- The Intrinsic Value Newsletter

- Posts

- 🎙️ 1-Year Portfolio Review: The Intrinsic Value Portfolio

🎙️ 1-Year Portfolio Review: The Intrinsic Value Portfolio

[Just 5 minutes to read]

Six months ago, I wrote our half-year portfolio review and mentioned how quickly time had flown by. Somehow, the six months since then went by even faster.

At this point, we’ve analyzed about 50 companies this year. The good news is that, despite some early doubts when we started this project, the well of opportunities hasn’t run dry. And yet, as you’ll see today, our watchlist has become more important than ever.

Every week, we study great businesses. But many of them simply aren’t attractively priced when we first look at them. Eventually, though, Mr. Market gives us opportunities — and those opportunities allow us to turn watchlist names into positions eventually.

That’s how we bought Copart a couple of weeks ago, and today, we’ll talk about another business that finally earned its spot in the portfolio after sitting on the watchlist for a while.

But a review also means making tough decisions. So yes — one company is leaving the portfolio today as well.

— Daniel

TIVP Portfolio Review: How did it go?

Usually, you would expect a company deep-dive here, but once or twice a year, we like to give an update, share some fresh thoughts, and highlight portfolio changes through a portfolio review. After covering about 50 companies and almost one year of this journey, today is a good time for that.

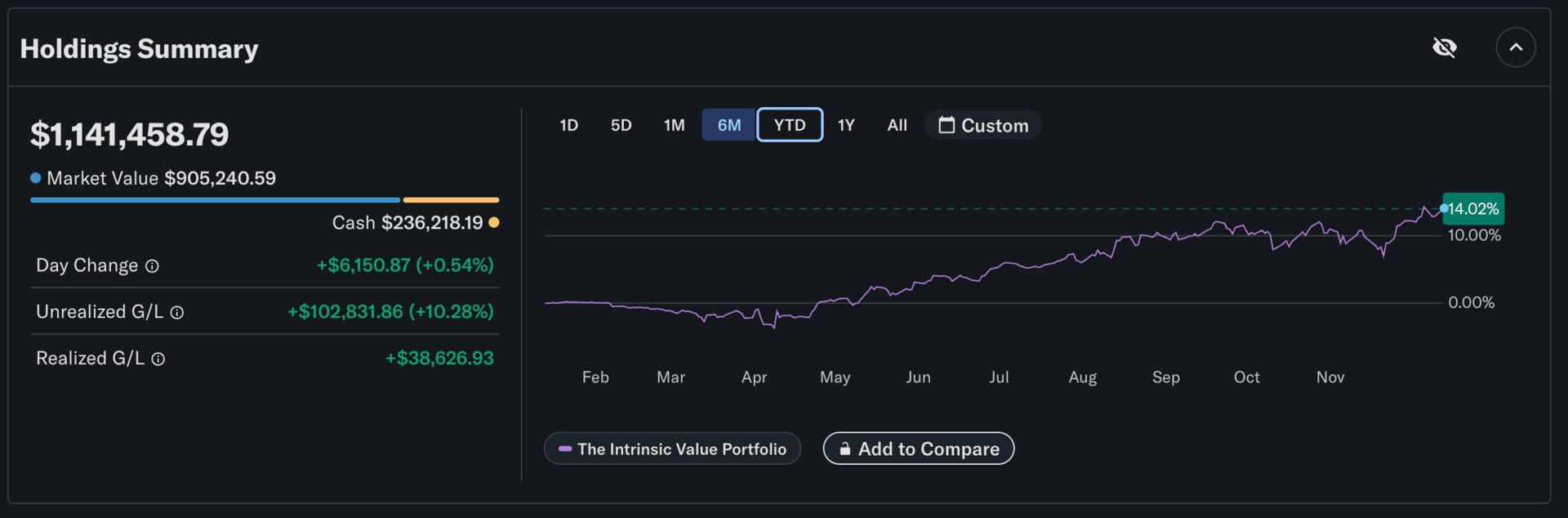

Of course, we can’t write a one-year portfolio update without talking about performance, so we’ll get to that in a second. But it always feels a bit arbitrary. As many of you know, the whole idea behind this portfolio has been, and still is, to show what it actually looks like when you build a portfolio from scratch.

That meant starting the year with 100% cash and only adding companies after we’d covered them on the show. And we didn’t want to take the easy route and just focus on the usual suspects. If we had opened the year by talking about the Mag7, we probably would’ve invested the entire portfolio within two months, and our portfolio looks like every second one on Wall Street… but, honestly, that would’ve defeated the purpose of the whole project.

