- The Intrinsic Value Newsletter

- Posts

- 🎙️ Robinhood: The Amazon Prime of Gen Z's Finances?

🎙️ Robinhood: The Amazon Prime of Gen Z's Finances?

[Just 5 minutes to read]

Robinhood has earned a bad name in some people’s view, and it has deserved much of the criticism it’s gotten, but I actually think its name is very fitting: the company has arguably done as much as any fintech to “take from the rich, and give to the poor,” living up to the ideals of Robin Hood (the fictional character), namely by bringing commissions on stock trading down to zero for millions of retail investors.

It may not literally involve taking from one side and giving to the other, but it certainly helped to level the playing field in wealth creation, making it as frictionless as possible for nearly anyone to own stocks over the last decade.

More interestingly, though, I think Robinhood is building something in Robinhood Gold that, in hindsight, may be seen as the Amazon Prime of financial services, particularly for Gen Z. That’s a massive market opportunity, providing the basis for a much higher quality business, if true.

Let’s explore.

— Shawn

Robinhood: Building the Foundation of This Generation’s Finances

Robinhood promoting its signature commission-free offering

If there’s a single idea that changed how I think about Robinhood, it’s this: One day, a few months ago, after moving my IRA and HYSA onto the platform and applying for their credit card with 3% cashback, it dawned on me that they were building the Amazon Prime of personal finance, namely for Gen Z and Millennials.

It’s not a perfect analogy, but directionally, I think it could be right. Prime took a commodity category—shipping—and wrapped it in a bundle so good that opting out has become unimaginable for tens of millions of Americans. Robinhood is doing something similar with money.

Start with a free brokerage, a clean mobile UI, and commission-free trading. Layer on a subscription with tangible, recurring value and keep tucking in benefits into the subscription over time, offering things like higher yields on savings accounts, contribution match programs for individual retirement accounts (IRAs), no interest on the first $1k of margin trading, the chance to participate early in IPOs, and a credit card product with industry-leading cashback.

At some point, whether Robinhood only makes you think of the Gamestop fiasco of 2021 or degenerate options trading, the gravitational pull of its ecosystem becomes obvious.

I’ll admit, I wasn’t predisposed to like Robinhood. The meme-stock era annoyed me; the “gamification” of investing was…depressing. But the product kept encroaching on the edges of my actual financial life.

Meme stock frenzy crescendos with “Roaring Kitty” testifying before Congress

As mentioned, I moved a chunk of cash into their high-yield savings as my wife and I’s “house savings fund,” because they had the highest APY I’d seen.

I set up an IRA because, well, getting a 3% match on your IRA equates to an extra $210/year in your account that you’d otherwise not have, compounding with tax advantages. Before Robinhood unveiled the IRA-match program, the idea was effectively unheard of. Brokerages didn’t contribute to customers’ retirements; the only entities contributing toward retirement savings with matches were employers in their employees’ 401(k)s.

For free users of Robinhood, the IRA match is 1%, which is still much better than nothing (like 99% of other IRAs), but I upgraded to Robinhood Gold because maxing out one’s IRA with the 3% match pays for the annual cost of a Gold subscription ($50) more than 4x over.

At this point, today’s newsletter might be starting to sound like an ad for Robinhood — it’s not, but as a consumer, when I get excited about a product, it pushes me to better understand the investment thesis, too.

Ad from Robinhood promoting their IRA match

Not everyone is going to max out their IRA like this, and Robinhood is banking on that to an extent, but for personal finance savants, it’s a hard deal to pass up. And so, the bundle finally clicked for me: a modest annual fee unlocks a bigger IRA match, higher cash yields, and a number of other perks, like discounted home loans and a $500 credit for closing costs on a home purchase(!)

While Robinhood’s business does simultaneously cater to day traders still, their new approach with Robinhood Gold, in the past two years, has clearly resonated with people like me.

For all the biases and stigmas I held against Robinhood, for them to be able to lure me into their ecosystem as a customer, not only migrating a significant chunk of my net worth onto the app but also signing up for their recurring subscription program (Gold) in short order, it seemed like they could probably lure just about anyone onto their platform.

Like I said, it reminded me of when I first signed up for Amazon Prime a decade ago.

