- The Intrinsic Value Newsletter

- Posts

- 🎙️ Ferrari: High-Speed Compounder

🎙️ Ferrari: High-Speed Compounder

[Just 5 minutes to read]

Enzo Ferrari insisted his company would “always deliver one car fewer than the market demands.”

That single sentence explains almost everything about a business that sells barely 14,000 automobiles a year, yet enjoys gross margins north of 50%, trades for a price-to-earnings ratio that would make most software founders blush, and has turned every dollar invested at its 2015 IPO into nearly ten today.

In an industry where few brands resemble anything close to “true luxury”, Ferrari stands apart: it’s both artisan and engineer, racetrack legend and design house. Investors, understandably, puzzle over how to value such a stock. Is a sticker price of 50x earnings indefensible for a carmaker (historically, one of the toughest industries to invest in), or entirely fair for an Hermès on wheels?

More below on the brand, and compounder, that is Ferrari, embodied by its iconic prancing black horse logo.

— Shawn

Ferrari: True Luxury in Automobiles

An Obsession: On & Off The Track

Scuderia Ferrari began life in 1929 as a racing team fielding Alfa Romeos.

Ten years later, Enzo Ferrari founded Auto Avio Costruzioni, and by 1947, the first true Ferrari, the 125S, roared onto the track under its own badge.

A year later, the 166 Inter took the marque onto public roads. From the outset, Enzo sold scarcity as fiercely as horsepower: “I don’t sell cars; I sell engines. The cars I throw in for free since something has to hold the engines in.”

He built his house inside the Modena test track, refused holidays, and endured an era when racing regularly cost drivers their lives. That relentless devotion became institutional memory. Today’s management still quotes Enzo’s vow to undersupply demand, empowering the brand to never be cheapened by volume.

Enzo Ferrari

Enzo’s race-track house

However romantic the back story, Ferrari’s economics are calculated, almost scientific.

This is a company with a $90 billion market cap, after all. Selling just a few thousand units a year, while boasting a market cap approaching $100 billion, would otherwise sound unfathomable if you didn’t know that the starting price for a Ferrari is about $250k and can easily reach a million dollars for limited edition supercars.

Daniel and I take solace in being able to buy the stock, at least, if it’ll be some time before we can afford to buy a new Ferrari ourselves.

Ferrari, and Then Everyone Else

Something like 90 million lightweight vehicles are sold every year globally, so Ferrari makes up a very, very small percentage of those sales (0.016%, to be exact), and its relative footprint looks even smaller when you compare Ferrari’s sales with other prestigious brands like BMW, which sells around 2 million vehicles a year (143x more!) Even Porsche sells 300 thousand cars annually.

So, Ferrari is truly unique for how few vehicles it actually sells, especially relative to the size of the overall business.

You might think Rolex is a brand that can rival Ferrari’s exclusivity, but in reality, it’s not even close. Rolex sells something like a million watches a year, several orders of magnitude more than Ferrari’s volumes.

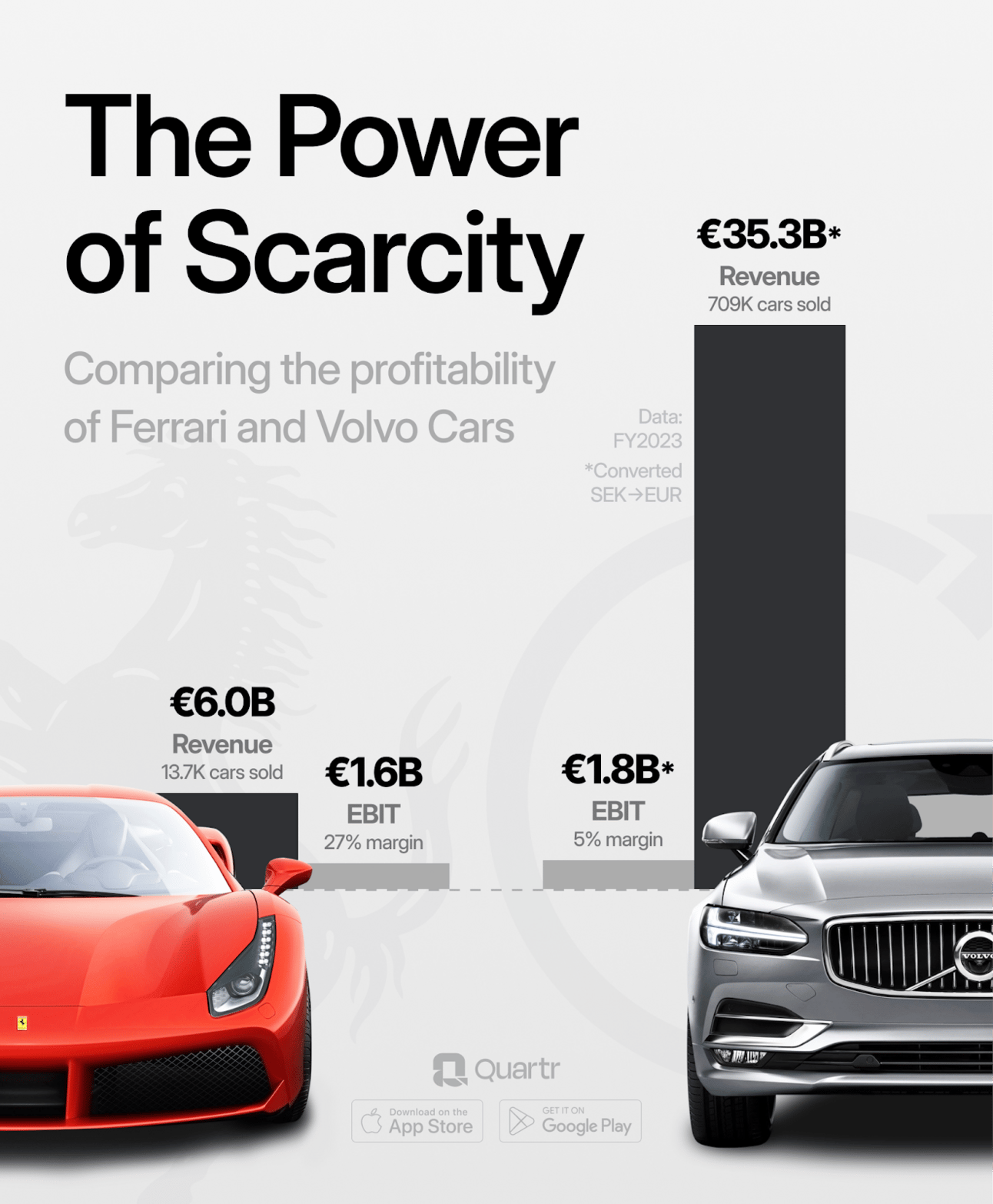

Just to hammer home how special Ferrari is: Volvo generates six times as much in revenue, to earn approximately the same total operating profit as Ferrari (see chart below).

