- The Intrinsic Value Newsletter

- Posts

- 🎙️ The Trade Desk: Heir to the Programmatic Advertising Throne?

🎙️ The Trade Desk: Heir to the Programmatic Advertising Throne?

[Just 5 minutes to read]

Back when the internet was first commercialized, there was this beautiful vision of a free and open web, where publishers could earn money from ads, advertisers could reach relevant audiences, and users could explore information without friction or gatekeepers.

Then came the walls.

Google built its own ecosystem. So did Facebook. Apple cut off tracking, and Amazon started hoarding first-party retail data. And just like that, the "open internet" started to shrink; walled gardens were winning.

But The Trade Desk? It bet on something different.

It bet that advertisers — and publishers — didn’t want to live under someone else’s thumb. That they’d want transparency, independence, and measurable results. That there was still a future where the open internet didn’t just survive, but thrived.

Today’s pitch is on The Trade Desk (Ticker: TTD), a company that is perhaps best positioned to push back against the so-called walled gardens (read: tech giants) and benefit from regulatory enforcement against Alphabet’s long-running abuse of the digital advertising ecosystem.

— Shawn

The Trade Desk: An Unbiased Champion For Digital Advertisers

The Open Internet vs. the Walled Gardens

The big idea behind The Trade Desk is simple but profound: the company exists to make advertising on the open internet more effective than advertising inside walled gardens like Meta, Google, and Amazon.

The open internet is everything that’s not contained inside those platforms — think connected TV apps, music streaming services, news websites, podcasts, mobile games, and digital billboards like Roku’s home screen on smart TVs. Unlike Meta or Google, where the platform owns the inventory, the data, and the ad auction, the open internet is fragmented and decentralized. Companies like The Trade Desk, then, exist to help their clients navigate this messy marketplace.

But the open internet is also where most of us spend a huge chunk of our online time. And that’s what makes it so valuable, assuming it can be organized, measured, and bought intelligently.

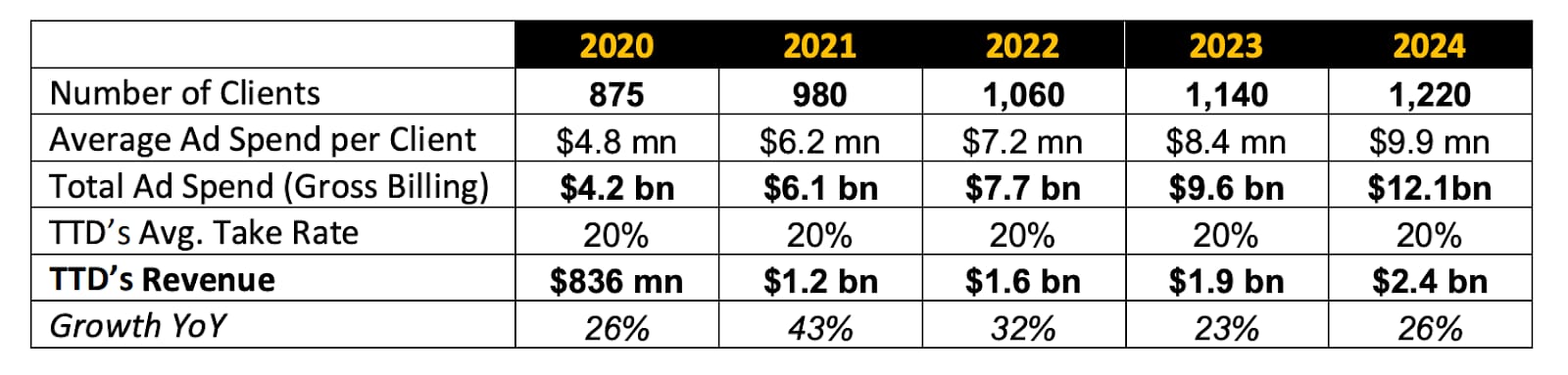

That’s where The Trade Desk has come in and built a business that has compounded revenues at an average rate of 50% a year for a decade(!), and closer to 30% in the last 5 years.