Before I knew it, I was sucked into their ecosystem. I had recurring subscription orders for everyday essentials with no shipping fees and ultra-fast delivery, which led to Amazon becoming my go-to for Christmas shopping, too. Soon after, I got an Amazon credit card providing 5% back on Amazon purchases (including Whole Foods) — further locking me into a Prime subscription — and found myself streaming TV series/movies on Prime Video from an Amazon TV and, now, NFL games as well, plus a number of other benefits from Prime that I’m sure I’m leaving out.

I often like to joke with Daniel that my approach to investing is super simple: I try to keep an eye out for products and services that materially change my life for the better, and then I use that as the basis for digging into the underlying companies to see if they’re worthwhile to invest in. From Uber to Reddit, Alphabet, Lululemon, Nike, PayPal, and Airbnb, you may notice that a chunk of our Intrinsic Value Portfolio consists of companies that Daniel or I have a personal soft spot for.

Put differently, we like to try and use our insights as consumers to inform our investments — we hope Peter Lynch would be proud.

I keep making the Prime analogy because the Gold subscription is the backbone of the product and, increasingly, the company’s entire business model. You may show up for one feature, like the IRA match or the HYSA yield, and then discover that the rest of the bundle makes the whole proposition sticky, with very real financial benefits for your loyalty.

That lollapalooza of benefits multiplying together not only makes for a good product, but as I’ve been making the case to Daniel, potentially a good investment, too.

How We Got Here: A Mobile-First Brokerage With Zero Commissions

Robinhood hit the scene only about a decade ago, but for anyone who doesn’t remember, the company’s genesis was baked in disruption. Their signature commission-free stock trading offering was unprecedented and quite literally seemed too good to be true, which, I think you could say, is how many great products/services come across initially before ushering in a paradigm change.

They took a process that felt archaic and expensive in stock trading and rebuilt it for the mobile phone. Not to be too dramatic, but it felt like they brought Steve Jobs’ design acumen to the world of personal finance, along with as low barriers as possible for customers to join.

No account minimums, a simple onboarding interface, and fractional shares so you can start trading no matter how much money you have.

I remember first getting so excited about investing after reading a book by ~Jim Cramer~ of all people, and being disheartened by the trading costs on Charles Schwab; it cost $10 to place a buy order, and then $10 to eventually place a sell order, too.

For small rollers like me at the time, $10 per trade might be 5-10% of the total transaction (buying $100 of stock as a 13-year-old felt like a big investment to me back then!) Robinhood’s value was strikingly clear, immediately.

By 2019, industry incumbents couldn’t cling to the status quo of years’ past any longer — they matched Robinhood on zero-commission trading across the board.

But blowing up a pillar of Wall Street’s business model doesn’t happen without scrutiny.

Robinhood’s advertising appeals to the masses

As Robinhood’s user base surged and retail trading spiked, critics fixated on design choices they argued encouraged speculation (which I don’t disagree with). And, well, the Gamestop meme-stock episode of 2021 poured gas on that debate, while the clearinghouse collateral crunch that followed exposed how fragile the brokerage industry’s pipes can be, and perhaps, how poor Robinhood’s risk management was.

It’s fair to say that Robinhood earned some of its criticisms and inherited others due to jealousy, as the company not-so-subtly became the platform where a new generation of investors appeared all at once.

Yet, the move into retirement accounts, which I’ve described as being core to the Gold subscription, reframed what Robinhood wanted to be, and who it wanted to be for. Evidently, IRA matches attract very different customers to become the foundation of your member base, diversifying away from the Reddit crowd of ‘degen’ traders that has been lucrative to tap into, but also left them with a black eye.

From Robinhood’s 2024 Investor Day

How $HOOD Makes Money Today

Anyways, that’s the set-up for how we get here. Now, let’s demystify Robinhood’s business a bit. There are three revenue streams that matter for the thesis: payment for order flow (PFOF) and other transaction-based revenues, net interest income, and subscriptions.

Starting with PFOF, in plain English, when a customer places a trade, Robinhood routes the order to a wholesaler (aka a market maker) who pays Robinhood a small rebate for that flow. That rebate is what originally made zero-commission trading possible. Said differently, commission-free trading was enabled by Wall Street trading firms reimbursing Robinhood for the traffic they direct to them, rather than having brokerages explicitly charge customers a fee on each trade.

