- The Intrinsic Value Newsletter

- Posts

- 🎙️ Dell: Overlooked AI Growth Story?

🎙️ Dell: Overlooked AI Growth Story?

[Just 5 minutes to read]

Dell has been around for a long time, over forty years, and it’s one of the rare hardware names that not only survived but actually emerged bigger than ever.

That said, I’ll be honest… I never really thought of Dell as a highly innovative company. In my mind, Dell was the company behind the kind of slow, boring PCs you’d find in an office cubicle.

But digging deeper, I realized I was selling them short. Yes, they are the company behind the PCs in office cubicles, but they also manufacture high-end laptops and desktops.

And more importantly for us today, Dell is also at the forefront of the AI buildout — shipping the servers and racks that power some of the world's largest AI projects.

So the question today is: are we looking at one of the most overlooked AI opportunities in the market? Or is Dell just a replaceable middleman in an AI value chain where other companies make the big money?

Let’s find out.

— Daniel

*The Intrinsic Value Community*

2nd Cohort Opening

After a very successful launch of The Intrinsic Value Community, we’re excited to open applications for the second cohort.

The Intrinsic Value Community is designed for sophisticated, long-term investors to exchange ideas, challenge each other’s thinking, and build meaningful connections with like-minded peers.

We give each other feedback on research, share high-conviction ideas, and join weekly calls to discuss investments and host guest speakers, from industry insiders to seasoned investors, who share their strategies, investments, and mental models.

This time, we’re opening just 20 spots. Based on the experience with our first cohort, they’re likely to fill quickly. If you’re interested, apply now! We’ll review your application carefully and get back to you.

Dell: Nvidia’s Right Hand

A Brief History of Dell

The first surprise I encountered when researching Dell had to do with its founder, Michael Dell. He is one of the wealthiest people in the world today, with an estimated net worth of nearly $130 billion — more than the company itself, which is currently valued at around $90 billion. It’s a rare case where the founder is worth more than the enterprise he created.

And yet, nearly all of his wealth comes from Dell. For one, he still has a substantial ownership in Dell, roughly 40% of the company. I don’t think we’ve ever covered a business where the CEO held such a large stake.

Another significant portion came from his stake in VMware, which Dell spun off in 2021 and was later acquired by Broadcom. Michael chose to be paid in Broadcom stock, a decision that has paid off handsomely, as the stock has since tripled in value. I suppose Michael Dell would’ve made a great stock picker too…

Michael Dell received his Broadcom shares in November 2023

But let’s take a step back and talk about Michael Dell before he was a billionaire, back when he was on track to become a doctor. His entrepreneurial story begins in his college years. Coming from a family of doctors, he was expected to follow that path and become the first of a new generation of “Dell Doctors.”

But Michael wasn’t exactly a fan of the idea. Instead, he turned his hobby of taking computers apart into a business. He began by selling upgrade kits for IBM computers, which at the time dominated the market so heavily that they made up about 80% of the entire tech sector. For context, that would be like a single company today being worth the combined market cap of Nvidia, Microsoft, Apple, and Amazon.

To be fair, the tech sector has grown a little bit since then…

The venture went surprisingly well, and he soon began selling fully self-built PCs. Just a week before his freshman finals, Michael officially founded Dell. In its first year, the company reached $6 million in sales, and by its second year, revenue had already surpassed $33 million. Over its first eight years, Dell grew at an astonishing CAGR of 80% — rivaling IBM itself.

Michael Dell in his early days

I guess when your son’s business pulls in $33 million by its second year, you stop worrying about him becoming a doctor. Part of this rapid rise was Dell’s direct-to-customer business model.

Unlike competitors that sold through middlemen, Dell sold directly, allowing it to stay close to customers, better anticipate demand, and reduce inventory risk in a fast-moving industry. While competitors might be stuck with excess stock at higher costs, Dell could build in smaller batches, update models faster, and sell at lower prices. This has been a structural advantage that made it the largest PC seller in the world by 2000.

Dell’s Direct to Customer Business Model vs. Industry Standard

But in the years after, Dell missed out on participating in the massive innovation cycles around mobile and later cloud computing. With its business slowing and Wall Street being less optimistic about its outlook, Michael Dell orchestrated one of the largest leveraged buyouts in tech history, a $25 billion deal to take the company private in 2013.