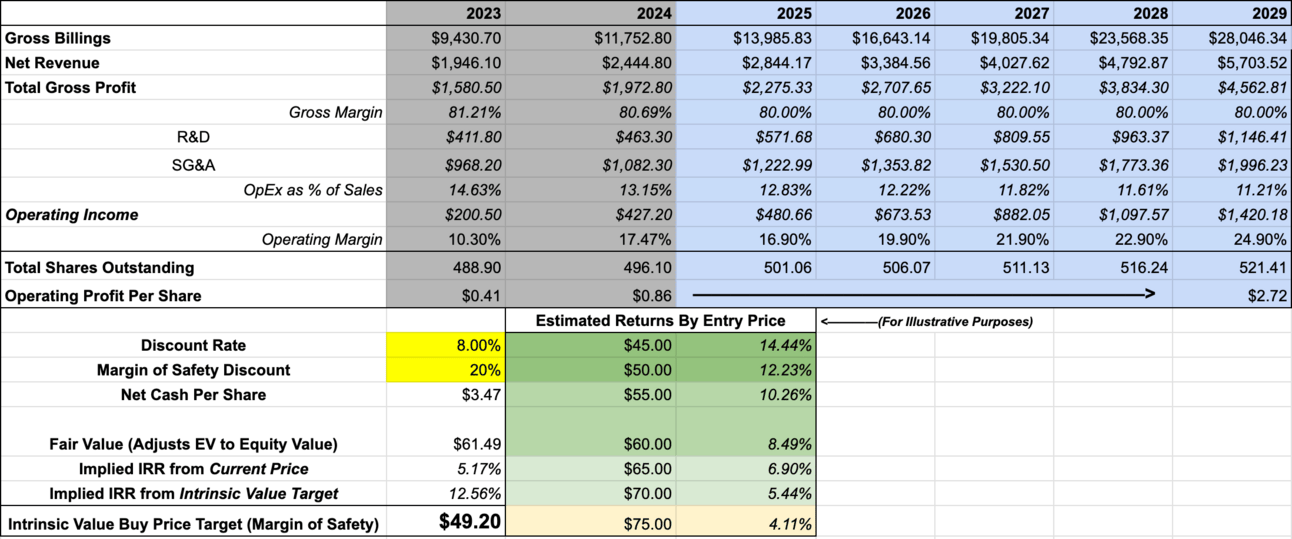

TTD’s growth since 2020 is fast but has decelerated from the 2010s

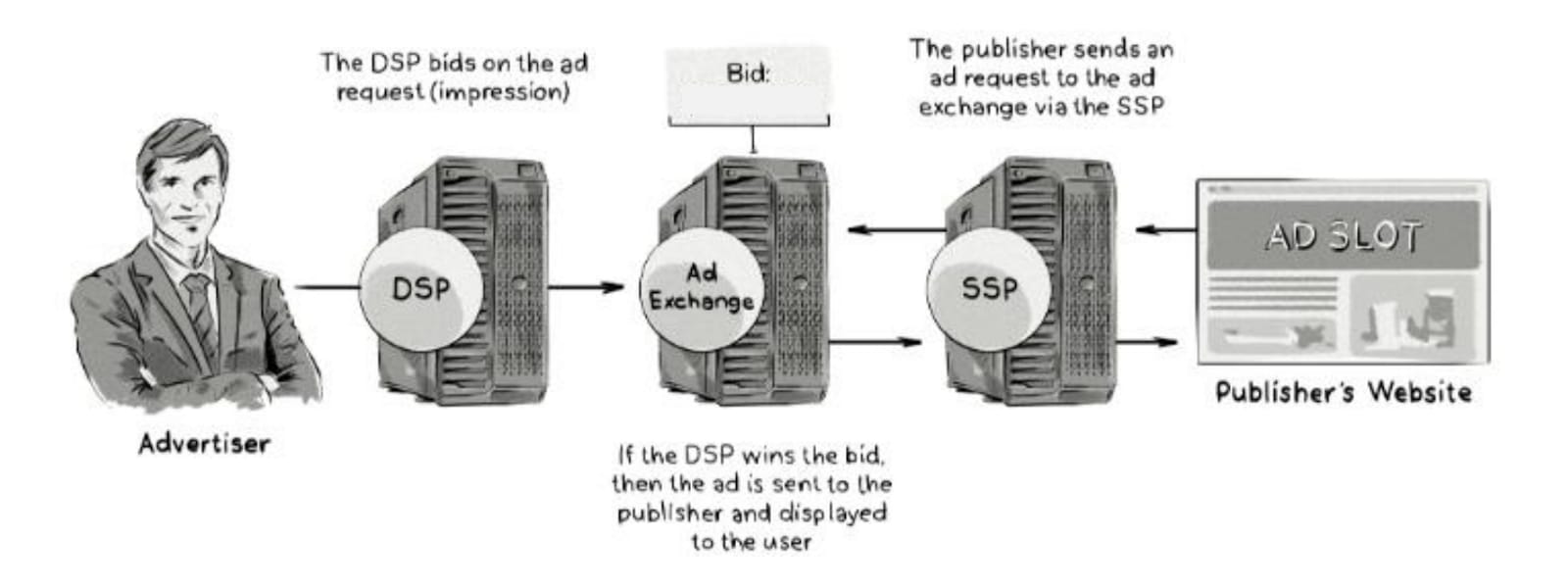

The company is a demand-side platform (DSP), as it’s known, acting as a broker for ad buyers. That means it serves advertisers directly and exclusively, helping them buy ad space across the open internet in real time, using data and software to decide where every dollar should go, ensuring advertisers unlock the most value per impression they pay for. This is also referred to as programmatic advertising, an automated cross-platform ad selling and purchasing process, as opposed to manually negotiating ad deals between sales and marketing teams.

For example, if a brand wants to run a campaign across ESPN.com, Roku, and Spotify, they can do that through The Trade Desk’s platform, all while tracking performance, adjusting bids on these ad spots against other ad buyers, and optimizing to target specific demographics.

TTD is focused on the advertiser, as a “DSP”

So, The Trade Desk doesn't own any media, nor does it produce any content. It’s a broker, facilitating purchases of ad space for marketing agencies and the companies they represent. That neutrality, combined with its massive scale and best-in-class software, is precisely what gives it power. It's like Switzerland for ad buyers on the open internet.

Ad buyers & Agencies on the demand side; Publishers on the supply side of advertising

Compare that to Google, which acts as both the “judge, jury, and executioner” in advertising across the open internet, as TTD’s CEO has put it. Google runs the advertising exchange that connects publishers of content across the internet (who create the “supply” for advertisers) with buyers of their ad space, while also owning its own content platform with YouTube, which competes for ad dollars, too.

They act as both a broker for ad buyers and publishers (ad sellers), placing them in the middle of, and on both sides of, the ecosystem for digital advertising. As owners of Alphabet in our Intrinsic Value Portfolio, Daniel and I aren’t complaining about the profits this has created for them over the years, but that doesn’t make it sustainable indefinitely.

Google’s size and control over all parts of this ecosystem have been an incredible competitive advantage, allowing Google to accrue monopolistic profits for years, arguably to the detriment of everyone else involved.

From an ad buyer’s perspective, to use a real estate analogy, it would be as if your realtor, the homeowner, and the seller’s agent were all the same entity. Conflicts of interest abound.

The Trade Desk has no such entanglements. From the outset, TTD’s CEO Jeff Green decided that the company would commit to only one side of the equation and chose to focus on ad buyers, since there’s a nearly infinite supply of possible advertising real estate, but a finite amount of demand for those ad spots.

From CTV to Retail Media: The Channels That Matter

There are two big ad channels where The Trade Desk has carved out success in an advertising world otherwise dominated by companies like Meta, Alphabet, and Amazon.

The first is Connected TV (CTV), an area that will be familiar to anyone who read our newsletter two weeks ago on Roku. As more people ditch traditional cable and stream content over the internet, the opportunity to place ads inside that content — and do so programmatically — has exploded.

Think about the free streaming tiers of services like Peacock, Hulu, Pluto TV, and Tubi. Or about live sports being streamed through smart TVs and connected devices. CTV is one of the fastest-growing segments in advertising, and The Trade Desk has planted its flag as the go-to partner for advertisers who want access to that inventory, with CTV driving half of its revenues.