Yet, if trading is “free,” critics would argue you’re likely to do more of it, and studies typically find that more trading equates to worse long-term outcomes for investors. So, a broker that earns fractional amounts on its trading volumes has an incentive, if not a necessity, to encourage as much trading activity as possible to squeeze out a profit (sound familiar?)

I think the more accurate reading now is that trading increasingly serves as a loss leader for brokerages, providing a funnel for broader, stickier relationships with subscriptions like Robinhood Gold and the services associated with it.

That brings me to the second revenue stream: net interest income. Robinhood has a complicated balance sheet. On one side are customer cash balances and securities; on the other are assets that yield interest — treasuries and other cash-like instruments — and products like margin loans. The spread between what the company earns on assets and what it credits to customers for deposits is meaningful. You can see why promotions that look expensive at the surface, like cash bonuses, IRA matches, and transfer credits, can still be ROI positive if they attract sticky balances.

Banks have known this forever; the difference is that Robinhood’s mobile distribution and lower cost to serve make small-balance customers economical in a way that looked impossible a decade ago. To those who enjoyed our coverage of Nubank, you might find the story to be similar, with a hip, fintech startup able to monetize customers largely ignored by incumbents.

The third part of the business, which is fast-growing but we’ve already discussed at length, is subscriptions. The important part of Gold isn’t necessarily the subscription fees, though; it’s the behavioral shift. When a customer moves from a free trading account to a paid membership, the center of gravity changes from “maybe I’ll trade sometimes” to “this is where my financial life lives.”

In my own case, the upgrade unlocked benefits I value (yield and match), and it changed what I’m willing to move into the ecosystem (retirement and cash savings, not just a speculative trading portfolio from my college days).

Robonhood aims to go from dominating Active Traders, to becoming a major Share of Wallet for Gen Z & Alpha, to becoming a Global Financial Ecosystem as they enter new verticals

I’m underwriting a world where PFOF is a smaller percentage of the pie than it has been, but net interest is a larger one, thanks to Gold (specifically, Gold customers bringing in more deposits & assets over time), which frames the rest of the business, turning the volatile transaction dollars of the Pandemic-era into more recurring, resilient cash flows as Robinhood enters new verticals to attract new customers into its increasingly-sticky ecosystem.

Owning the Stack — Clearing, Custody, and the Trade-Offs

One of the underappreciated edges here is how much of the plumbing Robinhood actually owns beyond just having a very slick user interface. That “plumbing” refers to the assets they custody for customers, how they clear trades, where the interest accrues, and spreads on things like stock lending.

For context, there’s the ‘introducing brokerage’ (Robinhood) that faces the customer, and the clearing broker that sits behind it (a subsidiary known as Robinhood Securities, in this case). Robinhood is by no means the only major brokerage to embrace vertical integration like this, compared to Schwab, Fidelity, and Interactive Brokers, but it’s somewhat more unique when contrasted with other app-centric fintech peers like SoFi and WeBull.

We do need to understand some of the nuances to this, though, so we can better understand the equity risk we’d be taking by owning $HOOD.

Arguing in favor of owning the stack — as they say, by handling clearing in-house, Robinhood minimizes the layers of third-party fees and time delays, can tune routing and execution for its customer base, and, crucially, captures more of the economics around customer balances.

This shows up in that net interest segment I mentioned, where, for example, owning the pipes lets the company sweep cash efficiently into higher-yielding assets and share a portion with customers (especially Gold members) while keeping a spread. It also shows up in securities lending, where the platform can lend out fully paid shares (with customer consent) and keep a larger piece of the revenue instead of ceding it to an intermediary. Owning the rails paves the way for higher profit margins at scale, and more tangible control over their risk exposures, which isn’t to say that this comes with less risk…

Control comes with a cost. Clearing services require regulatory capital, daily risk management, and the ability to meet drastic spikes in collateral when markets go haywire. The meme-stock episode taught the company about the not-always-boring realities of the deposit-clearing world, where intraday margin calls can require having billions of dollars of cash on hand when trading in volatile stocks spike.

I don’t say that to excuse Robinhood, because their inability to properly assess the cash collateral they’d need in response to the Gamestop episode in 2021 led the firm to scramble for liquidity, raising emergency capital, and, infamously, throttling buy orders on specific stocks (adding to the perception that the stock market was rigged amongst many retail investors on Reddit.)

That failure in risk management nearly killed the brand, and it certainly contributed to the prejudices I’d held against Robinhood.

