- The Intrinsic Value Newsletter

- Posts

- 🎙️ Match Group: Is Finding Love a Good Investment?

🎙️ Match Group: Is Finding Love a Good Investment?

[Just 5 minutes to read]

It’s easy to joke that our grandparents didn’t need an app to find their soulmates, yet 1‑in-10 romantic relationships today begin online.

Swiping right is a pop‑culture catchphrase, but it’s also a business generating billions of dollars in profit. Match Group (MTCH), owner of Tinder, Hinge, OkCupid, and a handful of other dating apps, is my pitch to Daniel this week, given its leading share of an online-dating duopoly rivaled only by Bumble.

The question I wanted to know, though, is whether helping people find love is actually a good business?

The stock has, painfully, gone from Pandemic darling to value bet after growth unexpectedly stalled two years ago, sending shares into a 70% free fall.

Yet, with 20%+ free cash flow margins, 20%+ returns on capital over the last 5 years, and a forward valuation of less than 9x free cash flow per share, the story is starting to look interesting again.

Let’s discuss.

— Shawn

New Cohort Opening

After a very successful launch of The Intrinsic Value Community, we’re excited to open applications for the next wave of members to join.

The Intrinsic Value Community is designed for sophisticated, long-term investors to exchange ideas, challenge each other’s thinking, and build meaningful connections with like-minded peers.

We give each other feedback on research, share high-conviction ideas, and join weekly calls to discuss investments and host guest speakers, from industry insiders to seasoned investors, who share their strategies, investments, and mental models.

This time, we’re opening just 20 spots, and more than half of them are already filled! If you’re interested, apply now! We’ll review your application carefully and get back to you as soon as possible.

Match Group: From Growth Darling to Value Bet

Match’s Portfolio of Dating Platforms

The “Love” Holding Company

Match Group is something of a digital LVMH, focused on dating, as opposed to luxury apparel, or at least, that’s how I put it to Daniel. In many ways, the comparison is lacking, but both companies do maintain a focus on consistently acquiring promising brands, which they elevate by plugging them into their ecosystem.

The playbook goes as follows: acquire brands with unique identities and integrate them into a shared infrastructure for marketing, payment processing, and technology. By centralizing back‑office functions, Match can run dozens of niche platforms that would never be profitable on their own. This serial acquirer model reinforces the company’s scale advantage because each incremental user and dataset feeds into its matchmaking algorithms and marketing machine.

Positioning of Match Group’s Brands

As a holding company of dating platforms, each tailored to a different demographic or use case, Match Group has become by far the largest player in online dating over two decades.

Its flagship app, Tinder, launched in 2012 and still commands the largest user base of any dating app with over 60 million monthly active users. Known for its swipe‑left (pass) and swipe‑right (like) mechanics, Tinder built its reputation on casual encounters but has been trying to reposition itself as a place for relationships. Tinder was, honestly, a defining part of the 2010s, in my opinion. When thinking about the most impactful apps culturally of that time, it’s hard not to list Tinder in the top 10.

And while there’s been some dating-app fatigue at a society-wide level, it has certainly not faded significantly in relevance.

Changing the hook-up stigma has been challenging, but management has stated that perceptions of Tinder being mainly for hookups have fallen 12 percentage points in the U.S. over the past two years.

I largely suspect this intended shift is because Match knows people are willing to pay a premium for help finding ‘love.’ Not to say that people won’t pay for help with connecting for hookups, but the search for love brings more serious intent and also the chance to add more value.

Connecting for hookups is a more commoditized service that rivals can more easily match, even if Tinder has long been the leader in this space. But since a date can range from $20-$200 in cost (or more!), a service that distills the best matches for you can cut down on the costs of serious dating dramatically over time, paying for itself.

Tinder is in something of an identity crisis, though, as its flywheel has begun to spin in reverse and its network is shrinking — more on that to come.