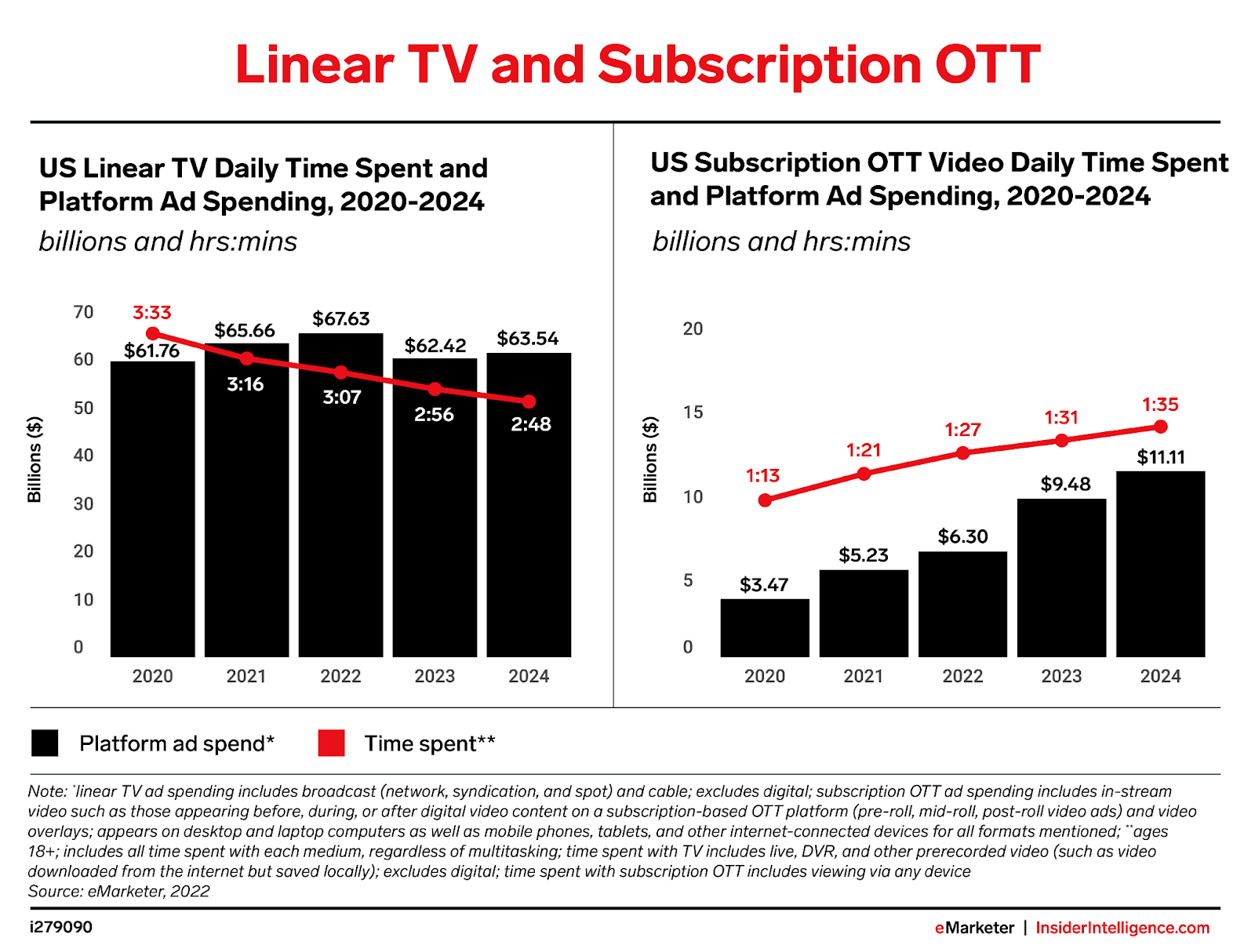

Again, you’ll recall from our Roku newsletter the conversation about how cable ad dollars are increasingly shifting from linear TV to streaming & digital, and while Roku is a beneficiary of this trend, from a different vantage point, The Trade Desk equally benefits from this as well, if not more so.

Linear = Cable, shift from Cable to Streaming

It’s easy to understand why. CTV has all the visual power of traditional television but with digital targeting and measurement. You can serve an ad during an NBA game and know which households saw it, which ZIP codes it performed best in, and how it influenced brand recall or site visits. That type of zoomed-in, individualized data is less available for traditional cable TV ads, which are more like blanket billboard ads indiscriminately presenting an ad to whoever sees it, with less data on, well, who actually saw it.

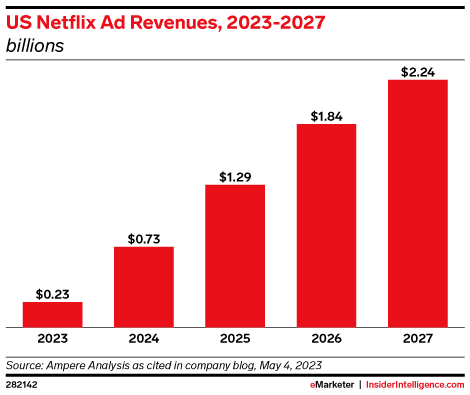

And as streaming platforms like Netflix increasingly rely on ad-supported tiers to monetize their businesses now, which I can testify to as a subscriber, more prime advertising real estate is emerging for ad buyers to utilize (i.e., ads on Netflix shows).

Projection of Netflix’s ad-supported revenues

The second major tailwind is retail media, referring to the ability to advertise inside of e-commerce environments, often using first-party purchase data to target shoppers.

Amazon pioneered this category, building a massive ad business by letting brands buy sponsored placements directly on its site. But there’s a growing wave of other retailers following suit: Walmart, Target, Instacart, Uber Eats, and DoorDash are all becoming ad platforms, as well as our portfolio company, Ulta.

The Trade Desk is integrating with many of these retail media networks to give advertisers access to their data and inventory. That’s a huge deal. For years, the power of advertising was tied to demographic targeting. Now, thanks to retail media, advertisers can target based on actual purchase intent.

It’s one thing to show an ad to someone who fits the profile of a car buyer. It’s another to show it to someone who’s been browsing used SUVs on multiple retailer apps over the last week. That second person is much more likely to convert.

And increasingly, that’s who The Trade Desk can help marketers find.

UID2: The Fight to Replace the Cookie

At the heart of The Trade Desk’s strategy is a bold attempt to rebuild the identity layer of the open internet to make it more competitive with the walled gardens.

For years, advertisers relied on third-party cookies to track users across websites. But with privacy regulations tightening and browsers phasing out cookies altogether (eventually), that system is seemingly on its way out.

So, The Trade Desk stepped up and proposed a new solution: Unified ID 2.0 (UID2).

UID2 is an open-source identity framework that replaces cookies with hashed, anonymized email addresses that users consent to share in exchange for access to content or services. It’s really not necessary to know how it works beyond this takeaway: It’s designed to be privacy-safe, secure, and interoperable across the ad tech ecosystem.

Importantly, UID2 isn’t proprietary to The Trade Desk. The company helped build it, but it gave control of the system to independent nonprofits and trusts. This was a strategic move, with the idea being to avoid appearing as another self-serving tech giant pushing its own standards, and instead foster real industry adoption.

And it’s working. From Spotify and Roku to Fox, DirecTV, Warner Bros., and iHeartMedia, a number of major platforms and content publishers have embraced UID2.

While momentum is building, this is still all very much unfolding.

Google has pushed its own system, the Privacy Sandbox, which uses on-device machine learning and aggregates targeting data into interest groups, rather than letting advertisers track individuals. It's a more closed, opaque approach, yet Google has a lot of leverage because of Chrome’s market share in search browsers.

So what happens if UID2 fails to gain critical mass?

Well, that’s the bear case. If advertisers can’t track users as effectively on the open internet in a way that rivals what’s possible on Facebook or Amazon, they’ll keep pouring money into the walled gardens.

But if UID2 succeeds — if enough publishers and advertisers embrace it — then The Trade Desk cements its role as the most important ad broker outside of big tech, making up the backbone of the open internet’s ad infrastructure.