Free from the pressure of quarterly earnings, Dell restructured the business and, with the $67 billion acquisition of EMC in 2016, made one of the boldest moves in its history.

That acquisition opened up an entirely new field for Dell: high-performance storage, data protection, and the above-mentioned stake in VMware. Today, that “end-to-end” offering of servers, storage, networking, and services remains the foundation of Dell’s Infrastructure Solutions Group (ISG), the part of the business now driving growth through AI.

And with this new setup, Michael Dell was ready to bring the company back to the public markets in 2018.

Business Model and Units

At its core, Dell’s business model is about being a one-stop shop for IT infrastructure. So Dell will provide everything from laptops to servers that run applications, storage that keeps the data safe, the networking gear that ties it all together, and the support to keep it all running.

Dell still leans on its direct-to-customer roots, especially with large corporate and government buyers, where it can tailor-make systems. Imagine a school district ordering 20,000 laptops. Dell won’t just ship a stack of identical PCs. It will preload them with the district’s software, configure the security policies, and deliver them ready to use straight out of the box.

At the same time, Dell also relies on a wide network of partners and resellers to reach mid-sized companies or local institutions, much like a clothing company working through retailers instead of only selling DTC.

The business today is split into two main segments:

1. Client Solutions Group (CSG)

This is the division most people associate with Dell — its PC and device segment. It accounts for about half of Dell’s revenue and is focused primarily on commercial clients such as large corporations, governments, and universities. Roughly 80% of CSG sales come from that customer base.

The PC market is notoriously cyclical. Sales surged in 2020 and 2021 during the remote-work boom, then slumped in 2022 and 2023 as demand cooled. Dell’s results reflect that pattern: CSG revenue fell 16% in FY24 to about $49 billion, with consumer sales down nearly 30%. By late FY25, though, things had stabilized. Commercial demand began to recover, allowing Dell to keep revenue roughly flat year over year.

AI could also help reaccelerate this segment, at least to some extent. AI PCs are on the rise, and Michael Dell believes they could spark a massive new upgrade cycle. Today, there are about 1.5 billion PCs in use, and roughly half of them are more than four years old. If AI PCs prove to be a meaningful upgrade over current models, a large share of those, especially in corporate environments, would likely be replaced.

AI PCs are built with dedicated chips, NPUs (“neural processing units”), that can run AI tasks locally instead of offloading everything to the cloud. That means faster voice recognition, improved video calls, and the ability to run small AI models directly on the device. The AI PC market is estimated at $50 billion today and projected to grow more than 20% annually over the next five years.

Still, as we discussed in the podcast, the definition of an “AI PC” is pretty vague, and the real advantages are limited. I don’t think many people will rush to buy a new laptop just because the background blur on Zoom is handled by an NPU instead of a GPU. That’s not the kind of breakthrough that drives a massive upgrade cycle. More likely, Dell’s CSG will remain a mature business growing at low- to mid-single digits, acting as a steady cash flow engine.

2. Infrastructure Solutions Group (ISG)

When you think of Dell as a one-stop shop for IT infrastructure, PCs and monitors are just the front end. Behind the scenes, something has to power and store everything, and that’s where ISG, the Infrastructure Solutions Group, comes in.

It sells servers (the heavy-duty computers that process data), storage (the vaults where that data is stored), and networking gear (the plumbing that connects it all).