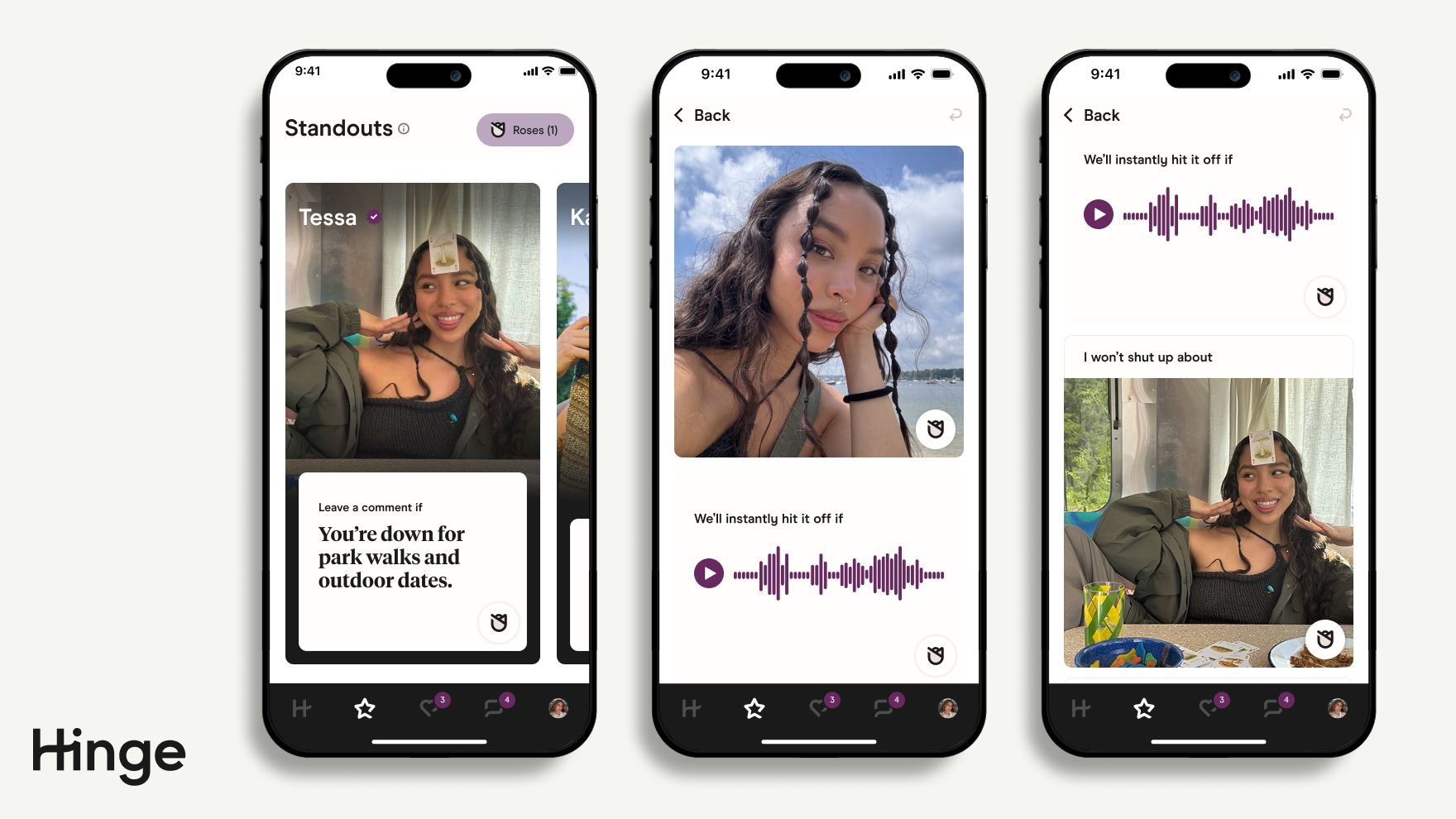

But next, we need to talk about Hinge, which was acquired in 2018 and marketed under the tagline: “designed to be deleted.” In what I would call nothing short of a master stroke, Match Group paid just $25m for what was a fledgling dating app at the time, not even ranking in the top 10 for dating-app mobile downloads, and it has now turned Hinge into a business with hundreds of millions in recurring subscription revenue, double-digit annual growth.

As icing on the cake, Hinge has even usurped Tinder’s throne in Apple’s App Store charts for top dating apps.

Hinge is broadly seen as the platform for more serious daters, and accordingly, Hinge’s onboarding process is 3–4x longer than Tinder’s, because it nudges users to spend extra time differentiating themselves with voice prompts, videos, and more details on personal preferences.

Hinge’s interface

Additionally, its Most Compatible algorithm (built on Nobel‑prize‑winning math, as they like to say) suggests a single top match per day, reducing the decision fatigue and overwhelm associated with sifting through hundreds of likes and potential partners.

Management believes Hinge is on track to become a billion‑dollar revenue business, making it the crown jewel of the portfolio, as much of the rest of the portfolio (and industry) struggles with declining user counts.

Monetization: The Power Law of Freemium

Despite dating’s intimate nature, the economics look a lot like other freemium services.

The vast majority of users pay nothing, generating negligible ad revenue for Match.

Instead, subscriptions account for roughly 70% of revenue. À‑la‑carte purchases offering boosts, super likes, and profile enhancements provide the remaining 30%, with prices ranging from a few dollars per week for a basic plan to Tinder Select at $500 per month for invite-only members (<1% of active users qualify, according to the company).