The Promises, and Shortcomings, of AI

CEO Jeff Green presenting Kokai

Everyone is doing AI these days, and, of course, The Trade Desk is no different, so let’s discuss that a bit.

In 2023, The Trade Desk rolled out Kokai, its new AI-powered platform designed to simplify the complexity of programmatic ad buying, and while promising, it’s now the focal point of a shareholder lawsuit.

Kokai is intended to be a meaningful upgrade to the user experience, automating more of the decision-making process while giving advertisers better visibility into how their campaigns perform.

Traditionally, programmatic advertising has been opaque. You set up your campaigns, let the algorithms run, and hope for good outcomes. Kokai tries to break that mold by providing clearer feedback loops, more intuitive workflows, and smarter recommendations.

It’s like going from Microsoft Excel to a smart dashboard that tells you which ads are underperforming, which data segments are overpriced, and how to reallocate your budget to improve ROAS.

That is the idea, at least. Flashing back to TTD’s Q4 2024 earnings report in February, the stock sold off 30% after the company fell short of its own financial targets for the first time in over 8 years (33 quarters, to be exact), while it became clear that management had been…less than transparent about the roadblocks they were hitting with Kokai’s adoption.

Since then, the company has bounced back (Q1 2025 was much better), and reportedly 2/3 of its clients are now using Kokai, so I wouldn’t say Kokai is all hype. According to the company, on average, clients have seen a 42% reduction in cost per unique reach, with 24% lower cost per conversion and 20% lower cost per acquisition. Any marketers in the audience will understand how significant that is.

But management’s communications leading up to the Q4 2024 earnings report, when reality could no longer be obfuscated, is an unexpected blemish and yellow flag for a company that has been, otherwise, operationally excellent since inception.

Business Model: Scaled SaaS, Not Media Arbitrage

Now, let’s make sure we actually understand how TTD makes money. Fortunately, The Trade Desk has one of the cleanest business models in digital advertising.

It simply charges a platform fee, typically around 20%, on the gross ad spend that flows through its system. So if an advertiser runs $100,000 worth of campaigns, The Trade Desk might earn $20,000 in revenue.

That fee isn’t fixed. It can vary depending on the services used, the data activated, and the media types bought. But the key idea is that The Trade Desk aligns its incentives with advertisers: the more effective the platform is, the more advertisers spend, and the more The Trade Desk earns. Although 20% sounds like a huge cut for TTD to take, if they can improve outcomes for advertisers by, say, 30% or more, then that fee pays for itself relative to the results advertisers would have if working with another DSP or advertising in other mediums.

Given the amount of value they create, the company has an extremely high-margin model. Gross margins typically hover above 75%, and the company generates impressive 27% free cash flow margins. Because it doesn’t need to invest in content or maintain massive salesforces like traditional media companies, it can scale efficiently.

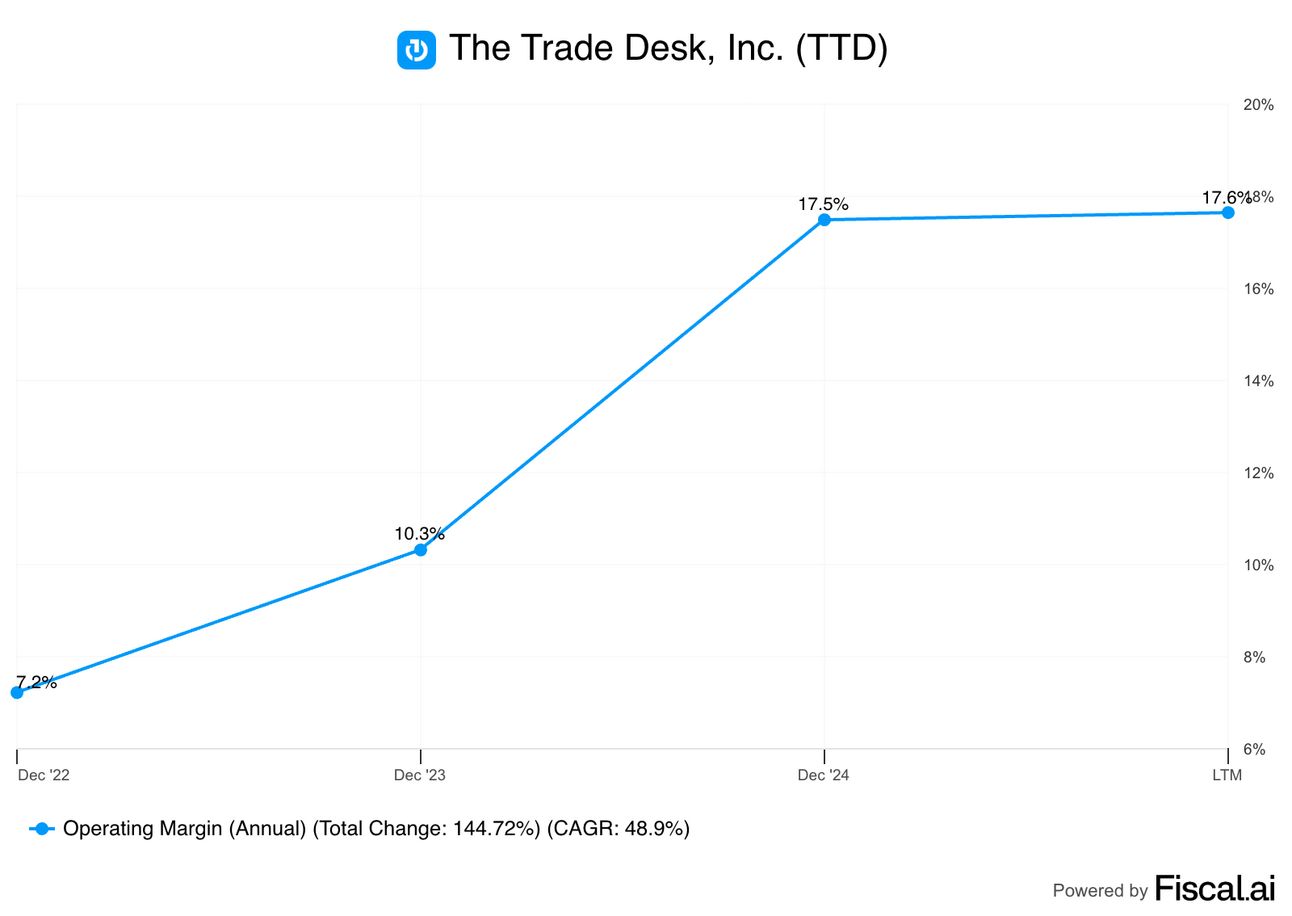

Again, TTD relies on algorithms to drive optimal ad spending, so there’s very meaningful operating leverage. R&D, software infrastructure, and G&A costs don’t scale linearly with revenue, which means margins can expand over time as the business grows.