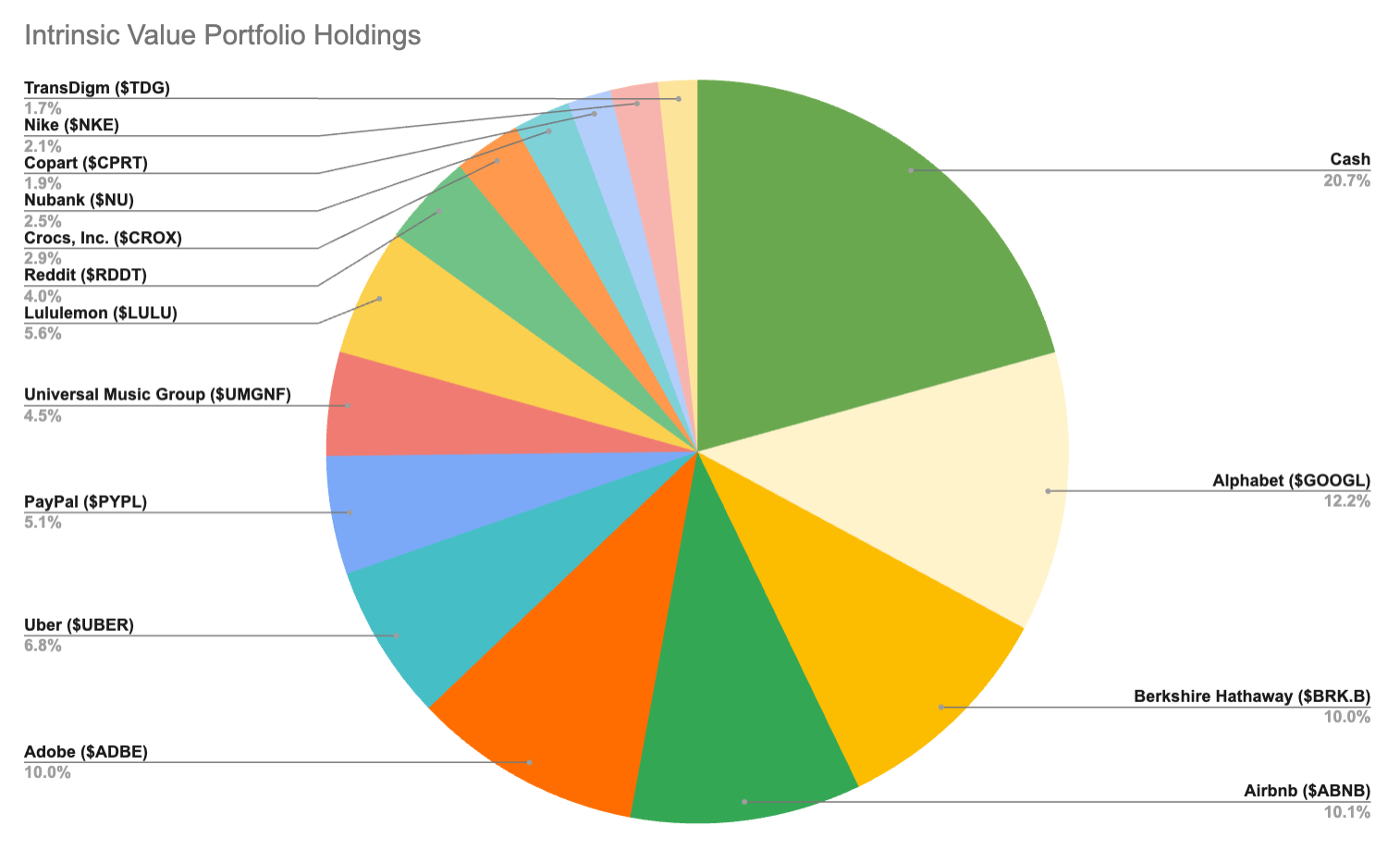

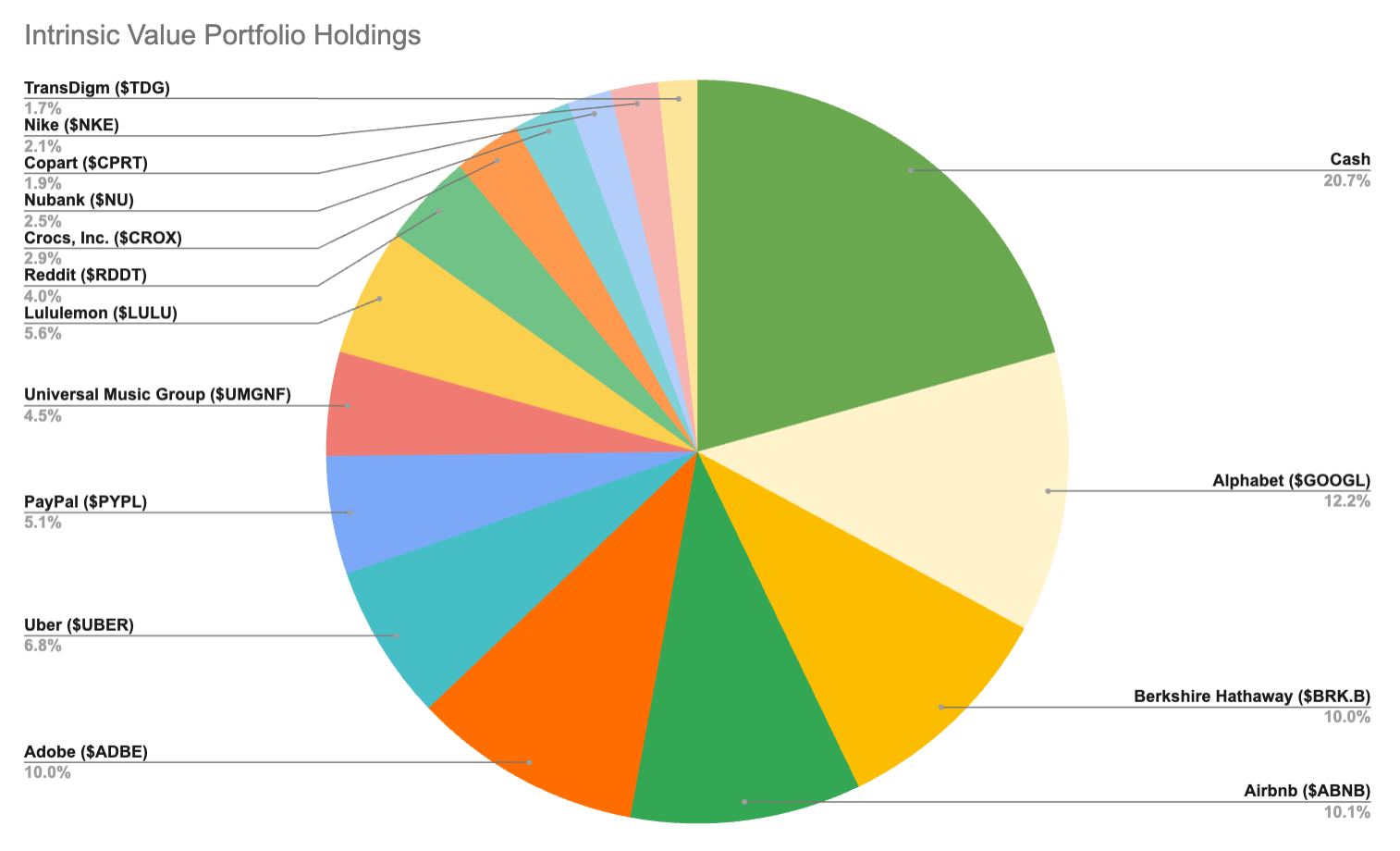

We also didn’t want to build 20% positions right out of the gate. From the start, we knew we wanted a portfolio of 15 to 20 holdings. So when we liked a company, the default position size was around 5%. When the outcome felt a bit less certain, but we still wanted exposure, we sized it at 2–3%. And when conviction was high, and the opportunity just couldn’t be missed, we allowed ourselves to go up to 10%.

Because of this approach, our portfolio sat on a large cash position for most of the year. Only now are we finally down to roughly 20%. And with that, a new phase of this portfolio journey begins, one where opportunity costs matter a lot more. Earlier in the year, cash was simply the default. Today, every new dollar has to justify itself against the companies we already own.

Anyway, with that backdrop, and despite the drag from keeping so much cash idle, we delivered a return of about 14% this year. The market rebounded quite a bit since the podcast recording, so the number moved up significantly. Honestly, I’m pretty happy with that. If we had held these companies without the cash drag, the results would’ve been much stronger. But, as we’ve said many times, one-year performance doesn’t tell you much on its own.