Tinder Gold and Platinum tiers offer unlimited likes, increased visibility, and Passport Mode, which removes geographic restrictions to match with anyone, anywhere. In contrast, Hinge’s premium plan unlocks additional filters and “Standouts” to let users message before matching.

Spending is highly concentrated; the top percentage of users generate a substantial chunk of overall revenues, similar to mobile-app monetization more generally.

A decade or so ago, Apple gave a rare insight into its business by acknowledging before Congress that 0.5% of App Store users generate 54% of total spending, and roughly 8% of the top users drive 95% of spending.

These super users subsidize the free experience for everyone else and create a virtuous cycle: paying users receive more matches, leading to more engagement and more spending. But concentration is a double‑edged sword. If high‑spending customers churn (as they find serious relationships) or migrate to competitors, revenue can decline rapidly, leaving the revenue base generally a bit shaky.

To encourage adoption and conversion, Match’s old management team, as well as its new CEO, Spencer Rascoff (co‑founder of Zillow), has leaned on more affordable weekly subscriptions to drive revenues and leveraged advertising via the “It Starts With a Swipe” campaign, one of the company’s few major brand campaigns after Tinder primarily grew initially by word of mouth.

The problem for Match Group was that, as users moved away from dating websites and toward apps in the 2010s, this changed the mechanics of their payment processing, exposing them to considerable app-store fees owed to Apple and Google.

For context, these fees have been nothing short of controversial for years now, with developers accusing big tech companies of operating monopolies and unfairly extracting fees for digital transactions. Companies like Uber and DoorDash mostly don’t pay these app store fees because their services are rooted in the physical world (ride-hailing/food delivery), but Match’s subscriptions are considered digital products and get no such exemptions.

Because app-store digital transaction fees can be 30% of revenues upfront, and because Match’s dating platforms used to be mostly through websites outside the purview of app stores, their margins actually took a significant hit as the company scaled, which is the opposite of what you’d expect for a software business, as more users began transacting through apps.

Churn, Reactivation & the Dating Funnel

Every time I’ve shared the pitch with someone for Match Group, the first thing they say, including Daniel, is something along the lines of: “Don’t they have a conflicting incentives structure, where if they succeed in making a match, they lose paid subscribers?”

Ding ding ding, that is, well, the reason why Match Group’s market cap lingers below $10 billion, and it isn’t a $100 billion+ subscription business like Spotify or Netflix. For this reason, Match Group can never be a true quality compounder in my opinion, but that doesn’t mean the business can’t be currently undervalued, which I’ll tackle in the Valuation section at the end of the newsletter.

Dating is inherently cyclical. Users download an app, go on dates, then deactivate once they enter a relationship. By design, the product works when a user leaves. This is likely an outdated stat, but years ago, management reported that Match’s churn rates were around 12–15% per month, which is several times higher than Spotify or Netflix.

Yet this churn is partially offset by high reactivation rates: When relationships end, former customers often return to Tinder or Hinge. This revolving door creates a funnel where marketing must constantly attract new singles or re-engage previous users, and without that paid marketing, there’s the risk that people will forsake online dating altogether, given the stigmas, or mix things up by trying alternative platforms (of which there are many — some owned by Match, and some not.)

That high turnover is one reason venture capitalists have historically avoided dating startups. As a16z partner Andrew Chen argued, “the better your dating product works, the more your customers churn,” and paid acquisition is expensive because social stigma limits virality.

As in, it’s a bit awkward to recommend dating apps, and that has capped organic growth (beyond the initial period when Tinder was so genuinely novel that people couldn’t help but share it).

Now, it’s much more likely, comparatively, that someone will share a cat video with a friend, requiring the recipient to download TikTok to watch, as a way to hasten adoption, than it is for someone to text a friend and recommend a specific dating app. No referral program in the world can match the virality of sharing viral short-video content, and after more than a decade, Tinder is hardly new or novel to anyone — they will have to continue paying for growth to an extent that social media platforms don’t need to.

It also doesn’t help that, structurally, there are all kinds of stats out there about how younger generations are dating less and are less interested in marriage.

Meanwhile, a concerningly high number of women have reported negative experiences on dating apps, playing into concerns about online dating not being safe, a narrative that Match has struggled to address (potentially because many of Tinder’s top-paying male users may be the most obsessive and harassing, and top female users may be using paid Tinder boosts as a way to promote OnlyFans accounts.)