To put it charitably, this was a learning experience, but the Robinhood of 2025 is a very different company than the Robinhood of 2021, with a more diversified customer base and business generally now.

Robinhood’s customer profile has shifted dramatically (From Robinhood’s 2024 Investor Day)

You could also say that this has pushed them in some innovative new directions in managing their own back-end logistics and wanting to make sure nothing like Gamestop ever happens again to them.

As a potential solution, they’re now pioneering near-instant settlement via stock tokenization, promising to flip the plumbing of the brokerage industry upside down, similar to what commission-free trading first did to the consumer-facing end of the industry a decade ago. Actually implementing this will be easier said than done, though.

To be clear, running a clearing broker is a grind; the compliance, audit, and infrastructure costs are substantial, with the stakes and scrutiny only increasing as the business grows.

But in a world where the success of Gold, and becoming the next generation’s go-to financial app, depends on making the “right” behaviors seamlessly easy with automatic IRA contributions and instant deposit funding without surprises (I still have to wait 2-3 business days for my cash transfers between accounts to be fully available in Schwab, whereas Robinhood provides instant access to deposits), then you could argue that Robinhood’s vertical integrations here contribute significantly to the long-term vision, much more so than taking the easy way out and outsourcing the plumbing.

Indulging the Bull

While important, clearing and custody talk is…dry. Pivoting back to the more colorful parts of this thesis, and because I think I’ve talked about Amazon too much for one day already, let me invoke Costco instead.

I’ve been to a Costco three times in my life. That might surprise some folks, but when I have been, it became exceedingly clear why people rave about it. You can get massive quantities of pretty decent-quality groceries and household supplies at barely any markup, assuming you’re a Costco member, with plans costing between $65 and $130 per year. You could say that it’s a simple subscription business masquerading as a jumbo retailer.

By returning so much value back to customers, they’re largely breaking even or losing money on the core operations (zero chance the famous $1.50 hot dog combo meal is profitable), but making it all back and more with subscriptions, and I think you could say Robinhood is in the very early process of trying to do the exact same thing. A credit card with really good benefits is effectively a marketing program that works to not only draw new users to their platform but also to make them more loyal and reliant on Robinhood’s ecosystem than they would be if they only used the app for stock investing.

And the potential here is for Robinhood to ride the wave of the next generation’s wealth accumulation and inheritance — CEO Vlad Tenev frequently cites how Gen Z and Millennials are set to inherit over $20 trillion in aggregate wealth from their parents over the next few decades. The company prides itself on disproportionately catering to these younger investors (and inheritance beneficiaries):

From Robinhood’s 2024 Investor Day

As Robinhood’s average customer account size has started to mature with its customer base and doubled in just two years, it’s still less than $10,000, whereas a broker like IKBR has an average account balance of approximately $170k.

From Robinhood’s 2024 Investor Day

Robinhood is sort of like a Trojan horse to these established financial players who think they’re ceding the investors on the lowest end of the spectrum, who are barely worth competing over today, yet these are the folks who will be controlling society’s wealth as the older generations age out.

Correspondingly, we’ve seen Robinhood’s assets under custody grow considerably as its penetration amongst the youngest generations has increased substantially:

It goes without saying that the defining question for Robinhood will not be whether they can dominate Gen Z’s finances, but whether they can remain the generation’s trusted financial partner as they grow up. For me, as a member of Gen Z, it was a lightbulb moment when I realized that, for a period of time, Robinhood had lost me as a customer, yet I came back, while many others had never left in the first place.

Do with that anecdote what you will.

Now, before we get to talking valuation, I have to comment further on some of the bolder ideas Robinhood has played with.

Robinhood’s Frontier Bets — Tokenized Stocks, Prediction Markets, and More

Starting with tokenized stocks, strip away the buzzwords, and the idea is straightforward: create digital claims that track the economics of underlying shares, public or private, so customers can buy tiny slices, trade with fewer frictions, and potentially access names that would otherwise be out of reach.

Near-instant settlement is one of the main talking points here, but I’m more interested in how this could pave the way for more people to invest in the best of the best private companies.