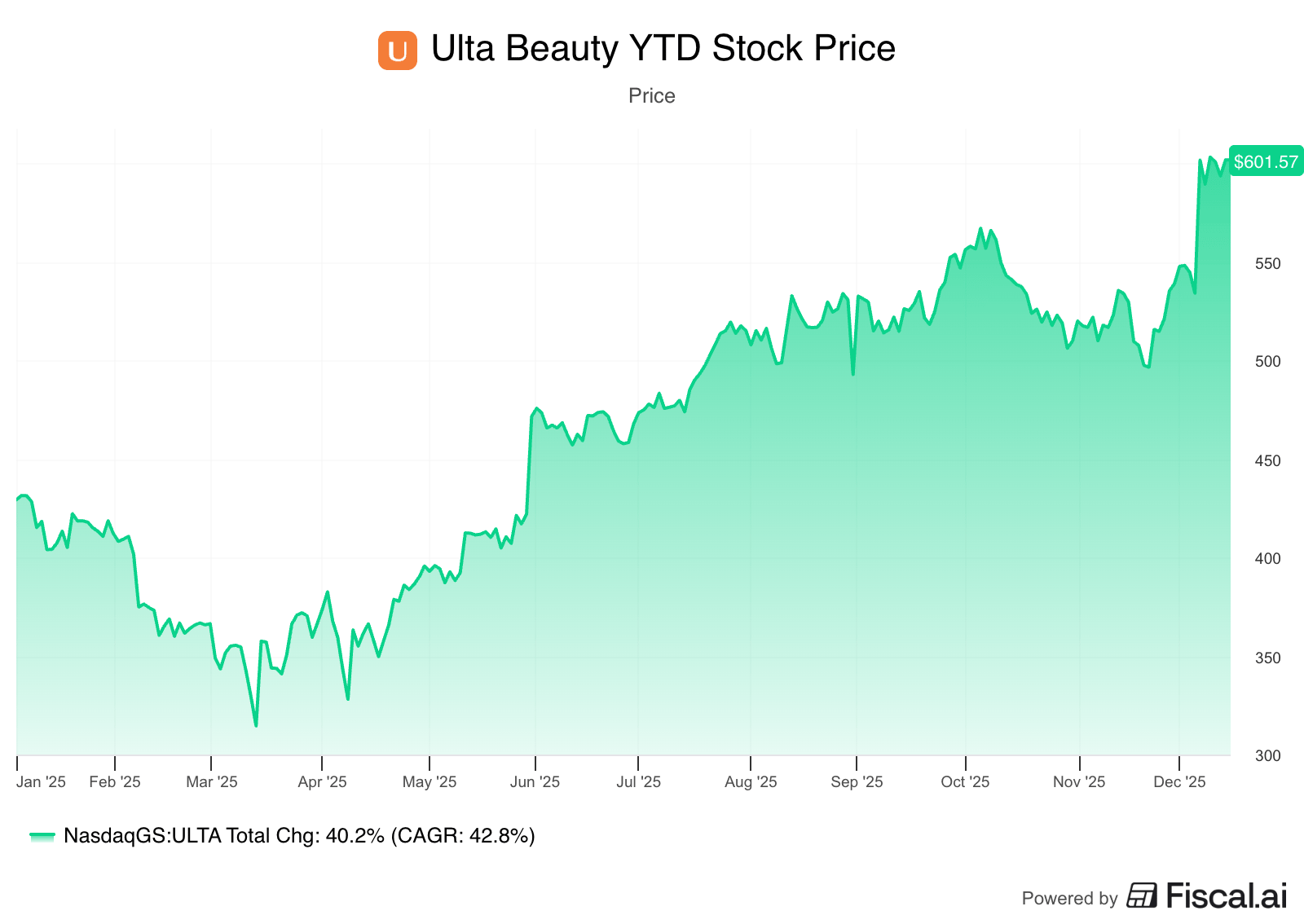

While it’s always nice when a thesis plays out quickly, most of the companies we own were added with multi-year holding periods in mind. Even the ones that lean a bit more toward being “trades” are still built on theses that usually need two to three years to fully unfold. One position where we didn’t need those two to three years, though, has been Ulta…

Ulta Beauty – Sold too Soon?

Ulta was the very first company to enter the Intrinsic Value Portfolio, so, in many ways, it marked the start of this whole journey. And now, it’s also the first company to leave the portfolio again.

The thesis played out pretty much exactly as Shawn had laid out. We bought Ulta at an attractive valuation, the stock re-rated nicely, cosmetics proved incredibly resilient in this economic environment, and any doubts about the new leadership team have largely disappeared. With the thesis essentially completed, we felt it was a good moment to lock in the gain and move on. Ulta is a very good business, arguably one of the best-run specialty retailers in the country, but not one we felt we would want to own for decades.

Of course, selling always comes with the risk of watching the stock continue to climb, which is exactly what happened. Locking in a 28% return doesn’t look quite as clever in hindsight when the stock keeps rising. Time will tell whether we made a mistake or whether allocating that capital elsewhere will turn out to be the better decision.

We should emphasize that at no point did we think Ulta wouldn’t continue performing well. That was never the issue. We simply felt that, looking ahead over the next five years, we could find opportunities with a more attractive risk-return profile than Ulta at today’s valuation.

One of those opportunities is Adobe.