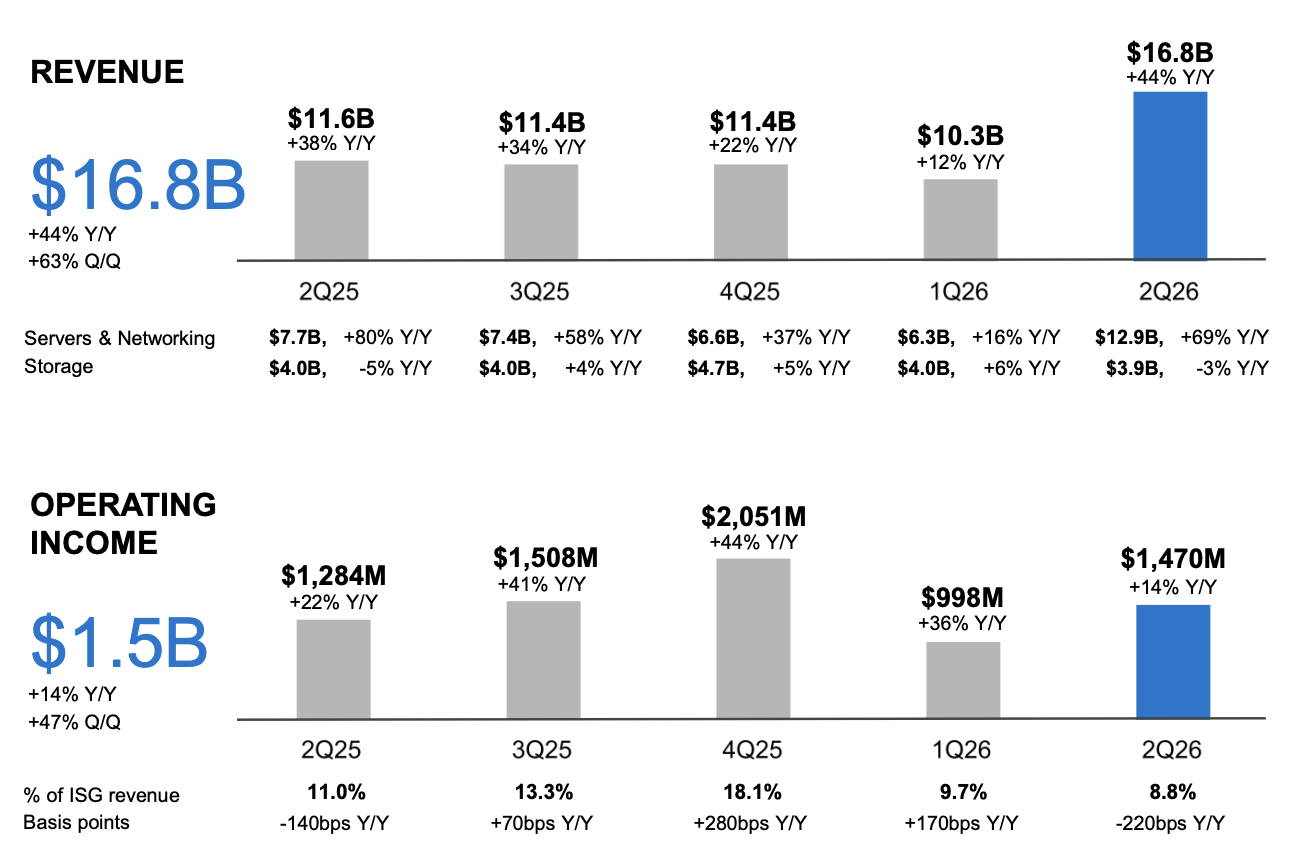

After years of being the smaller division, ISG has now overtaken CSG in revenue. At nearly $50 billion, it’s about $800 million larger than CSG. Relative to Dell’s total revenue of $100 billion, that difference may look negligible — but not when it comes to profits.

Thanks to its stronger margin profile, ISG generates more than twice the operating profit of the CSG business. With revenue growth surging since 2024, driven by demand for AI servers, and margins in the low teens, you might think this is the formula to make Dell a far better company than ever before.

High growth paired with margins twice those of the legacy PC business. Unfortunately, it’s not quite that simple. Let’s take a closer look at Dell’s position in the AI market.

Dell’s AI Strategy and Moat (or the lack of it)

Training and running large AI models requires specialized servers packed with GPUs, high-bandwidth networking, and advanced cooling. And Dell is one of only a handful of companies in the world that can deliver these systems at scale.

In FY25, Dell shipped about $10 billion worth of AI servers and ended the year with a backlog of over $14 billion waiting to be delivered. In just the first half of this year, shipments already topped $10 billion, and the backlog still stands at over $11 billion.