Robinhood rolled out trading of tokenized OpenAI and SpaceX stock in Europe to some controversy, but I do actually think the idea, despite some legal uncertainties, very much aligns with the company’s branding and aims of leveling the playing field between rich and poor. Honestly, it’s a bit absurd that OpenAI — the maker of ChatGPT — could structurally change society and capitalism, and yet, if you’re not an accredited investor in the U.S. (i.e, $200k+ individual income or $1m+ liquid net worth), then you simply cannot participate in what might be the biggest innovation since electricity or the internet.

Basically, Robinhood, as a major corporate investor, bought up legitimate shares in OpenAI and SpaceX, put those shares in a legal basket, and sold shares in the basket itself as a way to indirectly own either or both of these exciting companies. Again, whether you like it or not, that does sound a lot like something that the fictional character Robin Hood himself would do. Not that the shares were given away for free, but giving anyone on Robinhood (at least in the EU) the chance to get exposure to them.

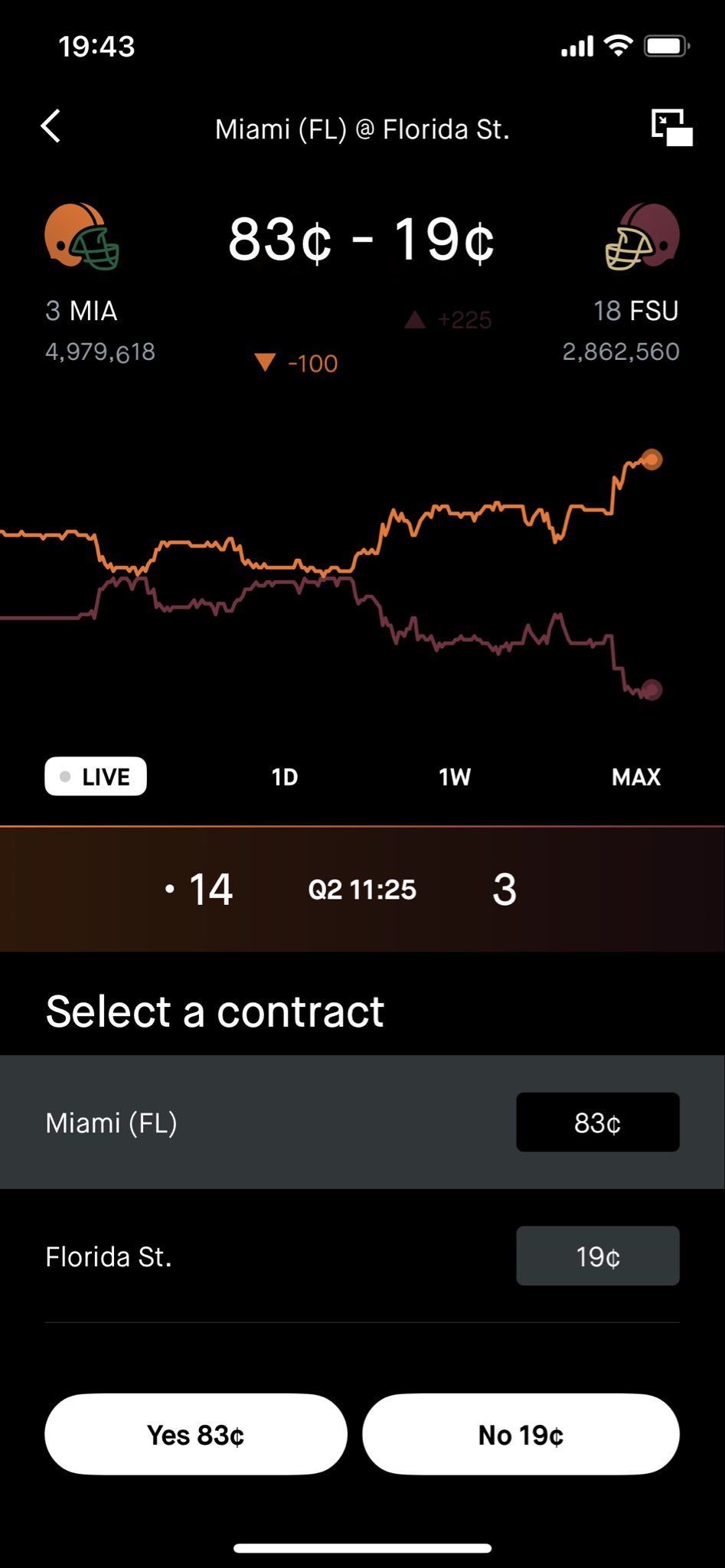

Nothing epitomizes the company’s libertarian ethos and democratizing instincts better than Prediction Markets, though. Again, I’m mixed here. I can get behind IRA matches and 3%-back credit cards, and maybe even 24/5 trading and tokenized trading of top-tier private companies, but you start to lose me when I see the company leaning so heavily into what is, effectively, sports betting.