Ferrari and Volvo generate roughly the same operating profit on very different revenue figures

That is the power of, well, pricing power! You can do way less work to produce and sell many fewer vehicles but generate the same nominal profit. From a margin perspective, Ferrari has really nothing in common with any other auto manufacturer in the world.

Ford clears 8% gross profit margins (GP = the difference between sales & costs of goods sold), while General Motors comes in with 12% gross margins. In contrast, software-powered Tesla, at its recent peak, hit 17%, and the great Mercedes-Benz commands just under 20%.

Ferrari floats above 50%. And the gap widens further, lower down the income statement, where Ferrari converts an impressive 23% of revenue to net income vs. 6.2% for Mercedes, 4.7% for BMW, 3.4% for Volvo, and -17% for Aston Martin.

Exclusivity Pays

Why? The waiting list itself for Ferrari is a marketing asset, while custom paint and carbon-fibre add-ons carry high incremental margins, and because second-hand Ferraris often appreciate, turning ownership into an “investment” in the eyes of ultra-wealthy buyers.

Eight of the ten most expensive cars ever auctioned are Ferraris, with residual values for Ferraris three years after delivery routinely eclipsing those of Lamborghini, Bentley, or McLaren. Scarcity begets cachet; cachet begets margin; wide margins fund the next leap in engineering, reinforcing scarcity all over again. That is, in other words, the flywheel.

The most expensive Ferrari ever sold, above, fetched $70m

Daniel and I first got our feet wet with luxury when he pitched Moncler months ago, and more recently, when we dug into LVMH to learn about “true luxury.” I’ve never seen anything like the demand for Ferrari, though.

There’s truly an almost cult-like following, where Ferrari rewards loyal and proven customers with the chance to buy special editions. Making people wait to give you money seems like a strange business model, but Ferrari has made a habit out of it, frequently extending two-year wait times just to buy a new model to folks who, well, aren’t used to having to wait or hear no, which makes them only want the product more.

As mentioned, the fact that Ferraris hold their value so well helps buyers-to-be rationalize a six-figure vehicle investment. In fact, not only has Ferrari consistently supplied many fewer vehicles than demanded, but it has also intentionally sold its vehicles at a discount to what they can immediately be resold for on the secondary market.

Ferrari is, of course, not leaving money naively on the table; this is a strategy that molds the lore behind Ferrari’s brand, lowers psychological barriers to purchase, and encourages first-time buyers to become lifelong, recurring customers, who truly believe the idea that Ferrari ownership is an investment.

And again, that belief is validated by new Ferraris typically selling below their secondary value (not something you can say of really any other carmaker on earth) and only possible when there’s an extreme imbalance between supply & demand for their vehicles.

