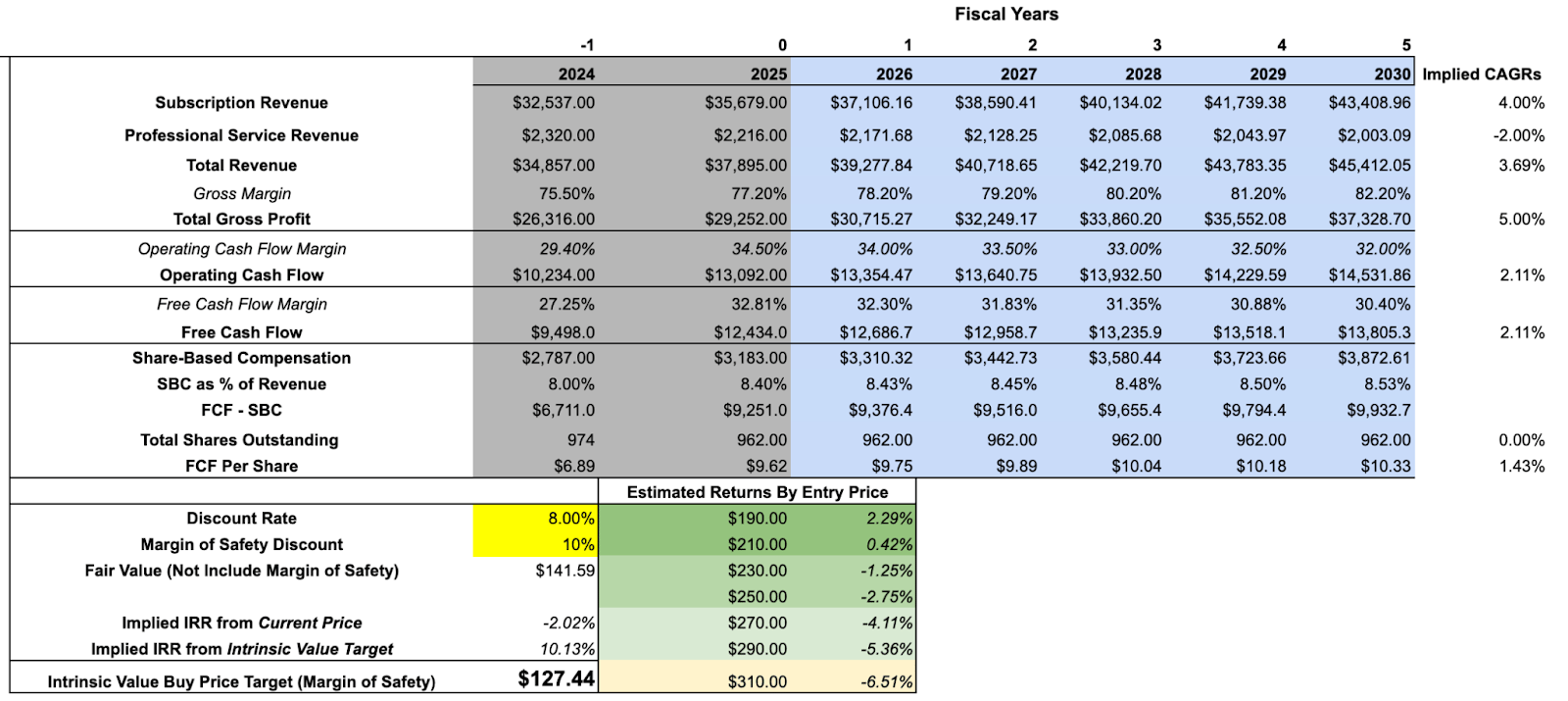

Salesforce is no longer valued as a hyper-growth software company. With a market capitalization of around $250 billion, the stock trades at a forward P/E of 21.5 and a forward P/FCF of just 17x. Based on these multiples, I believe the market has not only adjusted to Salesforce’s slower revenue growth but also anticipates some disruption to its business model.

In a base-case scenario, continued top-line growth in the high single digits and gradual margin improvement would support free cash flow growth of roughly 10% per year. Using an 8% discount rate and a 22x terminal multiple implies a fair value in the mid-$230s — close to where the stock currently trades.

Based on this, you might expect a return of 9%-11%. That’s not bad, but given the possibility of more severe disruption, it’s not yet a no-brainer in my books.

The more optimistic scenario relies on whether Agentforce can significantly speed up growth. If adoption increases and the platform reaches more of Salesforce’s customers, annual revenue growth could comfortably reach double-digits.