TTD’s margins since 2022

Peeking into the Bear Cave

Let’s get uncomfortable for a minute.

While it’s tempting to view The Trade Desk as the clear winner of the open internet, there are real risks that could derail the thesis or at least limit shareholder returns over a multi-year horizon.

Firstly, there’s the risk that UID2 doesn’t scale.

Yes, UID2 is an elegant, open, privacy-conscious solution. But it also requires significant buy-in from publishers, advertisers, ad tech platforms, and consent mechanisms. It relies on users logging in with emails, opting in to data-sharing, and consistently engaging across domains. That’s not a small ask.

Meanwhile, Google’s Privacy Sandbox, despite all its flaws, has a trump card: Chrome. With its dominant browser market share and growing control over Android tracking, Google can enforce adoption of its standards simply by pushing software updates. Google has also dragged its feet on moving away from cookies, too, which partially reduces the urgency and need to adopt UID2.

The open internet could remain fragmented and inferior to the walled gardens in terms of measurement and targeting, reducing the TAM that The Trade Desk can grow into.

In that scenario, The Trade Desk isn’t dead, but it’s much less compelling at its current valuation. It becomes just a really good DSP in a world still dominated by the black boxes (aka walled gardens).

Second, there’s the risk that The Trade Desk becomes what it claimed to disrupt, so let’s talk about OpenPath.

OpenPath is The Trade Desk’s initiative to connect advertisers directly with publishers, bypassing traditional SSPs (supply-side platforms) like Pubmatic in the process, which do what TTD does but for publishers.

On paper, it’s about cutting out unnecessary intermediaries, reducing fees, and improving transparency. In practice, though, it has raised eyebrows across the industry. Because while The Trade Desk has long marketed itself as the neutral middleman, OpenPath edges it closer to a full-stack solution.

The company says it has no plans to become an SSP. But when you start facilitating direct publisher access, and you’re already the dominant DSP, and you control the data layer through UID2, and you own the bidding algorithms…well, neutrality starts to look like a sliding scale.

And the more power The Trade Desk amasses, the more it invites scrutiny from publishers, regulators, and clients who may bristle at the idea of one company sitting in too many seats at the table.

It’s a delicate balance. And it’s not hard to imagine a future where The Trade Desk’s efforts to “streamline” the ecosystem alienate some of its partners, or worse, invite regulatory attention similar to what Google’s ad business is currently facing.

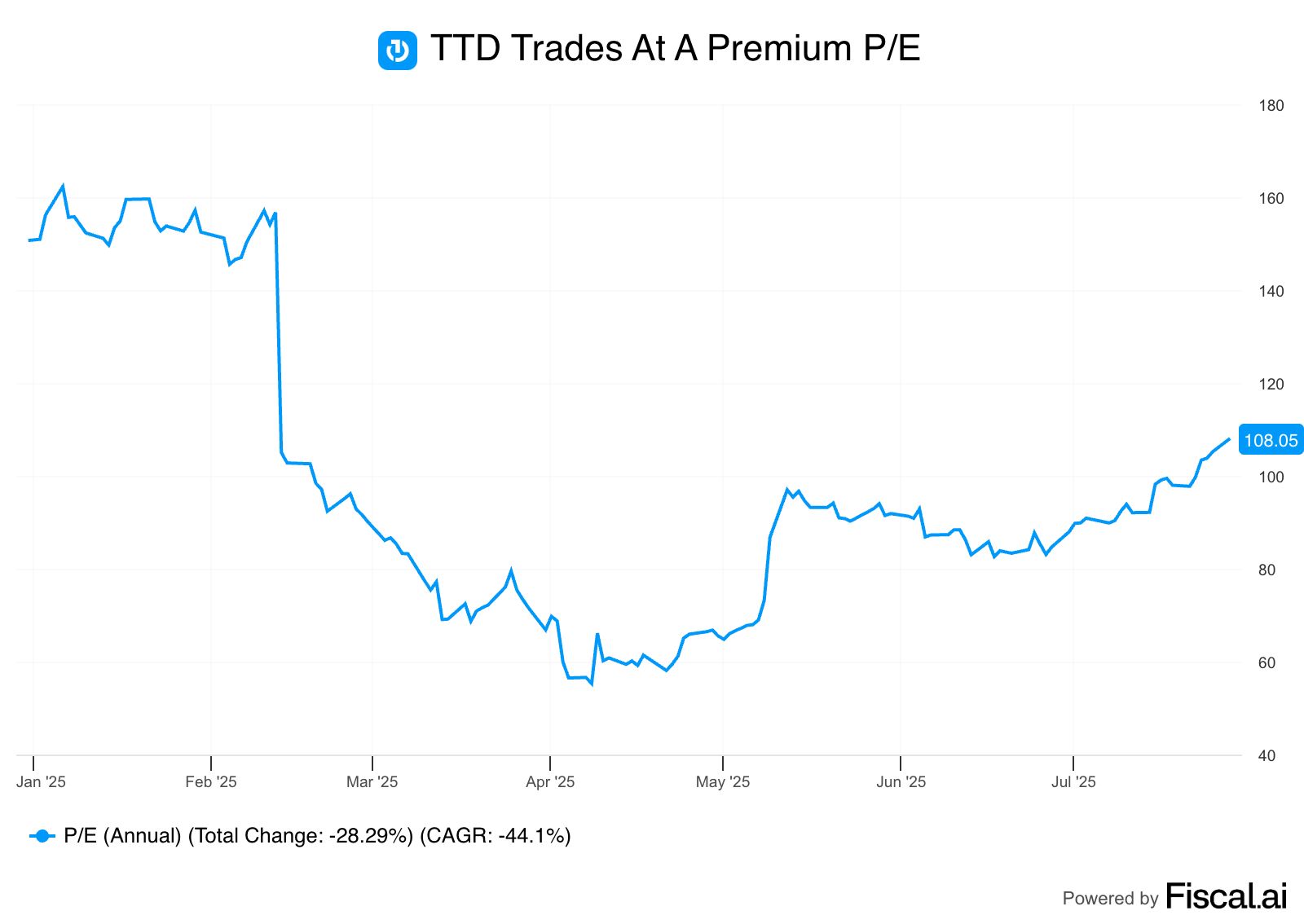

There’s also a significant valuation risk, given that Mr. Market has grown quite excited about TTD’s, and the open internet’s, prospects.

Even after a modest pullback, The Trade Desk still trades at something like 100x last year’s earnings, and 40x analysts’ estimates for earnings over the next 12 months. If anything slows down — whether that’s UID2 adoption, margin expansion, or ad market growth — there’s a lot of air under the multiple.