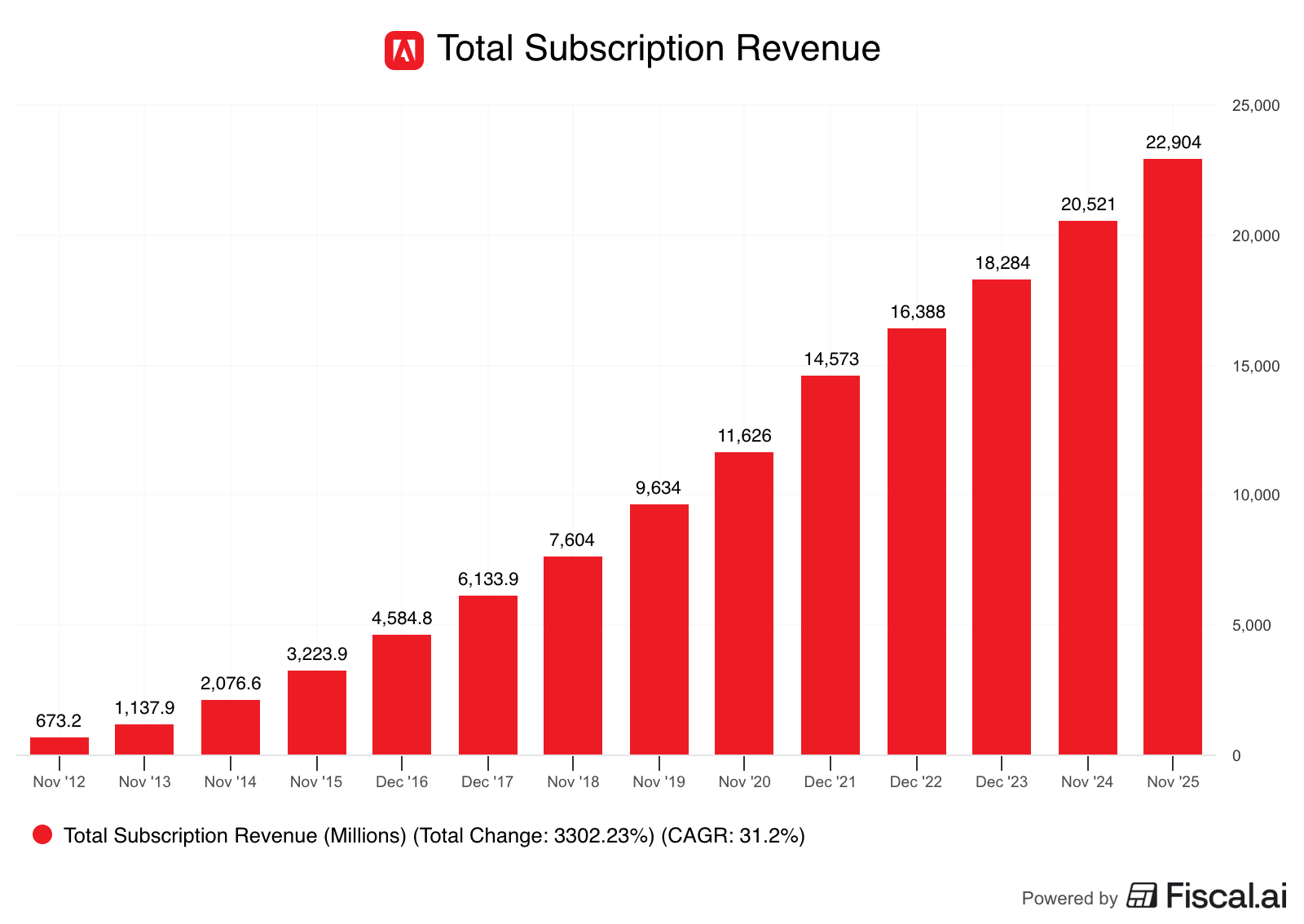

Adobe – Double-Digit Growth Continues

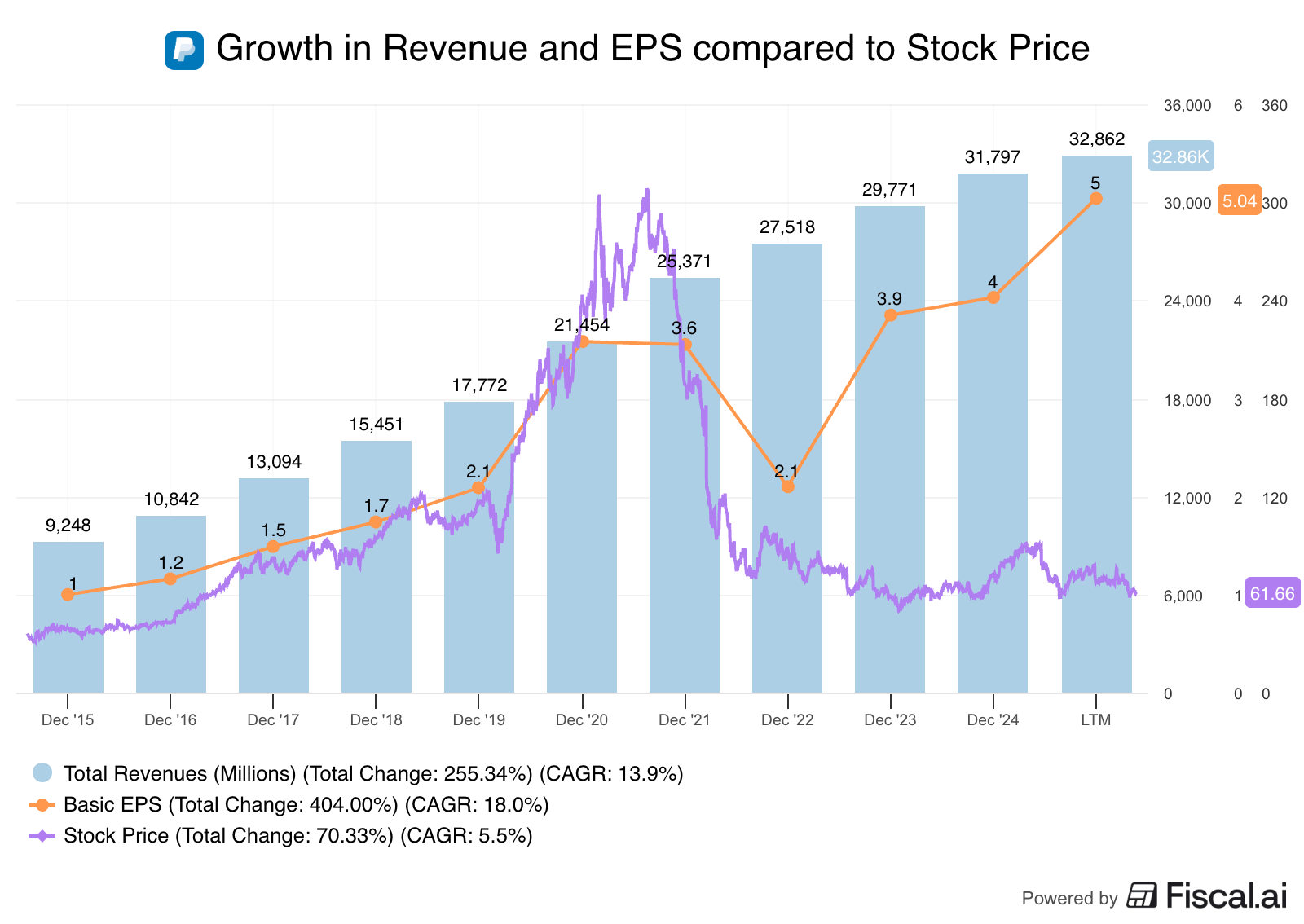

Adobe remains one of the most misunderstood large-cap stocks in the market. The dominant narrative is still that AI will somehow erode Adobe’s moat. But, once again, the latest earnings report tells a very different story — one of accelerating demand, strong fundamentals, and even deeper AI integration across the entire product lineup.

For FY2025, Adobe delivered record revenue of $23.77 billion, up 11% year over year, and generated more than $10 billion in operating cash flow — also a record. The real strength of the business continues to be the stickiness of its products, and that, unsurprisingly, hasn’t changed at all. Total Adobe ARR (Annual Recurring Revenue) reached roughly $25.2 billion, growing 11.5% year over year. In other words, Adobe exceeded its ARR target for 2025 and is now guiding for another 10% growth in 2026.

And users clearly like Adobe’s new AI tools. Generative Credit consumption grew threefold quarter over quarter. Acrobat and Express together now have 750 million monthly active users, up 20% year over year. Enterprise demand is strong as well, with more than 25% growth in customers generating over $10 million in ARR.

I’m usually not a fan of just throwing a list of numbers at you, but in this case, the numbers speak for themselves. Nothing makes it clearer that this business is not being disrupted than simply looking at the data.

And yet, Adobe is still trading at a forward P/E and P/FCF of 14x — its lowest valuation in a decade. The disconnect between narrative and fundamentals has rarely been wider. When we updated our model with the current price, we arrived at expected annual returns of roughly 18% using a reasonable exit multiple. Even with more conservative assumptions, closer to 20x earnings instead of 25x, Adobe still clears our 12% hurdle rate.

Given this combination of durable fundamentals, accelerating AI-driven growth, and a valuation that leaves very little room for pessimism, we increased our Adobe position to 10% (we decided to double down even more than the 8% mentioned in the podcast episode!). The market hasn’t rewarded our patience yet; we’re currently down about 4%, but we’re quite confident that this will look different in the coming months and years.