Margins would likely increase as well, but I kept them in line with the base case for now to not be overly optimistic. In that scenario, an exit multiple closer to 28x would be justified, which would imply a fair value in the $340–$350 range and an internal rate of return around 18%.

Keep in mind, though, that this implies about 1.5% more revenue growth than Salesforce guided to at Dreamforce, along with significant multiple expansion. On the other hand, though, I have the share count only decreasing by 0.5%. In a bull case, you could argue that Salesforce will buy back a lot more than that.

As a disclaimer for the bear case, I see this scenario as rather unlikely. Still, it’s worth modeling an outcome in which AI meaningfully disrupts Salesforce’s business and quickly erodes its market share.

In this case, I assume revenue growth slows to about 4% annually, margins decline, and free cash flow per share stays roughly flat. Applying a 20-times multiple would imply a fair value in the $120s. One could argue that Salesforce would respond by ramping up buybacks to boost free cash flow per share. That’s possible, but the market would likely view it as a declining company trying to compensate for slowing growth — reminiscent of Western Union. In that case, the multiple would drop far below 20x.

The point of this exercise isn’t to predict that outcome, but to illustrate the downside risk if the business truly starts to deteriorate. Salesforce looks inexpensive as long as its fundamentals remain intact, but if growth falters and disruption accelerates, the stock could fall much further.

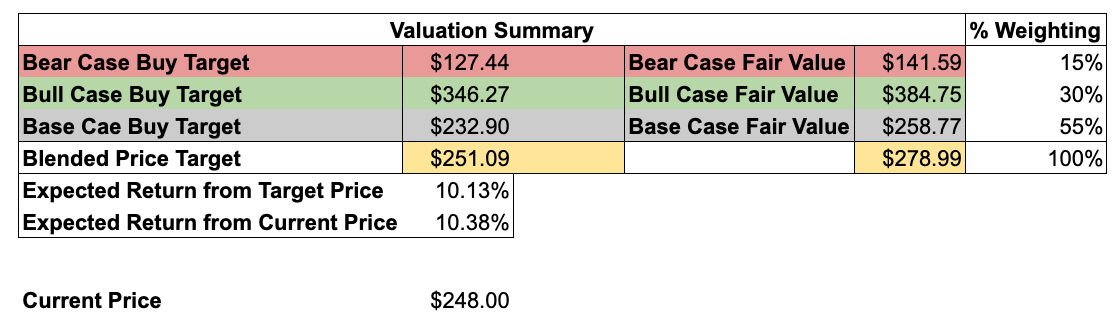

In the valuation summary, I see an expected return of about 10% from our fair value price target. I must say, I think Salesforce presents a quite interesting opportunity here. I modeled fairly conservatively in my base case, so I believe there could be more upside than 10%.

That said, and as I elaborated on in the podcast, I find it difficult to fully get comfortable with Benioff’s sales-driven language and the many promises around Agentforce that haven’t yet translated into measurable results.

To form a stronger opinion, I would need a better understanding of the product itself and how indispensable it really is for customers. On the surface, it seems plausible that AI could replicate much of what Salesforce offers. Yet the company’s deep integration across most of the world’s largest enterprises gives it a massive edge.

It doesn’t necessarily have to be far ahead of competitors; it only needs to remain good enough for customers to stay within its ecosystem. And Agentforce has definitely been an early push to stay in that position.

If you have experience with Salesforce’s products and perhaps competitors as well, feel free to message me at [email protected]

You might be the reason Shawn and I feel more confident about their staying power and choose to invest in Salesforce. For now, we decided to hold off.

For more on Salesforce, you can listen to our podcast here. And if you like learning about seemingly undervalued subscription-based businesses, check out our newsletter on Adobe from earlier this year, written by Shawn.

More updates on our Intrinsic Value Portfolio below 👇

Weekly Update: The Intrinsic Value Portfolio

Notes

Multiple of our portfolio holdings released earnings this week, and across the board, the results were mostly positive. Let’s start with our largest holding, Alphabet.

Alphabet has delivered its first-ever $100 billion quarter. Technically, there’s not much more that needs to be said… But let’s look at some of the details.

Overall, revenue was up 16%. Google Search, a business that was supposedly dead a couple of months ago, grew 15% y/y and continues to be a money-printing machine.

YouTube has been up 15% as well, and Google One and YouTube Premium now have over 300 million paid users. And as a Premium user myself, I can attest that this subscription business has lots of pricing power. I wouldn’t go back to YouTube with ads even if they charge me double the current rate.