A few relevant charts on these points, below:

Despite the headwinds facing the industry, Match’s scale gives it an advantage over competitors. With over 90 million total users across its apps, its marketing cost per incremental user is lower than that of upstart competitors, and new users are drawn to Match’s platforms because that’s where, well, most other people are.

A Massive Yet Underpenetrated Market

The next question usually on people’s minds after churn and safety is the TAM.

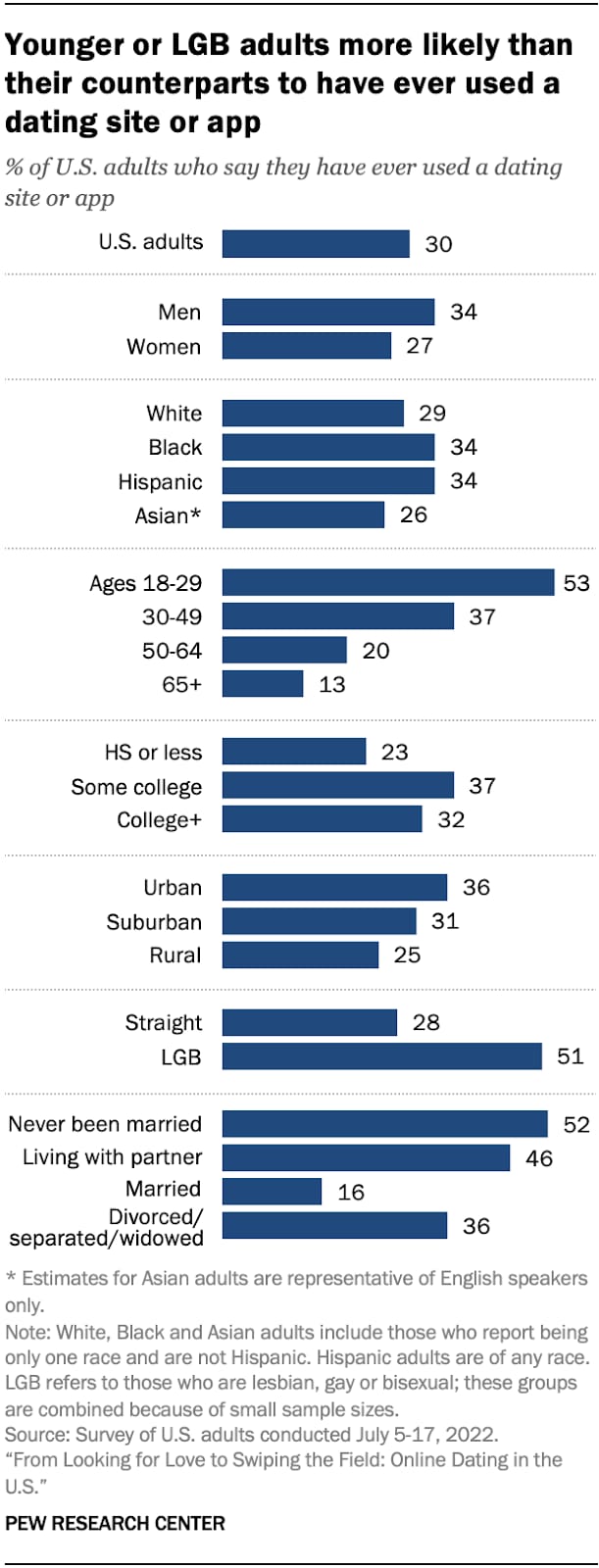

Although online dating services are struggling to resonate with Gen Z, on paper, online dating is far from saturated. Globally, around 250 million people use dating apps, reflecting roughly one‑third of addressable singles. In the U.S., only 3 in 10 adults have ever tried a dating site or app, according to Pew, and that figure has remained flat since 2019.

Usage also skews heavily toward younger cohorts: ~50% of 18- to 29-year-olds have used a dating app, compared with 20% of 50- to 64-year-olds and just 13% of adults over 65. That leaves a significant runway for increasing adoption in older demographics of singles.

On that point, aging demographics could be an opportunity.

By 2030, the U.S. will have more residents over 65 than under 18 for the first time, and about 30% of Americans over 50 are single. While surveys indicate 75% of singles over 65 say they aren’t looking for a relationship, part of that reluctance surely stems from not knowing where to begin.

Yet, today’s 65‑year‑olds are more tech‑savvy than previous generations and have used computers for four decades in some cases, even if they aren’t always using TikTok or Snapchat. If Match can de‑stigmatize senior dating — through brands like OurTime or by emphasising video chat and background checks — even modest adoption amongst older users could translate into millions of new users with deeper wallets.