Robinhood’s Prediction Markets’ interface

The libertarian argument is that Robinhood enables adults to do whatever they want with their money, whether that be investing in the S&P 500, buying crypto, or placing sports bets.

And the business appeal is obvious. Prediction markets create an endless set of binary bets for one to make, driving new trading volumes and new reasons to open the app. The early activity has been eye-catching:

From Q3 2025 filings

The reputational risk is equally obvious. If you’re positioning yourself as the default place for a generation to build wealth, you can’t let the casino swallow the bank.

Underneath these seemingly contradictory experiments is an ambition level I actually like. Management isn’t shy about where they want to be: Continued dominance of retail options trading, with leadership amongst brokerages in equity trading volumes by the end of the decade, and a longer-run roadmap where AI brings a degree of personalization to personal finance reserved usually for the wealthy only.

The idea is to digitize the family-office experience with AI-based tools providing financial advice to you individually, regardless of whether you have a $10m net worth or $10k.

You can roll your eyes at the buzzwords, but the direction makes sense. 15 years ago, who would’ve thought Amazon Prime would turn into what it has? To try and find 100-bagger stock picks, sometimes you do have to dream a little.

Valuation

Which brings us to talking about what a fair price to actually pay for Robinhood’s shares is. At current prices, with Robinhood’s equity valued at more than $130b, I don’t think Robinhood will be a 100-bagger going forward (10-bagger, though, isn’t off the table.)

Since October 2023, it’s actually already been a 15-bagger, so, unfortunately, Daniel and I are more than a little late here. At $10 per share, with the company trading roughly at book value, yeah, you could roll the dice on Robinhood’s turnaround journey and its grip on Gen Z. At $150 per share, all that — and more — is priced into the stock, unfortunately, which trades at around 75x earnings.

The frustrating thing is that, as a consumer, I first started noticing that Robinhood was doing something special about 18 months ago, so I had a chance to catch this company at a price with asymmetric upside and limited downside, but I was too close-minded at the time to take seriously what they were doing, until I couldn’t ignore their offerings myself any longer.

So why did I even bother pitching Robinhood to Daniel, then? Well, firstly, I didn’t want to be ignorant of the real innovations they’ve been shipping and the powerful subscription product they’ve been building any longer, but also, the thing with speculative tech companies is that they don’t compound their share prices in perfectly straight lines up and to the right.

This is still a young company taking on big challenges, many of which are very contentious, while being, at its core, a cyclical business tied to trends in financial markets (a rising stock market is mostly good for business, a falling stock market is mostly bad).

A 50%, 60%, or even 70% selloff would probably be needed for me to seriously get interested in more carefully valuing the company, but for now, I’m leaning on rough math and heuristics instead.

Fortunately, and point being, such a selloff wouldn’t be unprecedented at all, and the next time market sentiment craters generally, or some scandal causes a souring on Robinhood specifically, I’ll have (and now you!) the foundation of understanding to assess whether the company has continued to effectively strengthen the value of its Gold offering, and whether it’s resonating even more with younger generations accordingly.

Robinhood’s shares crashed 75% from its 2021 IPO price just 12 months later

If so, then I’ll be primed to recommend its addition to our Intrinsic Value Portfolio to Daniel.

Evidently, I’m kicking the can a bit, and would need to do some more work even if the valuation became more reasonable still, but this is a hard one to fully understand. With the basic model I did put together, I don’t have any FOMO by not investing in the company today, because the assumptions priced into it are very ambitious, too much so for Daniel and I’s taste, even if we see a really interesting vision beginning to come together.

Fortunately, there’s no explicit penalty for waiting and seeing for a while longer.

For more on Robinhood, and there’s so much we didn’t have time to cover here, I recommend digging into Daniel and I’s podcast on the company here.