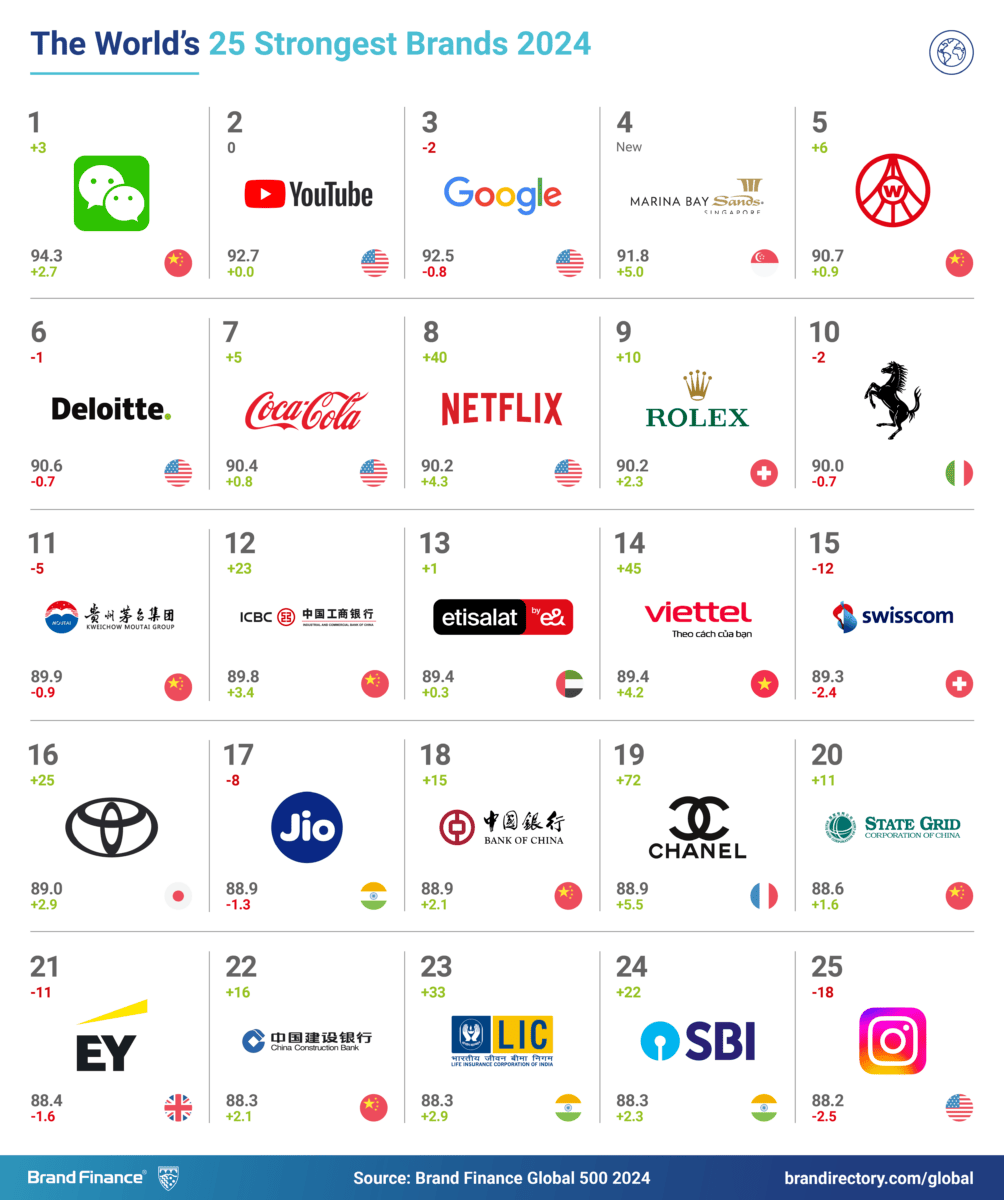

Because of this, and more, Ferrari consistently ranks as one of the strongest brands in the world:

Formula One: Marketing Budget in Disguise

Before we go any further, I don’t think we can tell the story of Ferrari without lingering momentarily on F1.

Ferrari is the only constructor to have competed in every Formula One season since 1950, and that unbroken streak is at the heart of the company’s flywheel. Roughly $400 million+ flows through its racing team, Scuderia, each year, manifesting as both marketing spend and R&D, since many of the developments made at the cutting-edge of racing soon find their way into new Ferrari models.

Plus, every Grand Prix delivers two hours of global prime-time exposure to an audience that over-indexes in the top 1% of household incomes, and Netflix’s Drive to Survive has further amplified that reach to tens of millions of new, younger, and increasingly female viewers. The show’s arrival coincided with a sharp drop in the average age of Ferrari’s first-time buyers to just under forty, showing that nothing about the brand is going stale.

It’s not a leap to argue that Ferrari is to F1 as the Yankees are to baseball — by far the most dominant franchise in the sport's history, and that dominance continues, with Ferrari’s recent signing of seven-time World Champion Lewis Hamilton, who is periodically described as the Michael Jordan of F1.

(Almost) As High Quality As It Gets

This is all great for the brand and, ultimately, Ferrari’s ability to command ultra-luxury pricing with long waitlists, but Ferrari doesn’t quite enjoy the same economics as arguably the world’s best luxury business: Hermès.

Namely, that’s because F1 racing and high-performance vehicle sales necessitate constant R&D, which is capital-intensive, even if it pays off. Around 15% of sales every year, on average, go toward Ferrari’s R&D. Hermès, in producing its signature Birkin bags, requires much less R&D with lower costs of goods sold, too, allowing the company to sustain 70% gross margins (20 percentage points > Ferrari) and 30% net income margins (7 percentage points > Ferrari.)

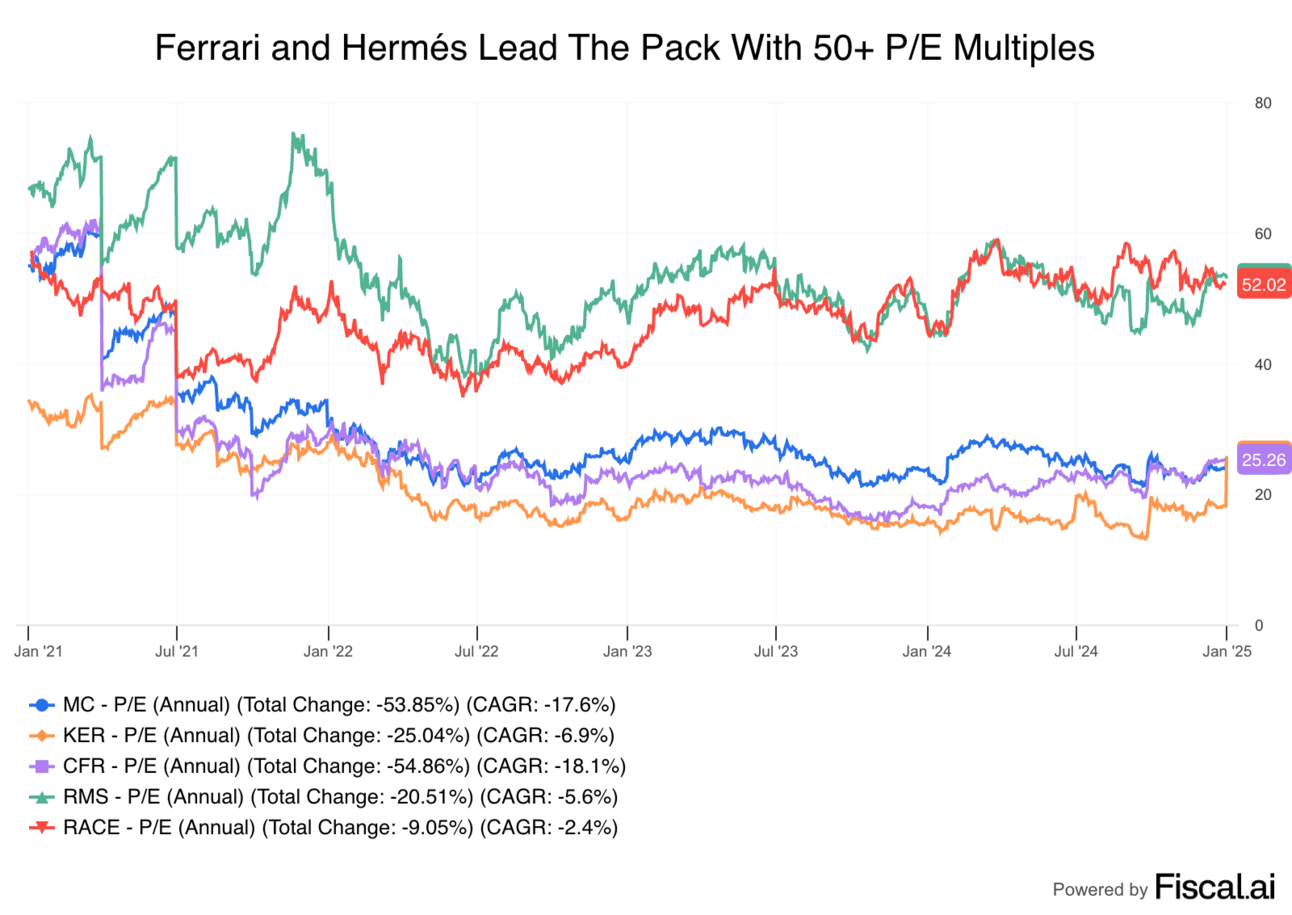

Ferrari stands head and shoulders above the world’s biggest automakers, and in the world of luxury, is really only rivaled, and beaten, by Hermès. Hence, it’s little surprise that Ferrari and Hermès trade at luxury-industry leading valuation multiples, with Hermés (green line) trading at a slight premium to Ferrari (red line):