The international opportunity is equally compelling in different ways. Regions like Latin America, Asia, and Africa are younger, more mobile‑first, and less penetrated. Match’s success with apps like Pairs in Japan, and Azar in Korea, demonstrates how localized platforms can thrive when matched with cultural nuances.

The Good With The Bad

To say it again, Match’s biggest advantage is its network effect. The more singles on a platform, the higher the likelihood of finding a compatible partner. For a new dating app to compete at scale, it would need to amass millions of active users in major cities (expensive!)

Historically, Tinder benefited from a first‑mover advantage on college campuses, and attempts to replicate that dynamic now face entrenched incumbents. While niche platforms may differentiate on identity or values (i.e., apps devoted to helping Muslims, Christians, African Americans, and even farmers date), by definition, they lack the universal appeal and scale economics of Tinder.

As is true of any software business, scale supports profitability. For Match, with operating margins around 25% and similar free cash flow margins, the company holds its own in terms of profit generation. Contrast that with Bumble’s 18% operating profit margin, which is the second-biggest player in the space.

With a relatively capital‑light business model, as revenue at Match grows, a large portion flows directly to the bottom line.

However, as the number of total active users and paying subscribers has declined over the last two years, pivoting sharply from years of fast growth, the stock has been absolutely hammered. I should mention, though, that the financial results themselves don’t reveal the damage fully yet, because they’ve been able to maintain flat-to-slightly-growing sales by raising subscription prices faster than the rates of decline in paid users.

Growth at Hinge has also helped the top line on the margins, too. But you can only rely on price hikes for so long if your paid subscriber base is shrinking on net…

Thus, where Match once traded at a P/FCF multiple of 60x in 2021, the stock now trades at just 8–10× expected FCF, offering a 10+% FCF yield!

Valuing A Giant in Online Dating

Beyond that seemingly very reasonable valuation, two catalysts could unlock further value.

First, the appointment of Spencer Rascoff in 2024 marks a potential cultural reset after a decade of high CEO turnover. Rascoff bought $2 million of stock within four days of taking the job and another $1 million in the following quarter, signalling alignment with shareholders. That’s the sort of thing ya like to see a CEO do with their own money, instead of just relying on stock-based comp to give them a stake in the business.

Match’s CEO Spencer Rascoff

Better, he has committed to returning more than 100% of free cash flow to investors via buybacks and dividends through 2027. At today’s valuation, that equates to repurchasing over 25% of the company’s enterprise value and 35% of the market cap. Few companies of Match’s size promise such aggressive capital returns.

Last but not least, changes in app‑store fees represent a call option for investors. Apple and Google currently charge around 30% on all in‑app purchases, as mentioned earlier, capturing roughly 20% of Match’s revenue and two-thirds of its cost of goods sold.

Without going down the rabbit hole on the court cases that have fought to change this dynamic, let’s just say there’s some baked-in optionality to the upside that, eventually, developers like Match Group may see a material boost in profit should Apple & Google be pressured/forced to reduce app-store fees. You shouldn’t rely on that in a base case, but the possibility exists over the next 5+ years and would immediately make Match a much higher quality business.

But before we get too carried away, let’s talk more about valuation. I had a hard time selling Daniel on Match Group’s future because, honestly, I wasn’t all that confident myself in giving them the benefit of the doubt.