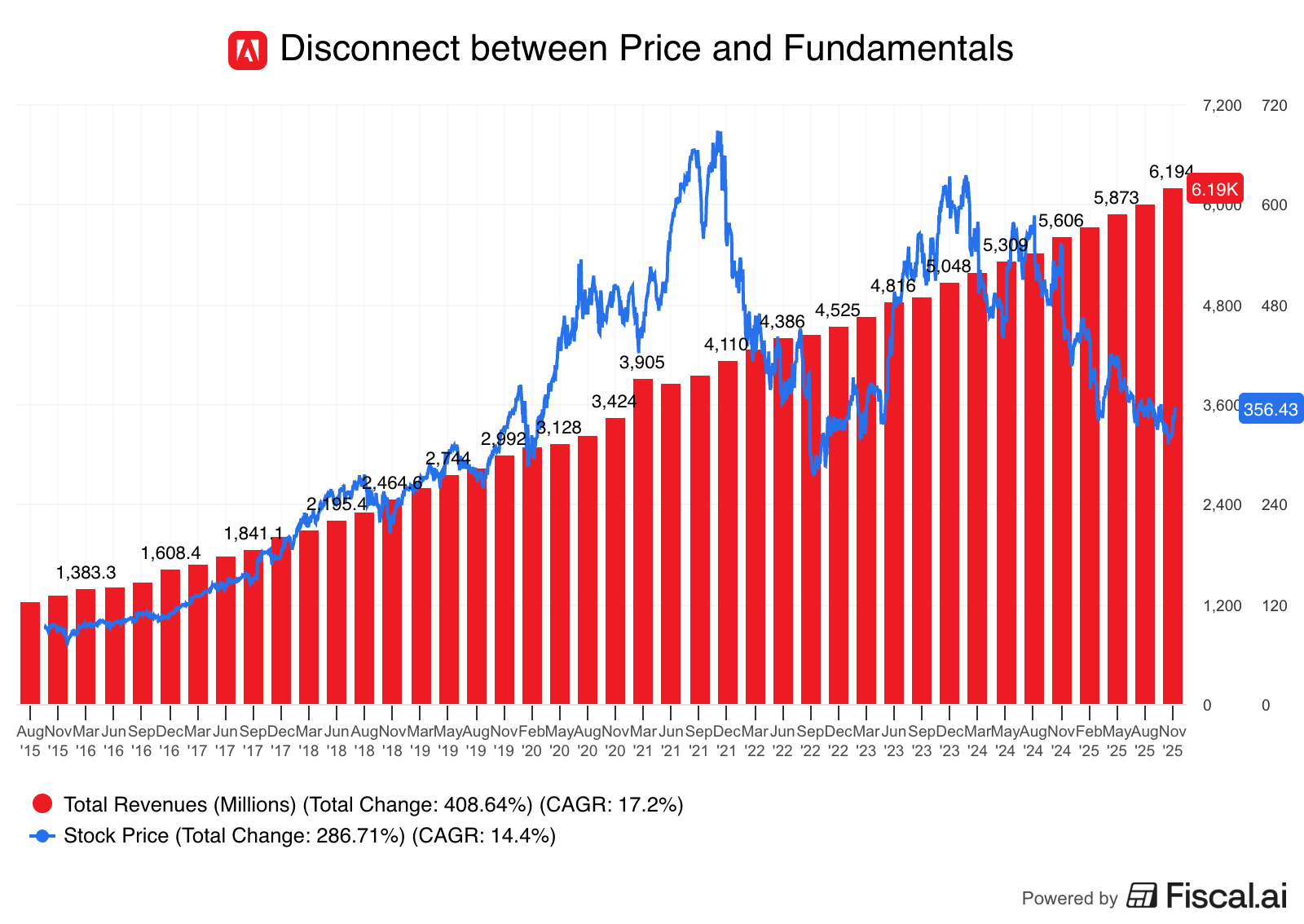

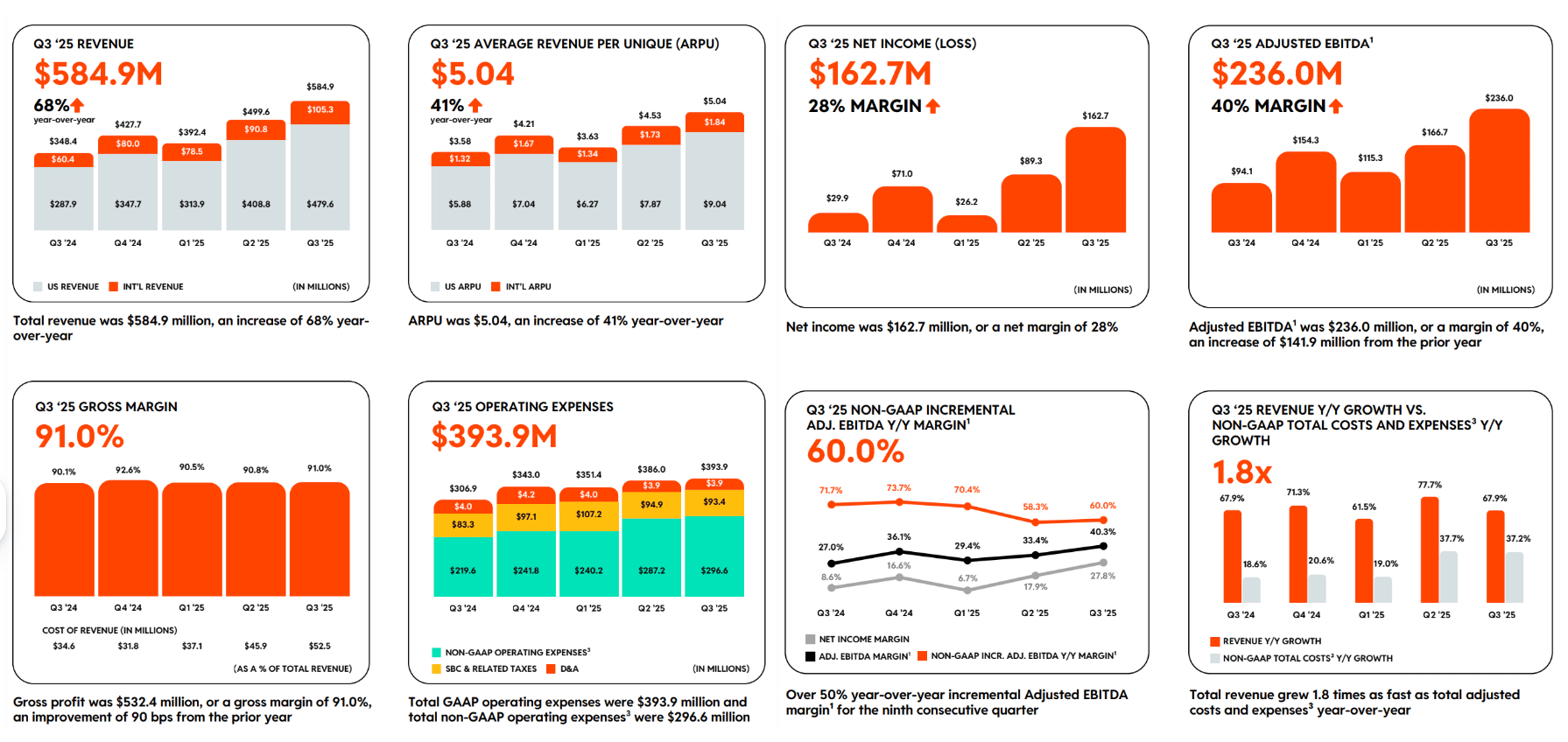

Reddit – 150% in a couple of Months

A company that has already performed incredibly well for us is Reddit. It has been one of the biggest surprises in the portfolio this year — not because we ever doubted the business (especially Shawn, who spotted the potential in this social media giant early on), but because the speed of the move far exceeded anything we modeled.

The stock is now up about 150% since our initial 2% position, making it one of the strongest performers in the entire portfolio. And the business continues to back it up. The latest earnings report was exceptional once again. Revenue grew nearly 70% year over year, ARPU jumped 40%, and margins improved across the board.

It took Reddit a few years longer than many hoped, but it is now clear that the company is following Meta’s path, not Snapchat’s. Monetization has begun to scale, advertisers are seeing real returns, and the platform’s unique community structure, which was always the differentiator, is finally translating into financial results.

I think it’s fair to say Reddit has made huge progress. At the same time, the stock is anything but cheap, so we’re obviously not adding here. Shawn and I did talk about trimming the position, and while the stock will very likely pull back again at some point, we ultimately decided to leave it untouched.

Reddit has now clearly proven its business model, and it still has a long runway ahead. If we sold part of our position here, the odds are high we’d never buy it back, simply because it would always look too expensive on whatever forward multiple it’s trading at.

Its monetization engine is still in the early stages of scaling, advertiser adoption continues to rise, and the company is executing far better than most people expected at the time of the IPO. Reddit will never reach Meta-level monetization, but it doesn’t need to. Even modest improvements, layered onto the growth trajectory it already has, can create meaningful compounding over the next decade.

The position has grown to roughly 4% of the portfolio purely through performance. We’re comfortable letting it sit there. We’re not adding, but we’re also not trimming.

This might be one of those cases where patience and resisting the instinct to over-optimize is part of the edge. And yes, I’m fully aware this might age terribly if the stock is down 50% six months from now…

Uber – On the Right Path

Uber might be the company we’ve talked about more than any other this year — on the podcast, at conferences, and inside our Intrinsic Value Community.