Blue (MC) = LVMH; Green (RMS) = Hermés; Orange (KER) = Kerring, Maker of Gucci; Purple (CFR) = Richemont, Maker of Cartier; Red (RACE) = Ferrari

The Economics of Excellence

Car and spare parts sales remain the core of Ferrari’s business, but customization is where the margins get wild. And the fact that most people buying a $500k car want it customized helps to squeeze even more juice out of every sale.

Incredibly, about 90% of all Ferraris ever produced remain on the road, according to the company, and many customers choose to upgrade theirs via the Atelier or Tailor Made programs, layering bespoke paint, leather, and carbon-fiber touches that can double the base price.

Yet, if you get carried away in your requests, Ferrari will actually reject your “bad taste” customization! How’s that for defending your brand?

After the sale, a seven-year free maintenance plan kicks in automatically, followed by optional coverage through year fifteen and then specialized maintenance kits through year twenty. Keep up with that care schedule, and your car can earn a factory certification that raises its resale value, reinforcing owners’ views that a Ferrari is an asset, not just an expense.

Unlike most automobile companies, in-house financing is a small part of the picture for Ferrari, and more a complementary feature than an essential part of the sales process, given the company’s wealthy clientele.

Ferrari Financial Services finances only about 4,800 U.S. loans, and the collateral is a car that often appreciates, so credit losses are practically nonexistent. Add in restoration services for vintage models, “flying-doctor” technicians who travel worldwide to solve tricky mechanical issues, and a growing ecosystem of branded apparel, fragrance, and even theme parks, and it becomes obvious why management can earnestly talk about cultivating a culture of lifetime ownership rather than merely just being a seller of cars.

I chatted with Daniel about it and joked that, in a way, the ownership mindset that Ferrari has cultivated among its customers reminds me of the attitude Buffett has fostered among Berkshire shareholders. That loyalty and long-termism has paid for itself, in different ways, for both companies. Incredibly, about 80% of all new Ferrari sales are made to repeat customers!

How Can Ferrari Be Worth So Much More Than Aston Martin?

This is a question that the famous investor and Ferrari shareholder, Guy Spier, addressed perfectly in a short interview.

The uninitiated may think that Aston Martin or Rolls-Royce are legitimate comps for Ferrari, but they may not be as similar as you’d think.

For example, Spier highlights how subtle differences in branding can show up as a big difference in the business’s economics. As he explains, Ferrari customers are so fiercely loyal to the brand that they don’t mind going to the edge of town to buy one, whereas Bentley and Rolls-Royce have to pay for very expensive showrooms in the center of town to reach their target customers, and that results in much higher costs of distribution.

That’s the difference between being able to truly pull your customers to you versus chasing after your customers. Again, it would be easy to think that Aston Martin is also similar to Ferrari, which is why it seems absurd that, with a market valuation of just $1 billion, despite selling a similar number of vehicles as Ferrari at six-digit prices, the market could value Ferrari as being worth 90x more.

A Ferrari (left) and Aston Martin (right)

But there’s a meaningful difference between selling cars at an average price of $300,000, and $570,000, as Ferrari did last year. And at that lower price point, Aston Martin can still only sell about half as many vehicles as Ferrari each year.

Without more pricing power, Aston Martin simply isn’t profitable, burning cash while Ferrari rakes it in. To the median car buyer more in the market for Toyotas than Ferraris, it might be hard to appreciate why one sells for twice as much as the other, but after diving deeper into Ferrari’s heritage, racing successes, and mainstream aspirational appeal, the differences have become clearer to me.

It’s a similar picture among Ferrari’s other “peers”: Lamborghini sold 3,000 fewer vehicles than Ferrari at an average price of $340k, and Bentley sold the same number as Lamborghini, but at an even lower average price, just below $300k. Volkswagen actually owns both Bentley and Lamborghini, and as I showed earlier, the two brands are hardly enough to move VW’s profitability above the average for the automobile industry, let alone relative to Ferrari.

Still An Automobile Company In Some Ways

Ferrari isn’t entirely spared from the challenges facing more typical automobile manufacturers. They haven’t bypassed the pressure to reduce their carbon footprint, for example.

Hybrids now account for about half of sales, proving customers will pay for new tech if it wears a cavallino rampante badge. And an all-electric Ferrari will debut at year-end, giving the brand fresh narrative fuel for another cycle.

—> Quick Aside on ICE Vehicles vs. EVs

I actually think that Ferrari could distinguish its brand in the future by receiving carve-outs for limited production of traditional internal combustion engines in a hybrid/EV world. The comparison that makes sense to me is to look at how horseback riding was once the standard form of transportation, and now, in many circles, it’s a hobby for the rich.

In 20-30 years from now or longer, I wonder if, in the same way that the wealthy enjoy slipping out to the countryside for horseback riding, they may also indulge in taking their ICE-powered Ferrari out for a spin, too.

Just an idea, with the point being, given their relatively small sales volumes, I don’t think Ferrari will face the same production crackdowns on carbon emissions that high-volume carmakers do, making their vintage vehicles (or new editions of classics) even more coveted to nostalgics.

Volume Game

For as strong as the Ferrari brand is, there are limits on the company’s ability to just keep hiking prices every year as a primary growth driver: total vehicle shipments have nearly doubled over the last decade, so the company is leaning more heavily on higher volumes than ever before. Yet, the average model’s production is still capped at around 1,000 units a year, meaning the company largely grows volumes by expanding its product lineup, showcasing around fifteen launches every four years or so.