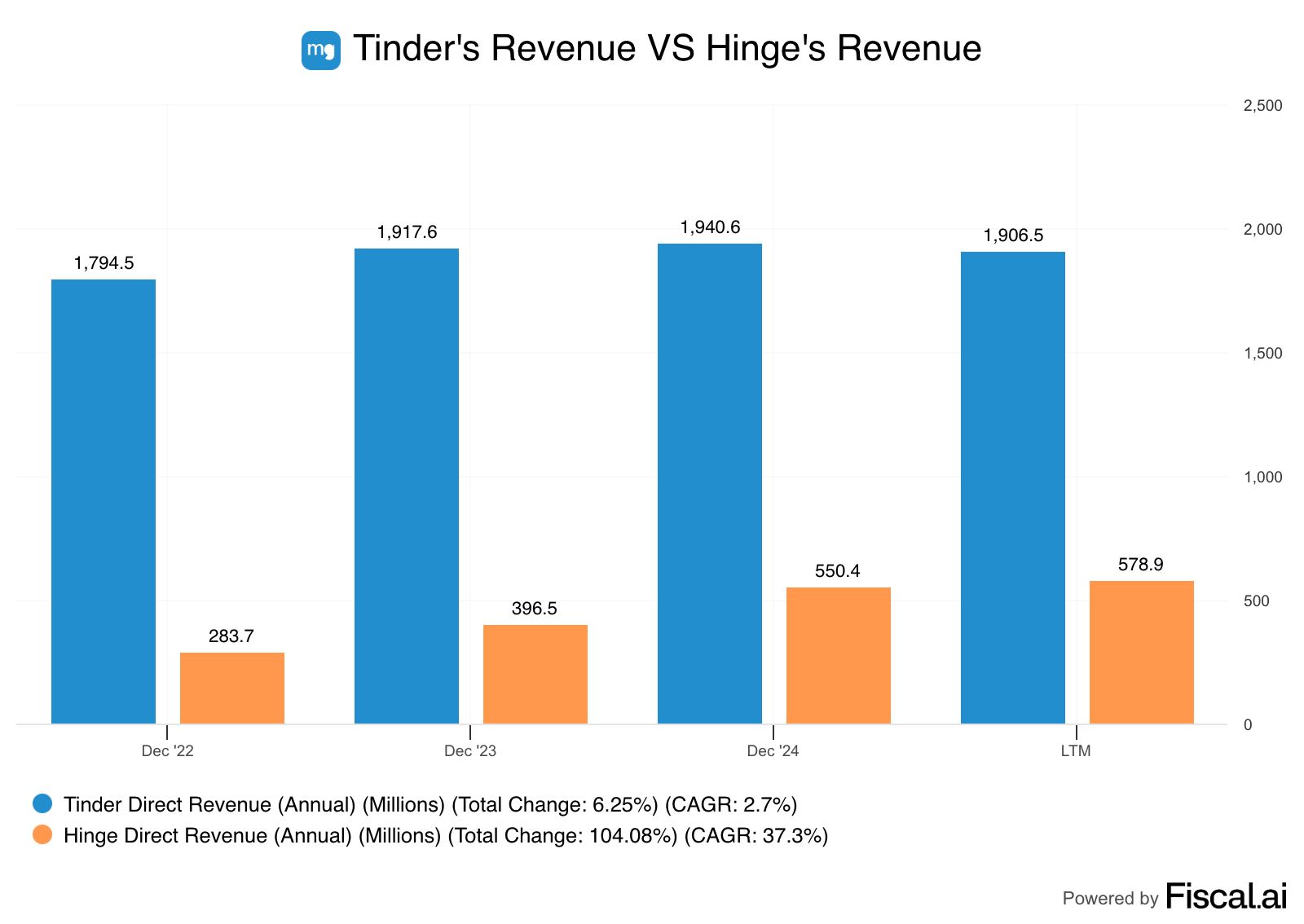

On the one hand, if Match can maintain its current business size and profitability, the stock absolutely looks too cheap, especially given the aggressive and accretive returns of capital that management is overseeing, so forward returns should be very good. Yet, I’ve seen nothing in their product road map to inspire me that they can, in fact, reverse the substantial decline in their core business (Tinder), and if Tinder’s network effect continues to implode, Hinge is many years away from being able to meaningfully fill that void:

Hinge generates about 30% as much revenue as Tinder

Stopping the bleeding at Tinder and slowing the rate of decline in active & paying users is essential to any bull case, and while I suspect they eventually will, that’s completely a guess.

I worry that Tinder’s reputation has been damaged beyond repair after years of failing to deliver on safety initiatives that address spam and harassment, on top of a hookup culture that’s driving some of the most valuable users to other platforms like Hinge (fortunately for Match) but also to Bumble.

And with AI and virtual reality on the cusp of changing how we all use the internet, it’s hard to feel confident that the first and second generations of dating apps won’t be adversely affected.

Why would I want to swipe left or right on a screen if I can put on a headset and be in the same virtual room as other daters? Or, as crazy as it sounds, for some percentage of the population, perhaps the prospect of AI partners & chatbots will satisfy their ‘dating’ needs and keep them off Match’s apps on the margins.

No shortage of “AI girlfriend” apps have emerged in the last two years

With these sorts of abstract concerns on the horizon, and a company with a poor history of innovation and operational execution, plus multiple management churns at the top, it’s hard to be too sure that Match won’t ultimately squander away its initial advantages in the way that AOL, MySpace, and BlackBerry famously did.

In my model, I assumed that Hinge can keep growing strongly, since its product seems to resonate so well with Gen Z and serious daters. At the same time, I modeled Tinder continuing to decline but at a slower rate, with price hikes for top users continuing to offset some of that pain. Additionally, with some recently announced cost-cutting initiatives helping to pad margins and buybacks reducing the share count, I think FCF per share can compound faster than revenue for the next few years.