Updates on our Intrinsic Value Portfolio, below:

Weekly Update: The Intrinsic Value Portfolio

Notes

Daniel and I picked a bad week to visit Portugal together! While we’ve been exploring Lisbon and speaking at an investment conference, markets have been quite volatile, with several of our key Portfolio holdings reporting earnings. As Daniel put it to me, despite the market being at all-time highs, the vibes are a bit bear market-ish — even with very solid results from companies like PayPal, Reddit, & Uber, traders threw a tantrum. More consumer-sensitive sectors, like retail, have been particularly volatile; both Lululemon and Nike have retraced gains and fallen back toward 52-week lows.

More on Uber: Food delivery has, naturally, been at the core of Uber Eats’ business, but increasingly, the company wants to deliver all forms of retail products. Combined, Uber sees a $12 trillion(!) addressable market in food & retail delivery. No matter how optimistic that may be, the opportunity is clearly huge. Underpinning this initiative, Uber has announced partnerships with a range of retailers, including Dick’s Sporting Goods, Five Below, Petco, Best Buy, Lowe’s, Sephora, Home Depot, Kroger, Wegmans, Dollar Tree, and many more. Food and retail delivery is now driving about $12 billion in gross bookings and has led to a 27% increase in how frequently existing customers use Uber monthly.

Year over year, Uber’s monthly active platform customers continue to grow strongly at 17%, as total trips booked on Uber have risen 22% (new users + more frequent bookings from existing users). Correspondingly, revenues grew 19% YoY!

Airbnb’s Q3 Earnings: As Wall Street worries about Main Street’s ability to continue affording small luxuries like new Nike sneakers or Lulu leggings, a handful of tech companies continue to hold up the market (and our Portfolio). Airbnb, our second-largest Portfolio holding, rounded out the week on a high note with promising results — travel in its core markets (i.e, the U.S., Canada) remains firmly intact while more promising growth markets like Brazil and Japan continue to see accelerating adoption. At the same time, Airbnb’s new Experiences offerings seem to be taking off well, with the company currently focusing more on guaranteeing high-quality experiences than driving as many bookings as possible. We remain cautiously optimistic about the business’s prospects, especially in Experiences.

More Good News for Alphabet: Our largest holding, Alphabet, has also done well, making headlines this week with a report that Apple has agreed to power Siri using the company’s AI model, Gemini, paying $1 billion a year for the right to do so. Meanwhile, the core Google Search business looks as strong as ever, and Waymo, of particular interest to us given our position in Uber (and their partnership together), continues to expand swiftly into new markets globally. With Alphabet’s class C stock at ~$285 now, we wish we could scoop up even more shares in the 150s, as we did just a few months ago!

You can further read our reflections on recent earnings reports for our Portfolio companies in last week’s newsletter.

Quote of the Day

"You know somethin', Robin. I was just wonderin', are we good guys or bad guys?"

— Little John, in Disney’s Robin Hood movie

What Else We’re Into

📺 WATCH: Amazon’s massive data center for Anthropic, with no Nvidia chips needed!

🎧 LISTEN: Intelligent Fanatics: How great business leaders win

📖 READ: Aswath Damodaran finds signal in the noise of gold’s price surge this year

You can also read our archive of past Intrinsic Value breakdowns, in case you’ve missed any, here — we’ve covered companies ranging from Alphabet to Airbnb, AutoZone, Nintendo, John Deere, Coupang, and many more!

Your Thoughts

Do you agree with the portfolio decision for Robinhood?Leave a comment to elaborate! |

See you next time!

Enjoy reading this newsletter? Forward it to a friend.

Was this newsletter forwarded to you? Sign up here.

Join the waitlist for our Intrinsic Value Community of investors

Shawn & Daniel use Fiscal.ai for every company they research — use their referral link to get started with a 15% discount!

Use the promo code STOCKS15 at checkout for 15% off our popular course “How To Get Started With Stocks.”

Read our full archive of Intrinsic Value Breakdowns here

Keep an eye on your inbox for our newsletters on Sundays. If you have any feedback for us, simply respond to this email or message [email protected].

What did you think of today's newsletter? |

All the best,

© The Investor's Podcast Network content is for educational purposes only. The calculators, videos, recommendations, and general investment ideas are not to be actioned with real money. Contact a professional and certified financial advisor before making any financial decisions. No one at The Investor's Podcast Network are professional money managers or financial advisors. The Investor’s Podcast Network and parent companies that own The Investor’s Podcast Network are not responsible for financial decisions made from using the materials provided in this email or on the website.