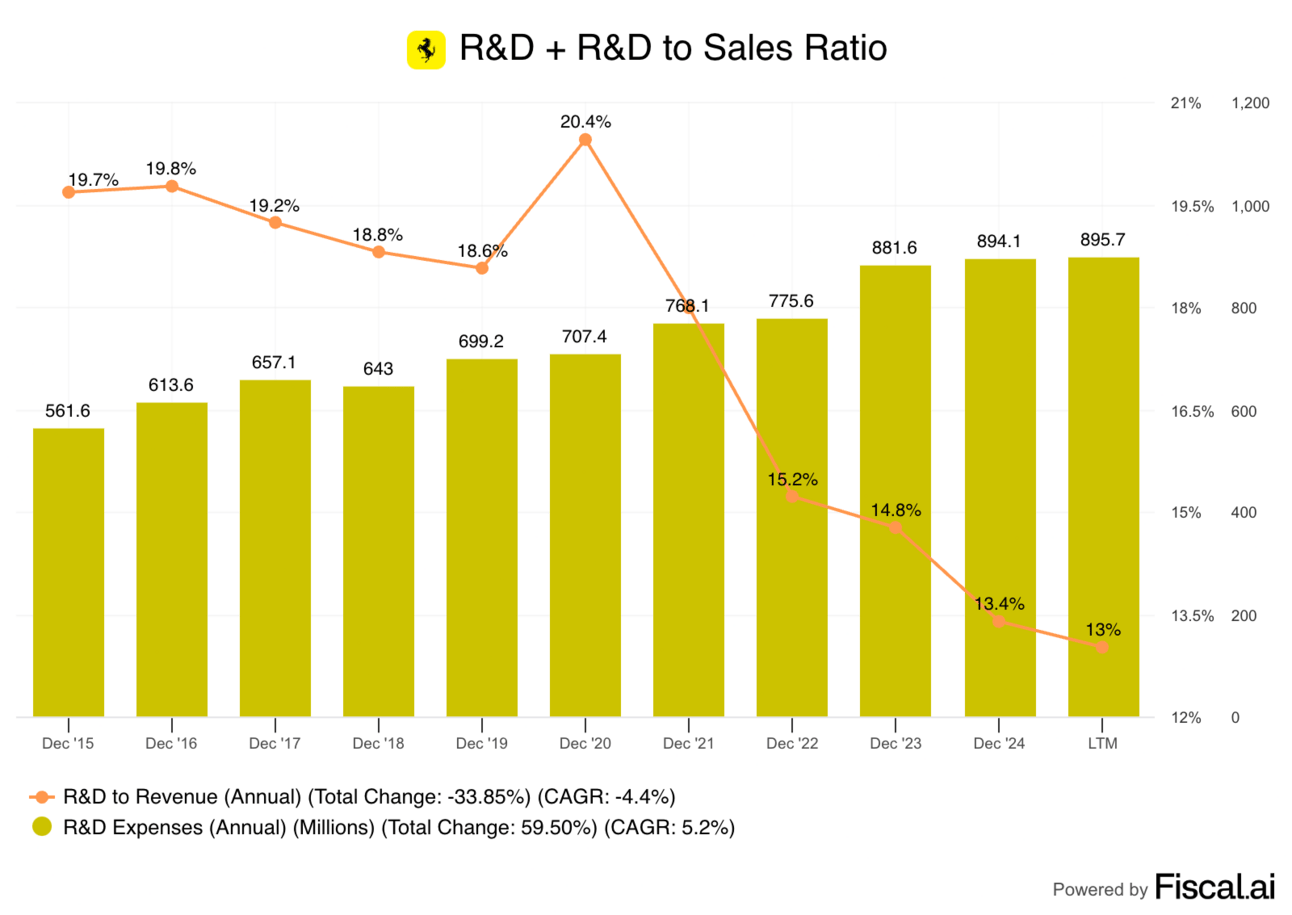

Still, their pricing power does give them a degree of operating leverage that’s uncommon among carmakers. While Ferrari spends $200 million more on R&D each year than it did in 2019, R&D as a share of revenue has fallen from 20% to 13%. This makes sense because, if higher sales are primarily coming from price, not volume, then R&D can gradually increase nominally while shrinking as a percentage. Put differently, R&D costs don’t need to scale linearly with the rest of the business.

Total R&D spend in yellow bars is growing each year, while R&D declines as a % of revenue

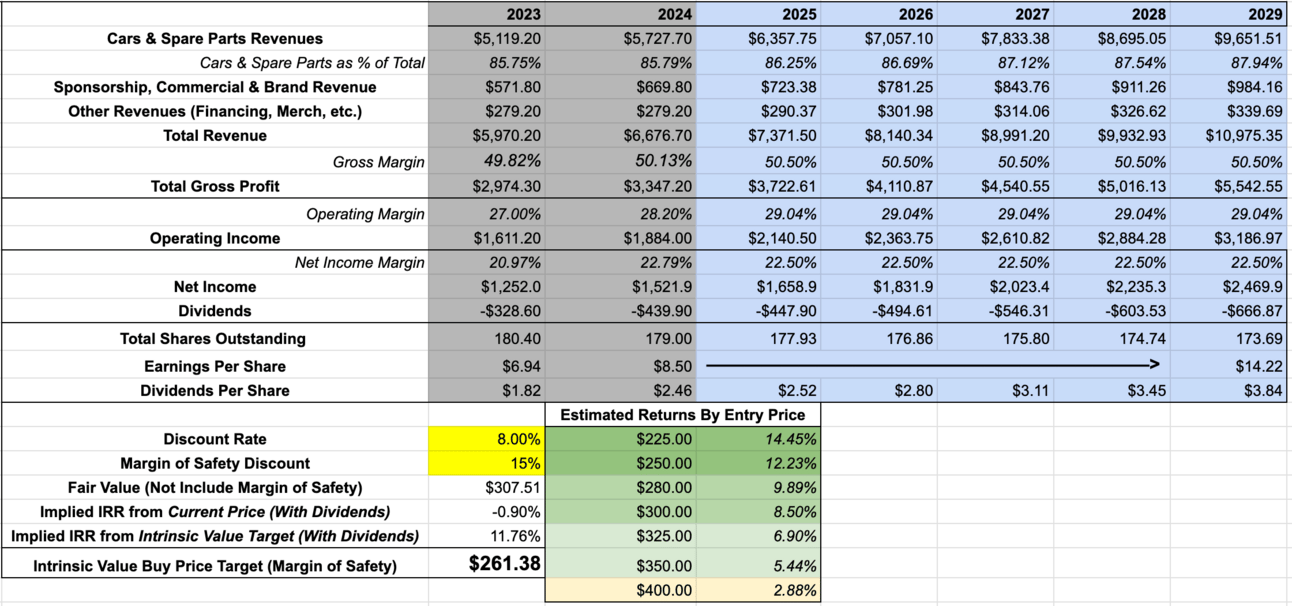

This translates into higher profit margins, as costs decline as a share of revenue, which is why in my valuation model, I anticipate that Ferrari’s operating margins can continue to rise over the next 5 years, hitting 30% and possibly even higher.