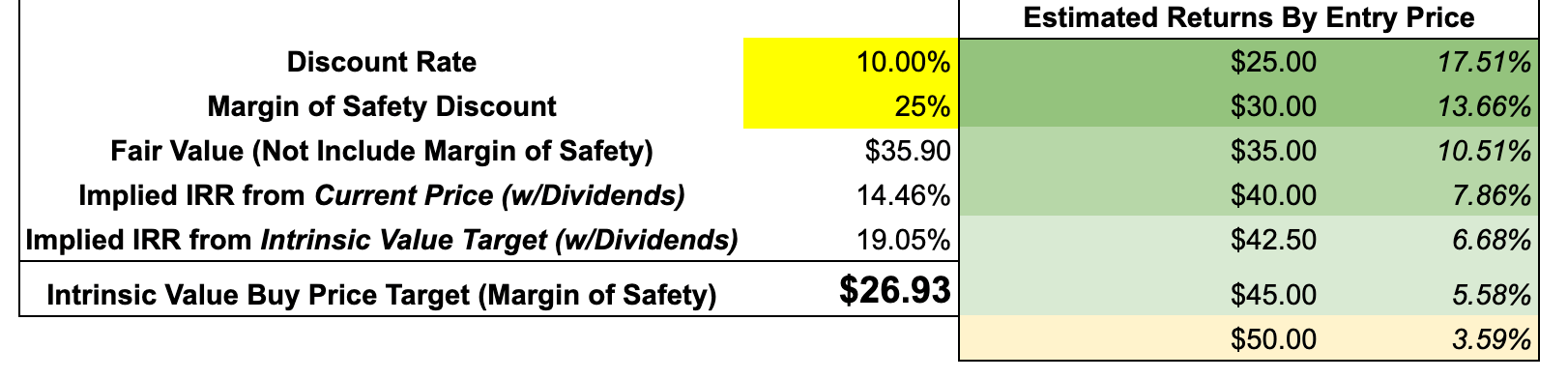

With that, I made an estimate of Match’s FCF per share by the end of 2029, and assumed a slightly higher exit multiple than today’s valuation, because this is a company that’s so profitable at the moment, there’s no reason the multiple shouldn’t be meaningfully higher once, if ever, it’s clear that Tinder’s user base has at least partially stabilized (which I’m more or less implying in my base case.)

Anyways, you can see my model and all the assumptions here, but I actually think the stock has been pretty attractively valued at times recently, especially when you include dividends.

Portfolio Decision

Does that mean Daniel and I will be adding Match to our Intrinsic Value Portfolio? Well, you might be surprised to hear, but the answer is no.

As I alluded to above, without being an expert on Tinder, Hinge, and Match’s other dating apps (or even ever using them for that matter), it’s hard for me to feel very confident about the turnaround plan, particularly as the industry faces so much change and as new features rolled out in the past two years have failed to slow the rates of user decline at Tinder despite optimism from management.

I told Daniel that I’d actually be more excited about buying Match at a modestly higher price, assuming we’ve gotten some firm data showing that Tinder’s user base is stabilizing. Otherwise, I’m not comfortable betting that management can turn Tinder around — even with great management, the brand’s perception could be too far gone, alongside changes in what Gen Z expects from dating.

If so, Match Group has much further to fall before becoming a bargain (Bumble trades at just 4-5x FCF!), at which point you’d be betting on Hinge’s future more so than you’d be betting on Tinder’s turnaround, as is the case at current prices.

It feels like such a cop out to say we’ll wait and see, but truly, we need to wait and see. I expect the rest of 2025, at a minimum, to be painful for Match Group, so I don’t feel there’s any reason to rush a decision (the stock has been flat for several years now). Instead, we’ll wait for more data points to come through and reassess the thesis over the coming quarters.

To keep learning about Match, listen to Daniel and I’s full podcast on the company here.

And for more on our Intrinsic Value Portfolio holdings, reading and podcast recommendations, and timely quotes, keep reading below.

Weekly Update: The Intrinsic Value Portfolio

Notes

Lululemon: Last week, our recent addition to the portfolio, $LULU, fell 18% the day after reporting earnings. I (Shawn) was enjoying some sun at the beach, so Daniel waited for me to return rather than sharing an update himself, since the company was originally my pitch, but I’m back and ready to tackle the elephant in the room. Here are my thoughts on their Q2 2025 earnings report:

The outlook for the company’s growth has been dramatically revised down over the last year, and the market has reacted strongly, going from being overly optimistic about a market darling to now, in my opinion, overly pessimistic about a still strong franchise. Growth in North America has decelerated in the last year and is basically flat at this point, while growth in China is still north of 20% but is also being revised down. This explains the significant contraction in the stock’s P/E multiple over the last 18 months.