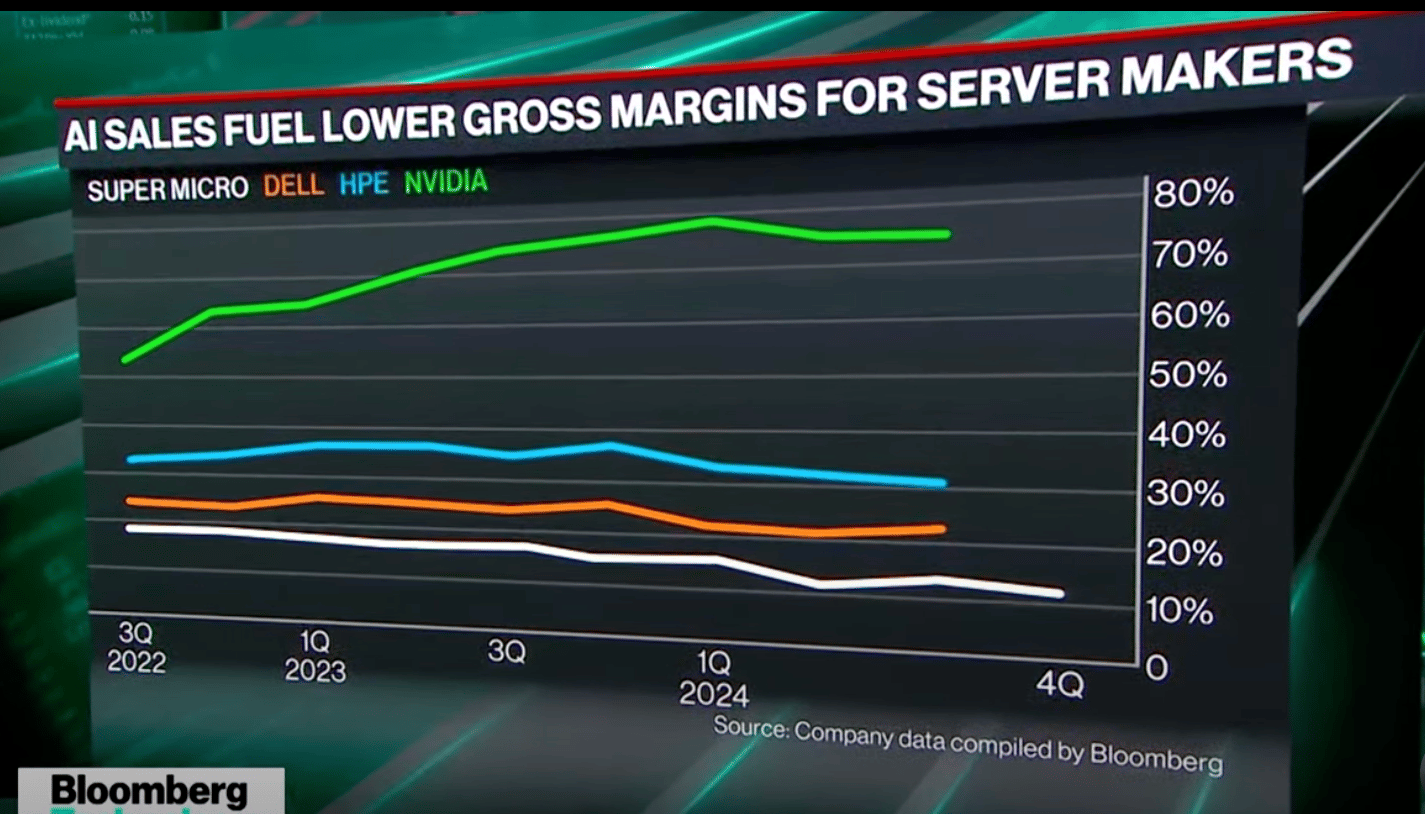

However, while everything AI-related sounds impressive, Dell isn’t in the strongest position within the value chain. It doesn’t run its own AI models, nor does it sell chips like Nvidia, and that’s where most of the money is made. A quick look at Nvidia’s margins compared to Dell’s makes that clear…

Margin Comparison between Nvidia, Dell, HPE, and Super Micro

Just looking at this margin profile, you can imagine that Nvidia chips are anything but cheap. Nvidia can charge these prices because there is virtually no competition. Dell also holds the No. 1 spot in its industry, but its moat is not even close to Nvidia’s.

As a result, Dell can’t charge steep markups to lift margins. So even while it’s shipping billions in AI infrastructure, the gross margins on those sales are thinner than on its traditional storage or enterprise server lines. Management has been upfront about this, noting that the surge in AI orders will actually push gross margin rates lower in the near term.