Speaking of models, though, let’s talk valuation.

Is It Worth It To Pay 50x Earnings For Ferrari?

Ferrari has compounded sales at 15% a year for the last three years, so it’s very much growing fast, but not lightning quick. That above-market growth, with expectations of continued growth, pairs with very high-quality earnings, too, in the sense that we know, thanks to order waitlists and deposits, Ferrari can continue to sell modestly more vehicles every year with substantial margins.

As such, over the next 5 years, by raising prices by, say, 6% a year, and growing volumes 1-2% a year, it’s not much of a stretch to say the company can continue compounding sales at 7-8% a year and delivering excess returns. On that point, I should mention that Ferrari has a 5-year average ROIC of 21.5%, evidence of a healthy moat.

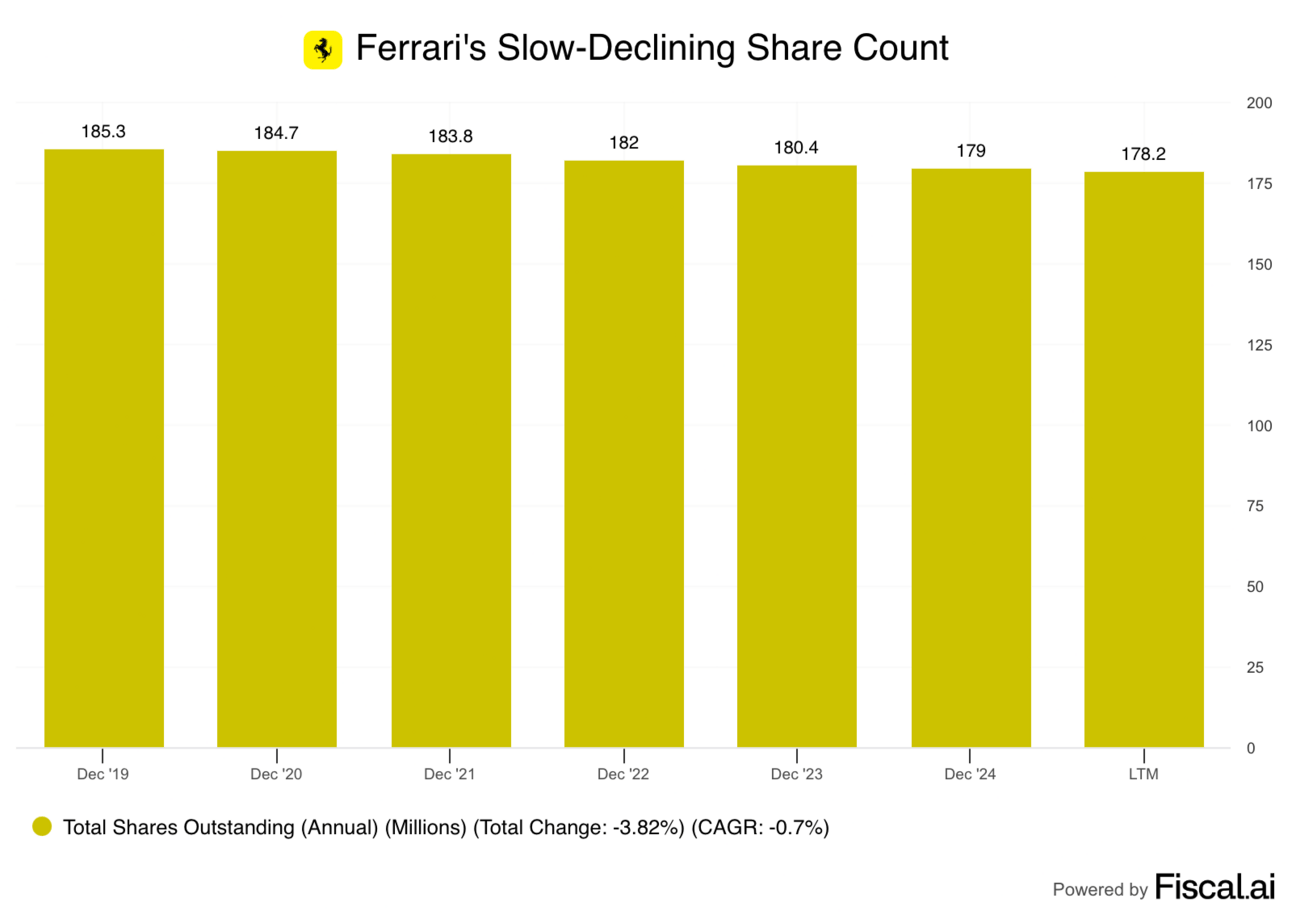

Additionally, as the business scales, operating leverage should continue to kick in and boost margins, meaning earnings per share could rise even faster than the top line, especially since Ferrari spends about 40% of its annual profits on repurchasing its own stock to reduce the share count (shrinking the denominator in EPS calculations).

Without diluting the brand to expand production volumes, there’s only so much the company can reinvest capital into, which is why a majority of their earnings go jointly to share repurchases and dividends (another 27% of earnings).