From tariffs to a modest excess in seasonal inventory requiring markdowns on some items, a range of factors have contributed to a 200 basis point decline in operating margins. More concerning, Lulu’s pace of product innovation has slowed and gone a bit stale, and competition is much tougher now than two years ago, too. This has been a wake-up call for the company, but I don’t yet see it as thesis-breaking.

Now, here’s the “but” moment: At less than 12x earnings, for a company with industry-leading margins, fabric quality, customer loyalty, sales per square foot, etc., that has become synonymous with the broader athleisure movement that I believe is more durable than “just a fad” (after more than a decade, I think athleisure reflects a structural trend in society favoring more comfortable, casual wear,) I do see the stock as having gotten more attractively valued relative to how much the fundamentals have weakened after this recent selloff. The timing of Lulu’s addition to the Intrinisc Vaue Portfolio a few weeks ago, though, is poor, but we now have the chance to potentially snap up shares at a further discounted price.

At the current valuation, even if sales in North America completely flatline over the next 5 years, with international growth and buybacks, plus buying at an already-low multiple, I think an adequate return can be earned, with significant upside optionality if the brand reset over the next year or so can stimulate consumer demand again. I found Lulu attractive at $230 a share, and while this past quarter is disappointing and raises longer-term concerns, it would be nothing more than panic to say that the stock is suddenly unattractive now that Mr. Market has given us a chance to buy shares at $170 per share. You can review my updated LULU model here.

This certainly has some of the trappings of a “value trap,” and I’m as susceptible to confirmation bias as anyone, but it’s worth reiterating that this isn’t a business that’s actually even in decline. A revision of expectations is one thing, but the market now seems to be discounting the possibility of a serious decline in the brand, which I’m not sure is warranted at this point. It’s hard to be as bullish on the brand as people were back in 2021/2022, but it’s equally hard for me to sour on it as much as the market has today.

What reassures me is that management has committed to its strategy of not relying on markdowns to drive sales, which reflects well on the brand’s longer-term durability. They also haven’t yet shown an inclination to dramatically pivot from their winning strategy of grassroots, advocate-based, word-of-mouth promotion in favor of spending aggressively on paid marketing to meet quarterly earnings targets. Both of those things indicate to me that management continues to think about protecting the brand and resisting the pressure of Wall Street, which I see as a good thing. It’s better to miss a quarterly earnings target than dilute the brand’s pricing power in the future.

I’m also cautiously optimistic that, as they push new product lines from 23% of their apparel to 35% of total apparel by next year, they may be able to refresh their brand and re-excite their core audience, though I’ll be watching how this unfolds carefully. Additionally, for the stock to be punished like it has, and to be designated as one of the biggest tariff losers, I can’t help but think that operating margins falling from 23% to 21% is hardly the nightmare scenario markets seem to think it is. If anything, this is a cost that’s more than priced into the stock now, and as mitigation efforts continue over the next year, the impact on margins should only diminish.

Quote of the Day

"The bitterness of poor quality remains long after the sweetness of low price is forgotten.”

— Ben Franklin

What Else We’re Into

📺 WATCH: Michael Lewis on why nobody understands the stock market

🎧 LISTEN: We Study Billionaires’ Q3 Mastermind on Uber, Merck, and Bath & Body Works

📖 READ: Quartr’s comprehensive telling of the story of Uber (one of our Intrinisc Value Portfolio holdings), and how it came to dominate ride-hailing & delivery

You can also read our archive of past Intrinsic Value breakdowns, in case you’ve missed any, here — we’ve covered companies ranging from Alphabet to Airbnb, Amazon, Shopify, Universal Music Group, Berkshire Hathaway, and more!

Your Thoughts

Do you agree with the Portfolio decision for Match Group?Leave a comment to elaborate! |

See you next time!

Enjoy reading this newsletter? Forward it to a friend.

Was this newsletter forwarded to you? Sign up here.

Use the promo code STOCKS15 at checkout for 15% off our popular course “How To Get Started With Stocks.”

Join the waitlist for our Intrinsic Value Community of investors

Read our full archive of Intrinsic Value Breakdowns here

Keep an eye on your inbox for our newsletters on Sundays. If you have any feedback for us, simply respond to this email or message [email protected].

What did you think of today's newsletter? |

All the best,

© The Investor's Podcast Network content is for educational purposes only. The calculators, videos, recommendations, and general investment ideas are not to be actioned with real money. Contact a professional and certified financial advisor before making any financial decisions. No one at The Investor's Podcast Network are professional money managers or financial advisors. The Investor’s Podcast Network and parent companies that own The Investor’s Podcast Network are not responsible for financial decisions made from using the materials provided in this email or on the website.