Shawn and I were Speakers at an Investing Conference in Lisbon last month

We first bought Uber in the low $60s and added again around $95, which puts our average cost close to $80. And especially after the sharp drop at the end of this week, it’s fair to say the stock hasn’t run away from us at all, at least not relative to the strength of the underlying business. With a forward P/FCF still around 18x (although FCF is overstated due to the insurance operations) and revenue growth north of 20%, the valuation remains very reasonable for what we believe Uber is becoming: the central aggregator of autonomous vehicle (AV) demand.

The sharp selloff this week was driven by Waymo releasing updated numbers. Six months ago, Waymo facilitated about 250,000 rides per week; now it’s above 450,000. By the end of next year, the company aims to reach 1 million rides per week, helped by expansion into more than a dozen new cities in the U.S. and internationally.

If you listened to our Uber episode — and certainly if you're part of the Intrinsic Value Community — you know we’ve spent a lot of time digging into the bear case. So none of this is surprising to us. Waymo is clearly making progress, but it doesn’t change our view on Uber. If anything, it shows the incredible scale of Uber.

While Waymo’s progress is great, fewer than half a million rides per week are not enough to compete with Uber’s 200+ million rides per week. Yes, more than 200 million… Waymo is basically in a race against all other AV companies to reach scale within its own app before other AV companies partner with Uber and plug into the ecosystem, which, by the way, is already about to happen. In part with Waymo itself, but also through partnerships with companies like Nvidia and Stellantis.

An even less likely, but potentially more “dangerous,” risk is the idea of someone acquiring Lyft. The most obvious buyer would be Amazon. With Lyft’s market cap sitting around eight to nine billion dollars, an acquisition would be trivial for them, and integrating Lyft into Prime could, at least in theory, drive meaningful adoption. Beyond that, Amazon’s logistics network could complement a mobility layer in some interesting ways.

But there’s an important point that often gets overlooked. Big Tech is fantastic at entering fragmented markets and consolidating them. They are not nearly as good at taking on markets with deeply entrenched leaders. And ride-hailing has exactly that in Uber. So even if Amazon were to enter through a Lyft acquisition, there’s a very real chance they still wouldn’t be able to compete with Uber’s scale, liquidity, or data advantage.

And at this point, we’re already dealing with a lot of “ifs.” So, in short, and I don’t think this comes as a surprise, we’re still bullish on Uber and decided to increase our position to 7%, buying in the low $80s.

Crocs – Revisiting the Ugly Show Brand

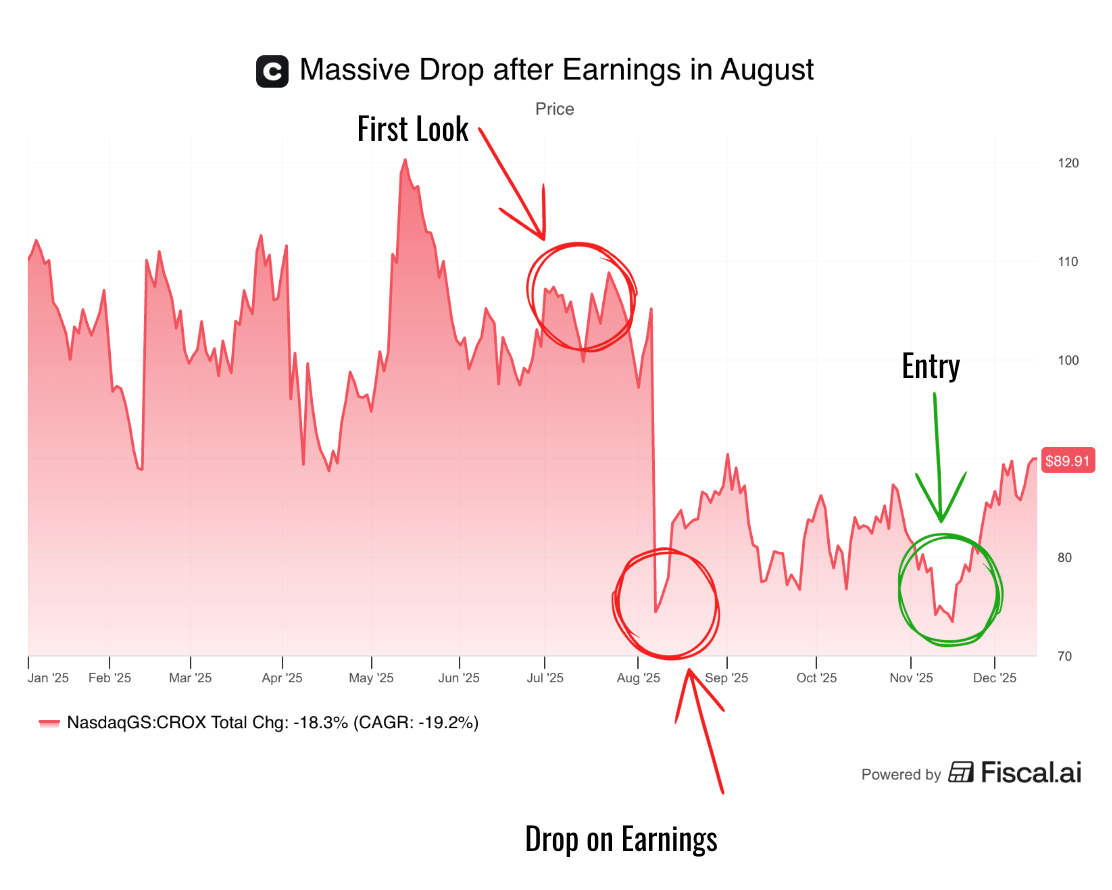

Crocs is a company I liked the first time I looked at it a couple of months ago. It’s not an outstanding business, although the margin profile and cash conversion would say otherwise, but at the right price, it can absolutely be a very profitable investment. Back then, though, the stock was still trading above $100.

Even at that level, it wasn’t necessarily unattractive if you ran a model and looked at the expected returns. But I still wasn’t willing to take on the risk that comes with owning Crocs at that price point.

You could call what happened next foresight, but honestly, I’d call it luck. The next earnings report came in, the stock did a nosedive, and suddenly the setup looked a lot more interesting. But at the same time, there were some real headwinds in the business, so we didn’t feel any urgency to jump in immediately.

Since then, the market kept pushing the shares lower again and again, and when the stock reached the low $70s, we decided to initiate a position. At that point, Crocs was trading at roughly an 18% free cash flow yield, backed by a business that has historically been one of the most profitable in the entire fashion category.

On top of that, management has been aggressively buying back stock, which translates into a roughly 16% buyback yield. In other words, you’re being paid a huge amount upfront while waiting for sentiment to normalize.