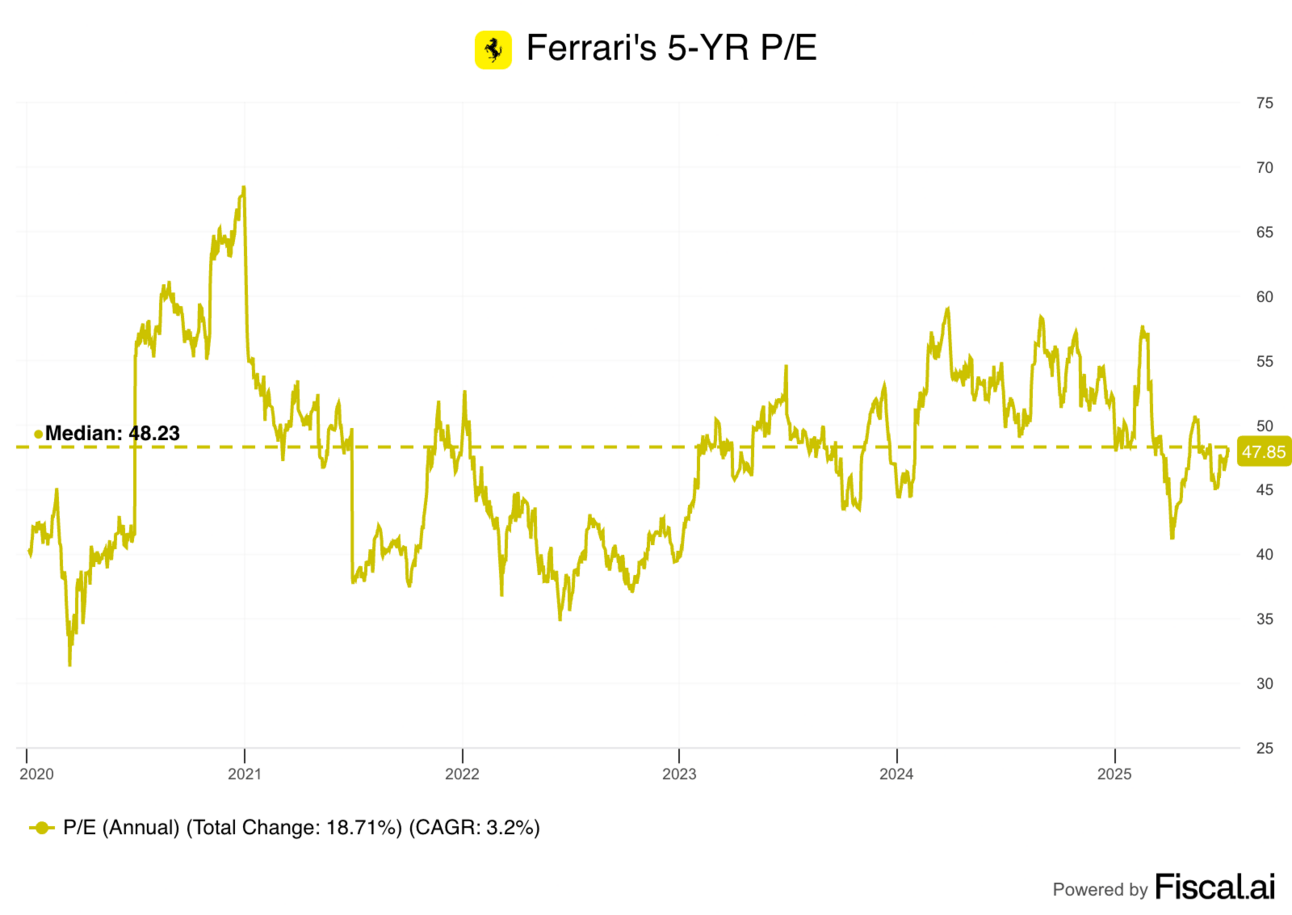

Now, to the question of whether 50x earnings is fair, I should say that this is slightly above the company’s 5-year median P/E valuation of 48x, meaning, relative to what the market has previously been willing to pay for Ferrari, the stock isn’t obviously cheap.

The Costs Of An Expensive Stock

But, as a quick tangent, I’d like to reflect on how this high multiple is both a blessing and a curse. For other companies, it might be useful for management to have a richly priced stock, as it can be better used to attract top talent with stock-based comp, or shares can be used as currency to make acquisitions with. However, neither is of material consequence for Ferrari, so the high P/E is mostly just a headwind to forward returns, especially for prospective shareholders.

The fact that Ferrari pays out almost a third of earnings on dividends to only produce a 0.8% dividend yield at current share prices is telling. The stock is so richly priced that what would be a consequential dividend at a lower price is a rounding error for expected returns. And this also means that the company’s spending on share repurchases is hardly productive, either — spending 2/5 of earnings on buybacks that only reduce shares by roughly 0.7% a year, since the shares are so expensive, isn’t an ideal use of shareholders’ capital.

Despite sizable buybacks, and minimal SBC, Ferrari has been unable to meaningfully shrink share count

Anyways, the point is that, at current prices, the dividend doesn’t move the needle, and billions are being allocated to share buybacks that really aren’t accomplishing much compared with, say, our Portoflio holding, Ulta, where they’re allocating a higher percentage of earnings toward buybacks, yet they’re shrinking the share count by 5-6% a year.

So, Ulta is spending maybe 2.5 times as much on buybacks, as a percentage of their net income, but shrinking their share count by almost 10 times as much. That’s a good buyback program comparatively!

In English, this means that Ferrari is too richly priced for Daniel and my tastes, and the growth prospects just aren’t compelling enough to justify this kind of multiple, in our opinion.

What’s A Fair Price For Ferrari?

Another great question. I’ve already alluded to some of our modeling assumptions, but I projected healthy growth for Ferrari over the next 5 years. However, if there’s a contraction in the multiple toward 30x earnings, which would still be a premium to the market average but much more reasonable, I get a fair value for Ferrari of approximately $300 per share.

With a margin of safety, I see Ferrari as being buy-worthy at $270 per share or below.

That would be a nearly 50% contraction in the stock from current prices, so we’re not holding our breath waiting for it to happen, but if we get the chance, we’d love to pounce on this high-speed compounder.

For more, you can play with the Ferrari model for yourself here, and listen to our podcast on Ferrari for even more insights that don’t fit in this email.