So why do ISG margins still look relatively healthy? A lot of it comes down to cost discipline. Over the past two years, Dell has cut expenses, streamlined operations, and benefited from supply chain efficiencies. Those savings have supported profitability just as AI orders have taken off.

But the latest earnings release showed how the mix shift is playing out: rapid AI growth, combined with thinner margins, is squeezing profitability. ISG margins fell from 11% in Q2 FY25 to just 8.8% in Q2 FY26 (Dell’s fiscal year runs a year ahead).

And while management said margins will recover in the second half, they also admitted that AI growth is “dollar accretive, but rate dilutive.” If they were confident that AI server margins could be lifted over time with higher-value services, I think they would have framed it differently.

The Competitive Landscape

And Dell is not the only company chasing the AI demand. Hewlett Packard Enterprise (HPE) is a direct rival with a similar mix of servers and storage, though its strategy leans more heavily into subscription models like GreenLake. Lenovo has been scaling rapidly in Asia and Europe, leveraging strong local relationships, but its China exposure limits its ability to win U.S. hyperscaler contracts.

And then there’s Supermicro, the stock market darling of the first half of the year. Supermicro’s appeal is that there’s no legacy business. It can design and ship new server configurations extremely quickly. However, it lacks the global services and enterprise sales footprint of Dell, making it more challenging to secure and support multi-billion-dollar infrastructure deals.

Finally, looming over everyone are the hyperscalers themselves, who could always choose to bring more in-house. Amazon already does this, and Microsoft or Meta could expand internal capabilities if they decide vendor reliance is too costly.

Dell generally has the issue of customer concentration. A small number of hyperscalers and large AI players account for a large portion of the AI backlog, and those buyers have bargaining power. If they pull back on spending or in-source more aggressively, Dell’s growth would take a hit. And over the long run, there’s the risk of commoditization. If rack integration and liquid cooling become standardized, Dell’s ability to differentiate on execution may erode.

For now, Dell appears to be in a strong position. It’s the market leader, and industry giants like Nvidia consistently prefer Dell over its rivals. Combined with the sizable backlog, it’s reasonable to assume that AI server revenue growth will remain strong over the next several quarters — and possibly years.

The real question is margins. With chip costs so high and competition keeping pricing power low, I don’t expect AI servers to achieve margins much above those of the CSG business. If that assumption holds, then even rapid growth in the segment will translate into only high single-digit profit growth.

In other words, Dell’s AI server boom is currently adding very little to the bottom line, and it might stay that way.

Capital Allocation

Speaking of profits, let’s talk about how Dell puts them to work. One of the first things that stands out in its financials is the volatility of operating cash flow. In some years, it tops $10 billion, while in others it falls to just $3–4 billion. At first glance, that might suggest an unstable business, but most of the swings are explained by working capital, changes in supplier payments, inventories, and customer prepayments.

Once you adjust for that lumpiness, Dell generates an average of about $4.5 to $5 billion in cash flow. How the company deploys that cash has shifted over time.

After the EMC acquisition, Dell’s balance sheet was burdened with debt, and for years, nearly all cash was directed toward paying it down. By 2024, Dell had reached its target leverage ratio of 1.5x and regained its investment-grade credit rating. With the balance sheet repaired, the company shifted toward rewarding shareholders directly.

In 2023, it initiated a quarterly dividend for the first time in its history at an annualized rate of $1.32 per share. The payout has been raised every year since, with guidance for $2.10 in 2026. That represents dividend growth of close to 20% per year, with a long-term goal of delivering at least ten percent annual growth through 2028.

Buybacks have become a major part of shareholder returns as well. Once leverage was under control, Dell began repurchasing shares aggressively. In just the first quarter of FY2026, Dell bought back a record-breaking $2.3 billion worth of shares. And the board has already authorized more than $12 billion in future buybacks.

Valuation and Portfolio Decision

Okay, so what are we willing to pay for Dell?

On the surface, Dell trades like a mature hardware company. At a share price around $120, the stock is valued at roughly 12x forward earnings and a bit more than 12x free cash flow. For a business tied into one of the fastest-growing technology trends in the world, that looks modest.