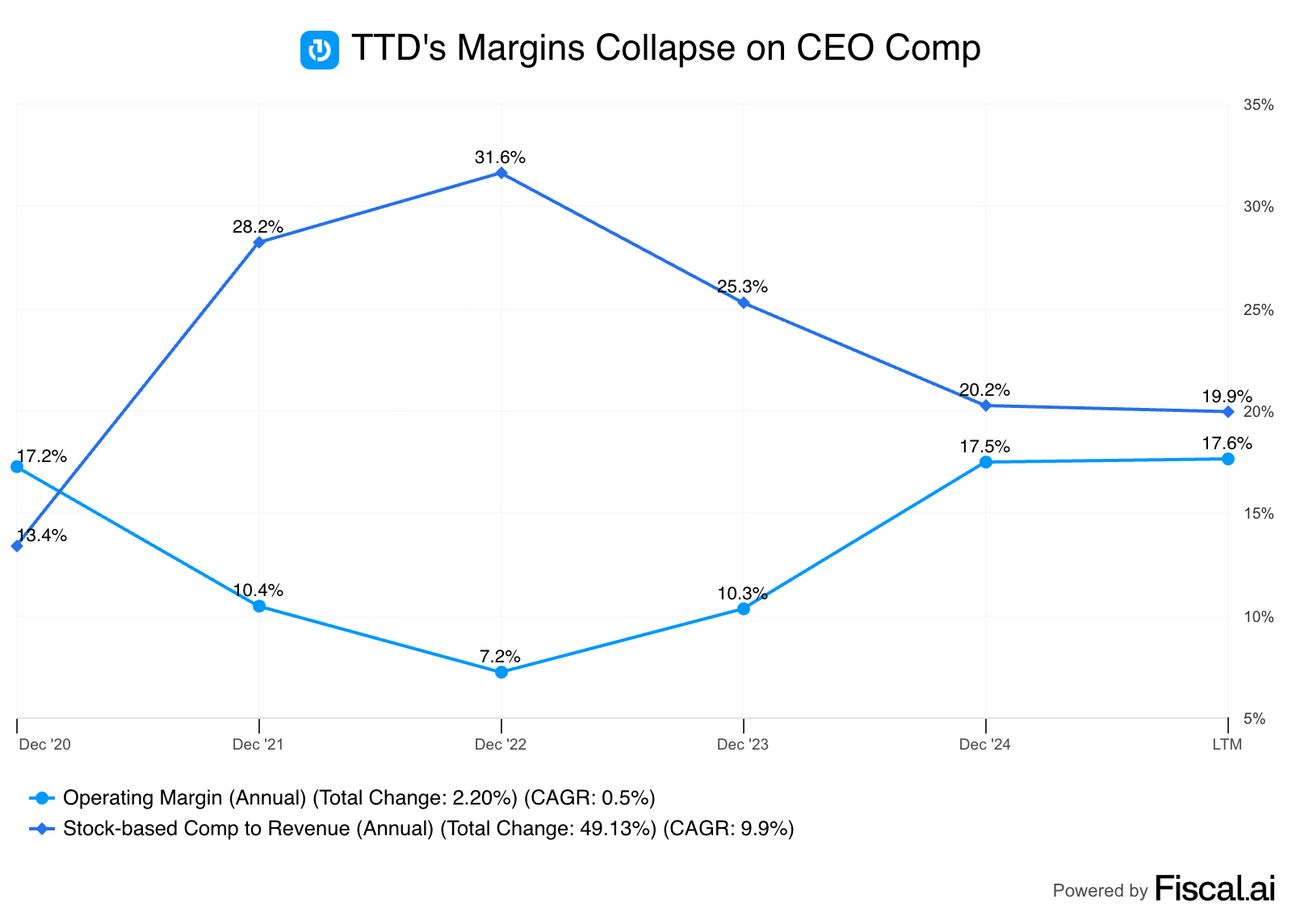

Lastly, we need to address stock-based compensation.

CEO Jeff Green’s 2021 comp package (one of the largest in Silicon Valley history) still casts a shadow over shareholder returns and the company’s earnings. The company’s operating margins used to be in the 20% range, and much of the falloff in margins over the last few years (which are now recovering) stems from accounting for Green’s huge pay package.

While entirely performance-based, it triggered a sharp spike in SBC expense, diluting ownership and drawing criticism over governance, so much so that this incident also triggered a shareholder lawsuit, which was eventually dismissed.

SBC as a percentage of revenue has started to normalize, and Green’s package will last for a number of more years, but it’s not an inspiring picture for long-term shareholders, nonetheless. The fact that the Board approved such a package in and of itself is somewhat damning.

Fuller Picture of TTD’s Margins and the Effects of the SBC Increase in 2021

One More Thing to Cover: Google

Before we get into the valuation and portfolio decision, we need to cover the latest with Google and how it could be a structural tailwind for TTD.

One of the more underappreciated aspects of the bull case for TTD is that regulatory pressure on Google could create meaningful tailwinds for The Trade Desk, both in the form of direct market share gains and a broader shift in how advertisers think about platform risk.