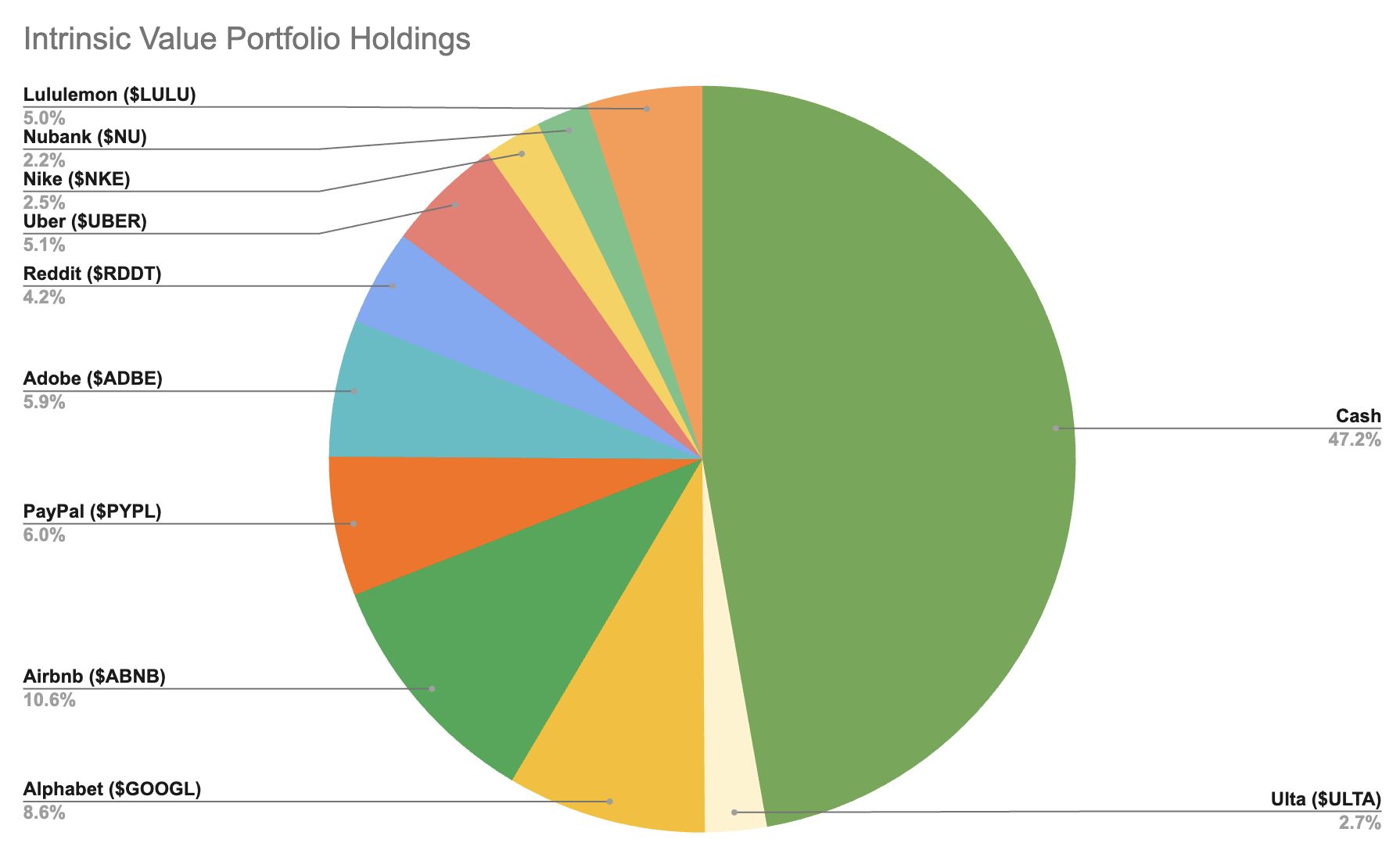

Now, it’s time for updates on our Intrinsic Value Portfolio, below.

Weekly Update: The Intrinsic Value Portfolio

Notes (Some Changes This Week!)

On Thursday, Daniel and I held our monthly Portfolio review call, and we came away with a few conclusions:

We’re more bullish on Uber than our Portfolio reflects; Adobe and PayPal’s valuations have lingered at levels that, given the amount of cash we have, it makes sense to add further to them; Reddit has risen 150% since our initial investment and now, despite liking the company’s prospects, the valuation is a bit too rich; and Ulta, which reported earnings on Thursday, isn’t as attractive of an investment north of $500 per share as it was when it was near $350 per share (around the level we first looked at the stock at).

In line with the above, we’ve roughly doubled our Uber position from 2.5% to 5% (bringing our average cost to $76 per share), lifted our Adobe and PayPal positions from the ~4% to 6% (bringing our average costs to $373 and $71 per share, respectively), and trimmed our gains in Reddit from almost 7% of the Portfolio down to 4%, and trimmed our Ulta position in half from 5% to 2.5%.

Despite having almost half the Portfolio in cash, we’ve returned 11%+ year-to-date, which is very satisfactory, and we think that sort of patience pays off. We’re excited to further allocate the remaining cash into great businesses, especially when we get stakes in them at great prices, too.

Quote of the Day

"No one remembers who took second place, and that will never be me.”

— Enzo Ferrari

What Else We’re Into

📺 WATCH: Inside Aswath Damodaran’s Personal Investment Portfolio

🎧 LISTEN: ASML: Europe’s Tech Monopoly, with Clay Finck

📖 READ: AI Stocks Give Dot-Com Bubble Déjà Vu

You can also read our archive of past Intrinsic Value breakdowns, in case you’ve missed any, here — we’ve covered companies ranging from Alphabet to Airbnb, Amazon, Shopify, Ulta, TSMC, and more!

Your Thoughts

Do you agree with the Portfolio decision on Ferrari?Leave a comment to share your thoughts |

See you next time!

Enjoy reading this newsletter? Forward it to a friend.

Was this newsletter forwarded to you? Sign up here.

Use the promo code STOCKS15 at checkout for 15% off our popular course “How To Get Started With Stocks.”

Follow us on Twitter.

Read our full archive of Intrinsic Value Breakdowns here

Check out our Intrinsic Value Community

Keep an eye on your inbox for our newsletters on Sundays. If you have any feedback for us, simply respond to this email or message [email protected].

What did you think of today's newsletter? |

All the best,

© The Investor's Podcast Network content is for educational purposes only. The calculators, videos, recommendations, and general investment ideas are not to be actioned with real money. Contact a professional and certified financial advisor before making any financial decisions. No one at The Investor's Podcast Network are professional money managers or financial advisors. The Investor’s Podcast Network and parent companies that own The Investor’s Podcast Network are not responsible for financial decisions made from using the materials provided in this email or on the website.