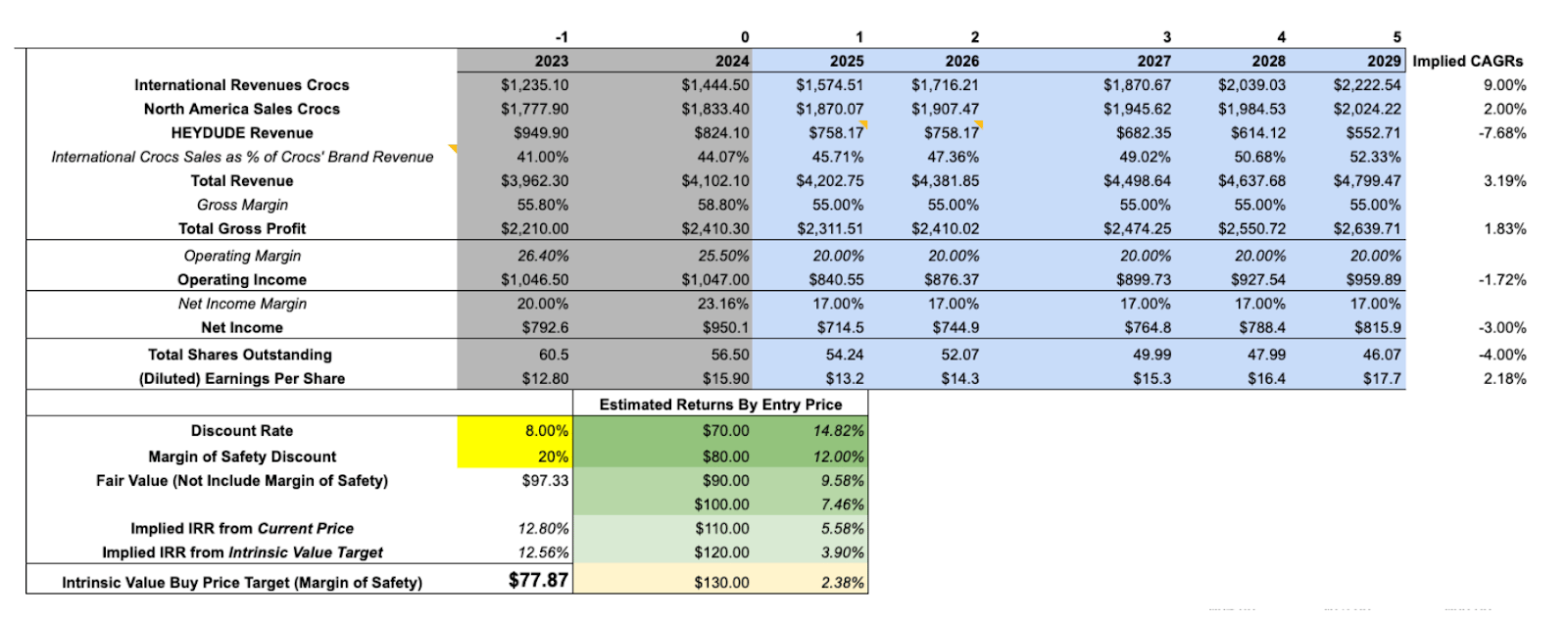

But valuation alone is not a thesis. And Crocs comes with two very real issues.

First, it’s a retail brand — a category we generally avoid unless the business has unusually strong moats. Lululemon and Nike are the two exceptions in our portfolio for that reason. Crocs is not at their level of brand durability and prestige, even if its margin profile looks similar.

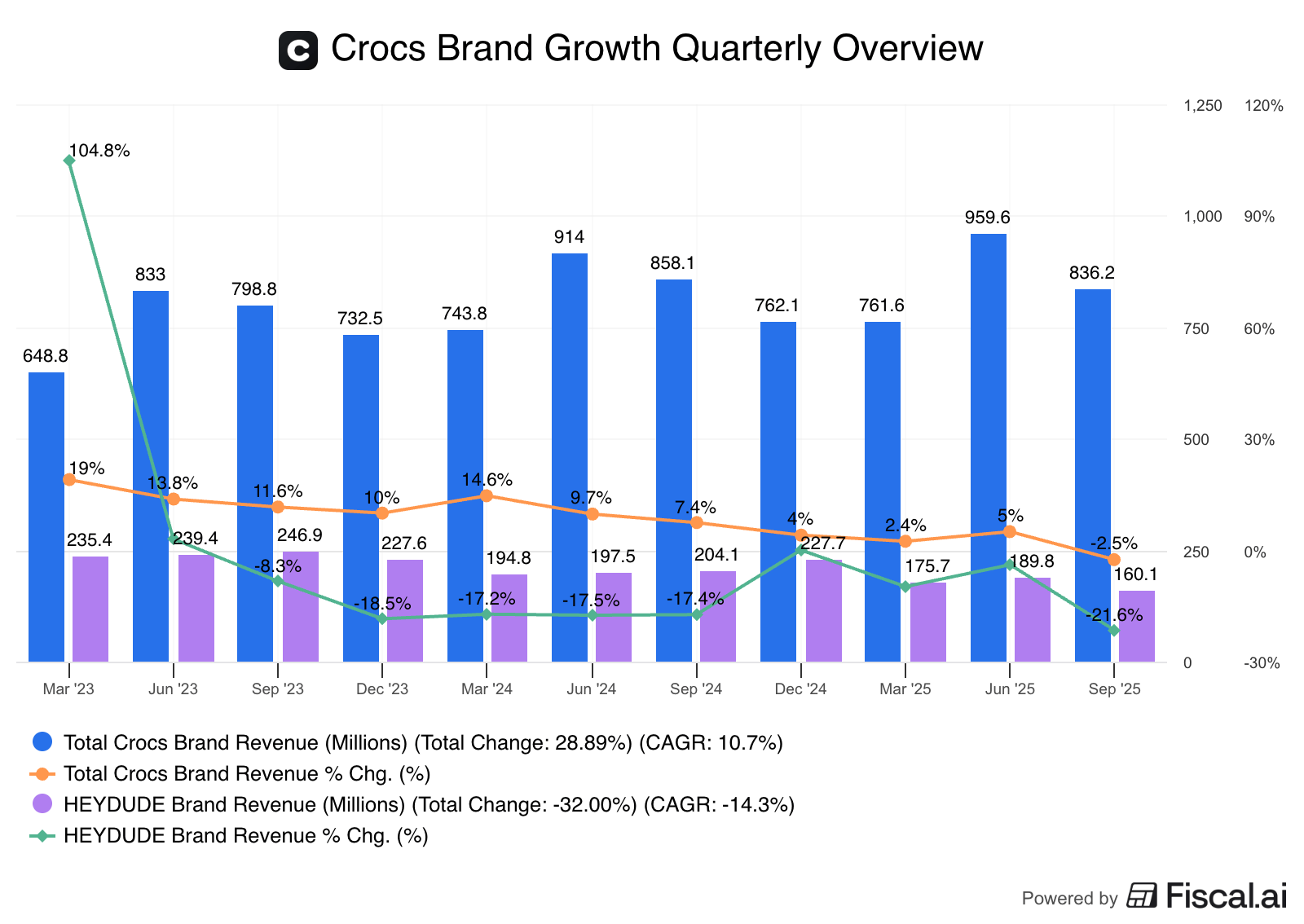

Second, sales are declining, and declining sales are never a good sign (these are the elite insights you’re subscribed for, right?). The key nuance, though, is where the decline is happening. Last quarter, revenue fell 6%, but almost all of that came from HeyDude, which was down roughly 20%. The Crocs core brand is more stable. Declines are very modest, despite pressure from reduced marketing to protect margins. International sales are still very strong.

From an investment standpoint, this distinction matters enormously. If the core Crocs brand were collapsing, this wouldn’t be a value play — it would be a value trap. But if the weakness is isolated to HeyDude, and the core continues to grow low single digits in the U.S. and just high single digits internationally (likely very conservative assumptions), Crocs looks like a bargain.

To test this, I tweaked my model a bit. Even if we assume HeyDude declines by 10% per year and the Crocs brand grows just 2% in North America and 9% internationally, we still end up above our 12% return threshold at a price of around $78 per share.

With any upside in brand momentum, or even just stabilization at HeyDude, the equity becomes meaningfully undervalued. In other words, once the stock slipped into the low $70s, the market was already pricing in a near worst-case scenario, and anything even slightly better than that creates attractive returns.