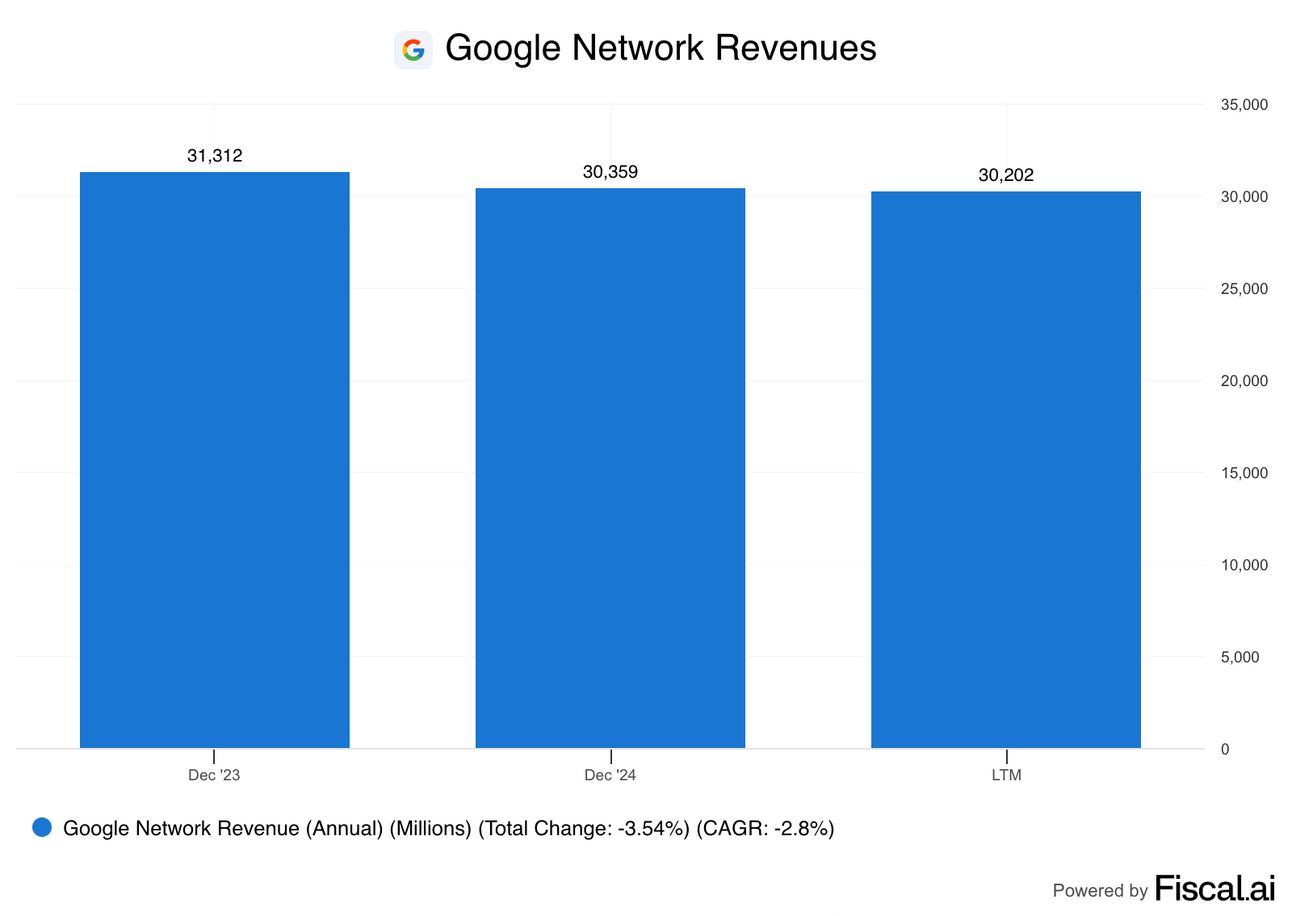

Google is currently under siege from regulators worldwide for its dominance in digital advertising, specifically with its role in running a two-sided marketplace facilitating ads across the open internet via its “Google Network” operating segment. (Just to be clear, this isn’t referencing Alphabet’s golden goose Search business; this is about their role in brokering advertising across websites.)

In the U.S., the Department of Justice has filed suit to break up portions of its ad manager tech stack, arguing that Google has abused its position as both buyer, seller, and exchange, as mentioned earlier. In Europe, similar cases are underway, with antitrust bodies scrutinizing how Google leverages Chrome, Android, and its ad stack to consolidate power.

At the heart of many of these cases is a basic structural problem: Google owns every layer of the ad transaction. They run the demand-side platform (DV360), the supply-side platform (AdX), and the exchange in between.

As regulatory scrutiny has piled up, an interesting thing has happened: Alphabet’s juggernaut of a business unit has stalled out and is now contracting. That $30 billion pie of Google Network revenues is currently being carved up by companies like TTD, as well as others like Pubmatic and Magnite, as advertisers and publishers across the open internet look to distance themselves from Google’s unfair practices and regulatory scrutiny.

Alphabet’s Google Network segment has been in decline over the last few years

Incrementally, I expect those outflows from Google to structurally benefit TTD, while there’s a tailwind generally supporting programmatic advertising at the same time.

Morningstar estimates the digital advertising market to be $700 billion currently, yet they expect it to more than double over the next decade, and if TTD can grow their market share from 2% to 5% as they soak up some of Google’s DSP business in the open internet, then The Trade Desk can quite plausibly continue to compound its sales at 18-20% a year for the foreseeable future.

Valuing The Trade Desk

Okay, now we can talk about whether The Trade Desk is fairly valued. In my base case, I assume TTD can grow revenues at 18% a year, while operating margins continue to expand to match and surpass their margins prior to giving Jeff Green a huge payday, in the 25% range.

Then, as always, I looked at peers, the company’s own valuation history, and accounted for my belief that the company will still be more profitable and growing faster than the average S&P 500 company in 5 years from now, leaving me to conclude a slightly premium exit multiple of about 31x operating profits could still be justified.

This reflects that they can substantially “grow” into their current multiple, yet this also cuts their current EV/EBIT valuation by two-thirds, which is to be expected as the business matures.

The question, really, is what degree of operating profitability you think they can reach, because I’m pretty sure the topline is going to still grow dramatically, even if more bearish realities come to fruition. If their steady state margins are closer to 30%, the company is probably closer to being attractively valued. At 25%, what I see as plausible, the company is currently still expensive and becomes more attractive around $50 per share, so it would need to fall by two-fifths to catch Daniel and I’s attention in a base case.

But if operating margins at scale are 20% or less in a bear case, well, it’s going to take a lot of topline growth for the current valuation to be justified.

As always, you can review and play around with my model here.

Final Thoughts

I advised Daniel that, for now, we pass on The Trade Desk. Honestly, I thought it would be easier to understand this business after having previously dug into Alphabet and Roku, but the world of programmatic digital advertising is convoluted, to say the least. It’s a highly technical B2B landscape, which makes it all a lot less tangible for me as an outsider.

I have trouble saying with any real confidence what will happen with UID2, OpenPath, or how exactly the status quo will shift in light of regulatory enforcement against Google’s multi-faceted role in programmatic advertising.

These are really big questions, and while I’m pretty sure TTD will be a dramatically bigger company in the future, the valuation and uncertainty just mentioned give me enough pause to be humble about adding this company to our Intrinsic Value Portfolio.

Over time, as we study other companies that overlap with the digital advertising ecosystem, maybe I’ll get more comfortable with understanding The Trade Desk’s moats, but for now, it feels like I have the inkling of a good idea, though not the conviction or expertise to act on it yet.

If anyone is particularly well-versed in ad tech, I’d love to chat — you can email me at [email protected].