However, this is not a business with “AI-like financials,” it’s still a hardware business with all the flaws that come with it, mainly, a low margin. And looking at Dell’s historic valuation, it’s currently above the median. So, it’s clearly not as cheap as it might seem at first glance.

In my “optimistic” base case, I’ve already built in assumptions that would count as a real success for Dell’s AI strategy, especially on the margin side. For the CSG segment, the PC business, I assumed 5% annual growth. That factors in the expected renewal cycle from Windows 11 and a modest uplift if AI PCs turn out to be the innovation Michael Dell believes they are.

For ISG, I modeled growth of about 12% per year through 2027, tapering to 10% by the end of the decade as the AI buildout matures. That would put Dell’s overall revenue CAGR at roughly 7–8%. On top of that, I gave Dell the benefit of the doubt by assuming operating margins improve 30–40 basis points per year through 2029, which only happens if Dell can successfully upsell higher-margin services alongside AI servers.

With that margin expansion, operating income grows at a 12–13% CAGR. Add in a 1.5% annual share decline from buybacks, and EPS compounds at about 17% annually through 2029. But even under those rather bullish assumptions, the fair value of the stock still comes out about 10% below today’s price.

When I add a bit more pessimism and adjust just three assumptions, Dell’s fair value drops to about $70. The changes: CSG grows at 3% instead of 5% (in line with historical averages), ISG grows at 8% instead of 11%, and, most importantly, ISG operating margins come in at 9% rather than 12%.

If Dell can’t lift the margin profile of AI servers, this feels like a realistic outcome. And even if they do, the stock already looks fairly valued. In my view, that leaves Dell with 30–40% downside risk but not enough upside to justify taking it.

I looked into Dell because many people described it as a hidden AI gem, but honestly, at no point in my research did I get excited about the company or the stock. Sure, there might be upside if execution is flawless, but the risk-reward just isn’t compelling.

That said, I don’t regret digging into the business. The best way to learn is by studying business models firsthand, and for me, Dell has been exactly that kind of lesson.

For more on Dell, you can listen to our podcast here.

More portfolio updates below 👇

Weekly Update: The Intrinsic Value Portfolio

Notes

Following a significant shift in our Portfolio last week, we made no additions or sales this week. However, there is news that had a material impact on our Portfolio.

Our second largest portfolio position, Alphabet, jumped 9% after a U.S. judge ruled that Google does not have to be broken up, meaning no forced sale of its Chrome browser or Android OS.

The ruling also allows Alphabet to continue paying Apple to make Google the default search engine on iPhones. A deal worth an estimated $20 billion annually. This continuation of lucrative payments provided further bullish optimism for investors.

Quote of the Day

"A lot of success in life and business comes from knowing what you want to avoid.”

— Charlie Munger

What Else We’re Into

📺 WATCH: Best In-Class Businesses w/ Clay Finck and Joseph Shaposhnik

🎧 LISTEN: Using Mental Models from Science in Investing w/ Kyle Grieve

📖 READ: What the Google Ruling means for Antitrust Regulation

You can also read our archive of past Intrinsic Value breakdowns, in case you’ve missed any, here — we’ve covered companies ranging from Alphabet to Airbnb, AutoZone, Nintendo, John Deere, Coupang, and more!

Do you agree with the investment decision on Dell?Leave a comment to elaborate! |

See you next time!

Enjoy reading this newsletter? Forward it to a friend.

Was this newsletter forwarded to you? Sign up here.

Use the promo code STOCKS15 at checkout for 15% off our popular course “How To Get Started With Stocks.”

Follow us on Twitter.

Read our full archive of Intrinsic Value Breakdowns here

Keep an eye on your inbox for our newsletters on Sundays. If you have any feedback for us, simply respond to this email or message [email protected].

What did you think of today's newsletter? |

All the best,

© The Investor's Podcast Network content is for educational purposes only. The calculators, videos, recommendations, and general investment ideas are not to be actioned with real money. Contact a professional and certified financial advisor before making any financial decisions. No one at The Investor's Podcast Network are professional money managers or financial advisors. The Investor’s Podcast Network and parent companies that own The Investor’s Podcast Network are not responsible for financial decisions made from using the materials provided in this email or on the website.