Insiders seem to agree with our view as well. We saw a bit of activity with insiders buying shares in the $70s, which is always a useful signal when you’re dealing with a company that isn’t a straightforward compounder. Given the valuation, the underlying brand strength, and the asymmetry of the setup, we initiated a 2.5% position. This is not a forever compounder; it’s a classic deep-value opportunity with a clearly defined thesis and a clearly defined set of risks. But at those prices, I believe the potential reward more than compensated for those risks.

I speak in the past tense because, once again, we got a bit lucky and Crocs is already up about 25% since we bought it.

PayPal – Slower than Expected Turnaround

PayPal is a position where the fundamentals and the sentiment couldn’t be further apart. The business still produces $6–7 billion of reliable free cash flow, buys back roughly 10% of its market cap each year, and trades at a ~10% earnings yield — the kind of setup value investors usually dream about. And yet, every time management speaks publicly, the stock tends to sell off.

Last week was no exception. At the UBS conference, PayPal CFO Jamie Miller gave an interview that, for the first time, left me genuinely conflicted. Guidance was reiterated, but the tone was noticeably more cautious, and in some cases, harder to reconcile with the strength shown in Q2 and Q3.

Before diving into that, it’s worth recapping the thesis quickly:

PayPal is a (slow-)growing, high-cash-generation machine with meaningful upside optionality. Most importantly, Venmo and BNPL continue to grow north of 20% year over year, with Pay with Venmo closer to 40%.

You have the ads business, led by Dr. Mark Grether, who built the advertising businesses at both Amazon and Uber, that could evolve into a significant profitability lever.

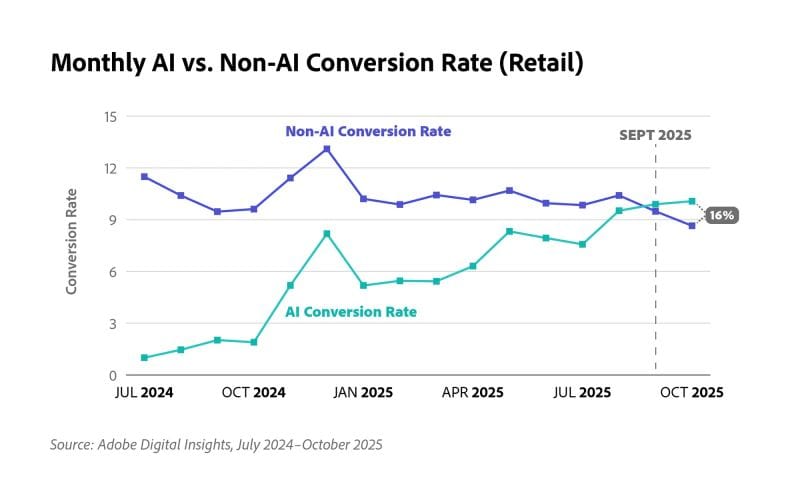

Agentic commerce is already live with Perplexity, and partnerships with OpenAI and Google are lined up for 2026, supported by early data indicating that AI-assisted shopping drives meaningfully higher conversion rates.

PYUSD, PayPal’s stablecoin, is now the fastest-growing in payments and is up roughly fourfold year-to-date, and PayPal World — expected to go live in 2026 — may eventually connect nearly two billion users across the ecosystem. In short, the ingredients for a multi-year turnaround remain intact.

However, the bedrock of the thesis is that PayPal’s cash-printing machine, the branded checkout, is at least growing in the mid-single digits in the long term.

According to the CFO, though, branded checkout growth in Q4 will be at least 200 basis points weaker than in Q3 (where it grew 5%). Some of that is macro — weaker consumers, lower basket sizes — but at this point it feels increasingly specific to PayPal as well. The problem isn’t that branded checkout is slowing in one quarter. My problem is the messaging inconsistency.

Throughout Q2 and Q3, everything pointed toward 2025 being the transition year PayPal needed. Branded checkout was stabilizing, product velocity accelerated, partnerships expanded, and leadership seemed to have a coherent roadmap. For the first time in years, execution and narrative were aligned. That’s why we entered the position. After UBS, that alignment feels less certain.

The CFO also noted higher investment spending on agentic commerce, branded incentives, and product expansion — all of which will pressure EPS and transaction margins. None of this is unreasonable. Long-term bets require capital. But those bets are easier to make from a position of visible strength, and after a strong Q3, it felt like PayPal finally had that momentum. After UBS, the picture looks muddier.

It’s important to note that full-year guidance was reaffirmed. The company claims it will comfortably achieve its targets, which, to some extent, amplifies the disconnect between message and tone. PayPal is known to underpromise and overdeliver when it comes to guidance, so this is either the management deliberately resetting expectations, or near-term visibility is weaker than they would like to admit.

So where does that leave the thesis?

One thing I want to clarify is that stock prices anticipate business fundamentals. I saw a lot of talk about how 2026 will be a dead year for PayPal if the business is still in transition mode. That does not have to be the case at all. If the business improves and some of the above-mentioned business units gain traction, the stock can certainly move a lot before the fundamentals increase to the same extent.

So our fundamental view hasn’t yet changed. But we will keep an even closer eye on branded checkout and the reasons for the slowdown despite fantastic BNPL and Venmo growth. If branded checkout softness continues into 2026 without a convincing explanation or without evidence that PayPal is regaining ground, that would be the moment to reassess the position.

For now, though, the valuation gives us the patience to wait. The business still prints cash. The optionality remains intact. But the execution must become clearer, and the messaging more consistent, for the stock to re-rate.

Alright, that was quite a lot of movement for a single portfolio update. We don’t usually make this many changes at once, but given where valuations have moved, and how some of our theses have evolved — it felt like the right moment to take action. And maybe we also wanted to make it an interesting one for you, haha.

For more on our portfolio, you can check out our Masterfile with all positions and the watchlist here and listen to our podcasts here.

More updates on our Intrinsic Value Portfolio below 👇

Weekly Update: The Intrinsic Value Portfolio

Notes

If you have any recommendations for companies we should cover on the show, feel free to leave a comment on this newsletter, and we will take a look!

Quote of the Day

"Patience is not passive; it is concentrated strength.”

— Bruce Lee

What Else We’re Into

📺 WATCH: Stig Brodersen walks us through his Mental Models and gives a Portfolio Update

🎧 LISTEN: William Green chats with Howard Marks about managing Risks and “Steady Excellence”

📖 READ: Lessons and Ideas from Benjamin Graham by Jason Zweig

You can also read our archive of past Intrinsic Value breakdowns, in case you’ve missed any, here — we’ve covered companies ranging from Alphabet to Airbnb, AutoZone, Nintendo, John Deere, Coupang, and more!

Do you agree with the changes made to the Portfolio?Write a comment to elaborate! |

See you next time!

Enjoy reading this newsletter? Forward it to a friend.

Was this newsletter forwarded to you? Sign up here.

Join the waitlist for our Intrinsic Value Community of investors

Shawn & Daniel use Fiscal.ai for every company they research — use their referral link to get started with a 15% discount!

Use the promo code STOCKS15 at checkout for 15% off our popular course “How To Get Started With Stocks.”

Follow us on Twitter.

Read our full archive of Intrinsic Value Breakdowns here

Keep an eye on your inbox for our newsletters on Sundays. If you have any feedback for us, simply respond to this email or message [email protected].

What did you think of today's newsletter? |

All the best,

© The Investor's Podcast Network content is for educational purposes only. The calculators, videos, recommendations, and general investment ideas are not to be actioned with real money. Contact a professional and certified financial advisor before making any financial decisions. No one at The Investor's Podcast Network are professional money managers or financial advisors. The Investor’s Podcast Network and parent companies that own The Investor’s Podcast Network are not responsible for financial decisions made from using the materials provided in this email or on the website.