Perhaps the most important part of the story right now is AI. The Gemini app has reached over 650 million monthly active users. Performance ratings for Gemini are great as well, so it’s safe to say, AI is a tailwind for Google, not a threat.

The most important metric for Amazon this earnings season has been AWS growth. They delivered, so the stock rose. However, Google Cloud outpaced AWS growth by 14%, growing 34% y/y and improving its operating margin from 17% to almost 24%. Incredible results.

PayPal has released earnings as well, and the day after, I joked to Shawn that “PainPal” has struck again. PayPal reported solid results and even announced a partnership with OpenAI (and one with Google as well). The market initially loved it — the stock was up 18% in pre-market trading — but by the closing bell, the excitement had faded, and PayPal finished the day flat.

Total Payment Volume (TPV) increased by 8%, representing a 2 percentage point rise compared to the previous year. Revenue grew slightly less at 7%, partly due to short-term issues in Germany and the gaming platform Steam.

Free cash flow remained very strong at almost $2.3 billion. This was anticipated and confirms once again that PayPal is on track to reach $6-$7 billion in FCF for the year.

Branded Checkout continues to be the focal point for investors, growing at (only) 5%. That’s still too low to drive a change in market sentiment, but I expect growth to accelerate in Q4 and even more next year as Buy Now, Pay Later (BNPL), Venmo, and the advertising initiatives become an even bigger part of the pie. All of them are growing fast.

BNPL processed about $40 billion in TPV, growing more than 20% year over year. Venmo revenue rose 20%, driven, among other things, by strong adoption of the Venmo Debit Card, which grew 40% thanks to college partnerships. In Germany, PayPal’s debit card has also been a hit, adding around one million users per month to reach five million in total.

Another positive sign is that Braintree is turning from a headwind into a tailwind. After several quarters of intentional downsizing that weighed on growth, the business is now expanding again — up mid–single digits this quarter and likely approaching double-digit growth next quarter.

Reddit delivered another impressive quarter. Despite its high valuation, the stock rose about 7% after the report. As in PayPal’s case, the initial reaction was even bigger.

We don't own many stocks that are in the early innings of their company lifecycle. Reddit might be the only exception. So, it’s rare for us to discuss a portfolio company growing revenue by 68% year over year.

Advertising revenue jumped 74% year over year, underscoring that Reddit is becoming a must-buy platform for advertisers. User growth was strong across the board, with weekly active users up 21% and daily active users up 19%.

Margins were outstanding as well — gross margin reached 91%, and net margin came in at 28%. Both metrics highlight how efficiently Reddit’s model is scaling, and there’s still plenty of room for further net margin expansion in the years ahead.

Quote of the Day

"You can’t just ask customers what they want and then try to give that to them. By the time you get it built, they’ll want something new.”

— Steve Jobs

What Else We’re Into

📺 WATCH: The Art of Buffett w/ Tobias Carlisle and Stig Brodersen

🎧 LISTEN: Are we in a bubble? That’s what Jim Grant and William Green discuss on the most recent Richer, Wiser, Happier episode.

📖 READ: A Look Under the Hood – New Memo by Howard Marks

You can also read our archive of past Intrinsic Value breakdowns, in case you’ve missed any, here — we’ve covered companies ranging from Alphabet to Airbnb, AutoZone, Nintendo, John Deere, Coupang, and more!

Do you agree with the Investment Decision on Salesforce?Leave a comment to elaborate! |

See you next time!

Enjoy reading this newsletter? Forward it to a friend.

Was this newsletter forwarded to you? Sign up here.

Join the waitlist for our Intrinsic Value Community of investors

Shawn & Daniel use Fiscal.ai for every company they research — use their referral link to get started with a 15% discount!

Use the promo code STOCKS15 at checkout for 15% off our popular course “How To Get Started With Stocks.”

Follow us on Twitter.

Read our full archive of Intrinsic Value Breakdowns here

Keep an eye on your inbox for our newsletters on Sundays. If you have any feedback for us, simply respond to this email or message [email protected].

What did you think of today's newsletter? |

All the best,

© The Investor's Podcast Network content is for educational purposes only. The calculators, videos, recommendations, and general investment ideas are not to be actioned with real money. Contact a professional and certified financial advisor before making any financial decisions. No one at The Investor's Podcast Network are professional money managers or financial advisors. The Investor’s Podcast Network and parent companies that own The Investor’s Podcast Network are not responsible for financial decisions made from using the materials provided in this email or on the website.