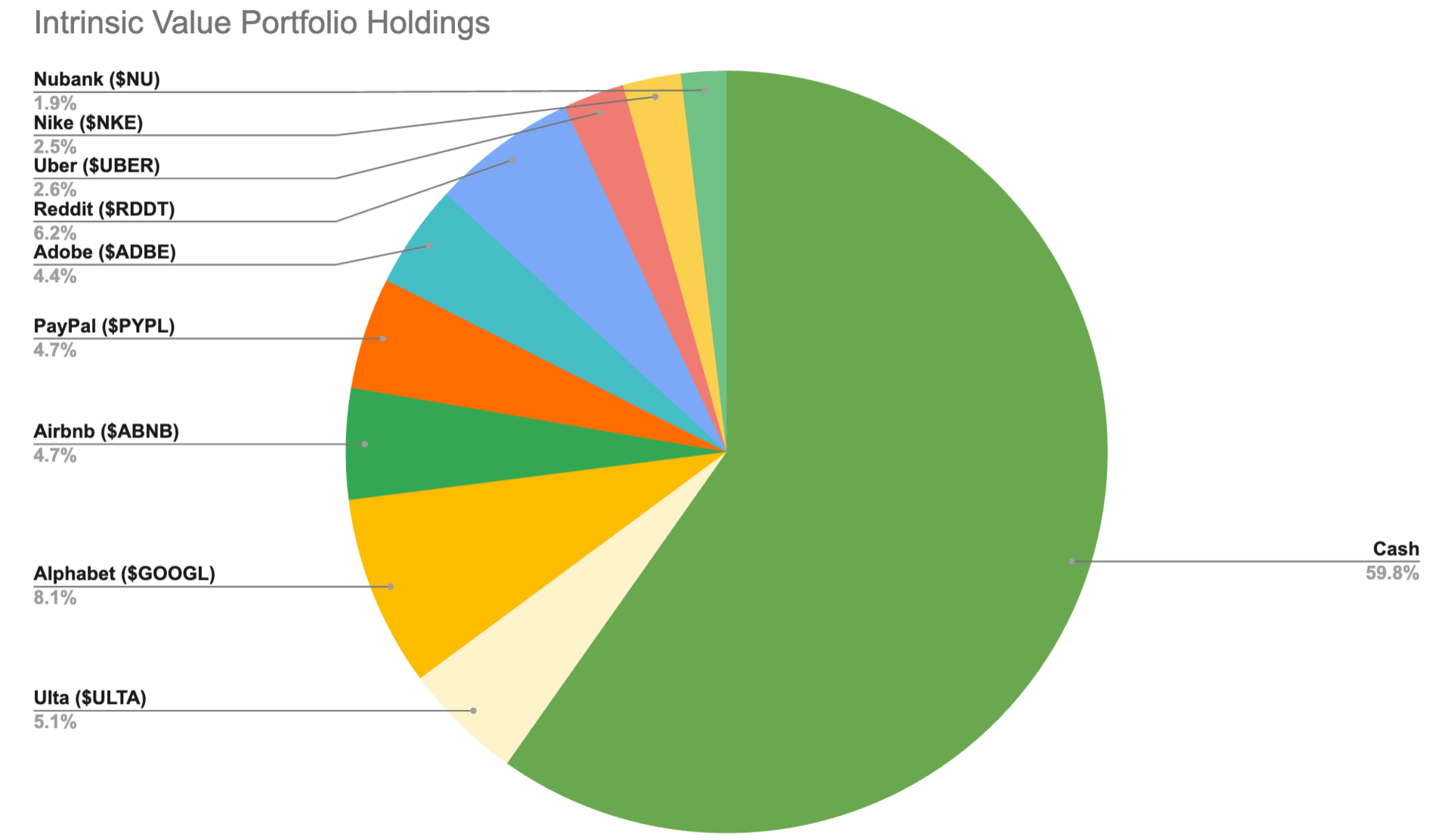

Weekly Update: The Intrinsic Value Portfolio

Notes — Recapping Earnings For Portfolio & Watchlist

Earnings season has gone into full effect. Here are some of the earnings reports we’ve been keeping an eye on: Reddit, Spotify, Alphabet, and PayPal.

Alphabet: Alphabet delivered solid results, showing no signs of ChatGPT eating its search business (which grew 10% YoY), while the company pledged to further ramp up its capex on AI. In fact, OpenAI recently announced plans to use Google Cloud to support ChatGPT! We continue to believe the company is modestly undervalued, with some upside optionality from mean reversion in the valuation multiple and their bets on Waymo, as well as in using AI to discover new ways to treat disease.

Reddit: At the time of writing, Reddit stock is up over 20%, climbing above $190! That makes Reddit our first “double” in just a few months, so we’re very glad to have entered the position when we did. It’s easy to say that I wish we had made the position size larger, but given the information we had at the time, I don’t have any regrets. And at over 6% of the portfolio now (versus 2% initially), Reddit has increased its weighting all on its own.

I recommend reading Reddit’s shareholder letter for more, but in short, the business is growing soundly on all metrics. Revenue was up 78% YoY; after years of unprofitability, they produced an 18% net-income margin; free cash flow came in at $111m (up $83m YoY); the number of daily & weekly active unique users rose 21%; international user growth came in at 32% YoY; and average revenue per user rose 47% YoY.

TLDR: The business is firing on all cylinders, growing even faster than our most optimistic expectations! The stock jump isn’t just speculation — it reflects genuine improvement in the fundamentals.

PayPal: Our newest holding, PayPal, also released earnings and…well, the market didn’t like them nearly as much as it liked Reddit’s. We viewed the results much more positively.

Don’t get me wrong, it wasn’t a flawless quarter, but it was better than expected, especially considering this was arguably the toughest quarter of the year. PayPal delivered a triple beat and even raised its full-year guidance.

Operating margins approached 20%, and transaction margin dollars grew by 8% (excluding interest on customer balances). Braintree, PayPal’s enterprise-focused payments segment, is expected to return to growth in Q3, earlier than initially expected.

Still, the market wasn’t impressed. Shares dropped 10%, wiping out our early gains in the position. The pullback seemed driven by concerns over branded checkout and the relatively modest size of the guidance raise, possibly signaling a weaker second half, or, as in previous quarters, a case of management sandbagging.

Long story short: the turnaround is well underway, but the market remains skeptical.

Quote of the Day

"Many a small thing has been made large by the right kind of advertising.”

— Mark Twain

What Else We’re Into

📺 WATCH: How NFL stadiums are engineered to maximize profits

🎧 LISTEN: The Intrinsic Value of Reddit & Uber w/Shawn O’Malley on We Study Billionaires

📖 READ: Given the frothiness in markets, we’re revisiting Warren Buffett’s Dot-Com Bubble shareholder letter from 2000 — write us in to share your reflections!

You can also read our archive of past Intrinsic Value breakdowns, in case you’ve missed any, here — we’ve covered companies ranging from Alphabet to Airbnb, AutoZone, Nintendo, John Deere, Coupang, and more!

Your Thoughts

Do you agree with the investment decision for TTD?Leave a comment to elaborate! |

See you next time!

Enjoy reading this newsletter? Forward it to a friend.

Was this newsletter forwarded to you? Sign up here.

Use the promo code STOCKS15 at checkout for 15% off our popular course “How To Get Started With Stocks.”

Follow us on Twitter.

Read our full archive of Intrinsic Value Breakdowns here

Keep an eye on your inbox for our newsletters on Sundays. If you have any feedback for us, simply respond to this email or message [email protected].

What did you think of today's newsletter? |

All the best,

© The Investor's Podcast Network content is for educational purposes only. The calculators, videos, recommendations, and general investment ideas are not to be actioned with real money. Contact a professional and certified financial advisor before making any financial decisions. No one at The Investor's Podcast Network are professional money managers or financial advisors. The Investor’s Podcast Network and parent companies that own The Investor’s Podcast Network are not responsible for financial decisions made from using the materials provided in this email or on the website.