- The Intrinsic Value Newsletter

- Posts

- 🎙️ Gaining Confidence

🎙️ Gaining Confidence

[5 minutes to read] Plus: What's left to be ETF'd?

By Matthew Gutierrez and Shawn O’Malley

The cuts are here! The Federal Reserve reduced interest rates by a half-percentage point. Much more below.

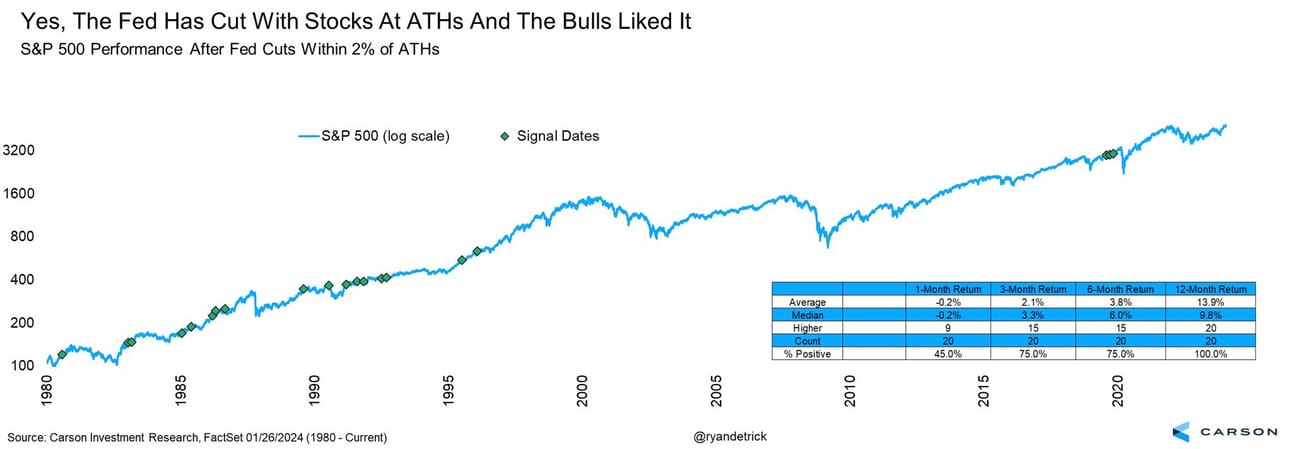

What’s next for stocks? Today’s charts show that the Fed has cut rates with stocks around all-time highs on 20 occasions. The S&P 500 was higher a year later all 20 times, with an average gain of 13.9%.

By the way, there’s still space left in the Richer, Wiser, Happier Masterclass — a select group of people who wish to study with William Green for a year. Members of the group will discuss key themes of his book in monthly Zoom calls and meet in three unique in-person events.

Interested? Email Kyle Grieve: [email protected].

— Matthew & Shawn

Here’s today’s rundown:

Today, we'll discuss the biggest stories in markets:

Breaking down the first rate cut in four years

What’s left to be ETF’d?

This, and more, in just 5 minutes to read.

POP QUIZ

Sponsored by FNRP

Diversify Your Assets with CRE

Introducing FNRP — your bridge to passive commercial real estate investing.

Enjoy lower volatility, tax advantages, and fully-managed real estate investing. See how. Invest in professionally vetted, fully-managed, institutional-quality real estate deals.

In The News

✂️ Federal Reserve Cuts Interest Rates By Half a Point

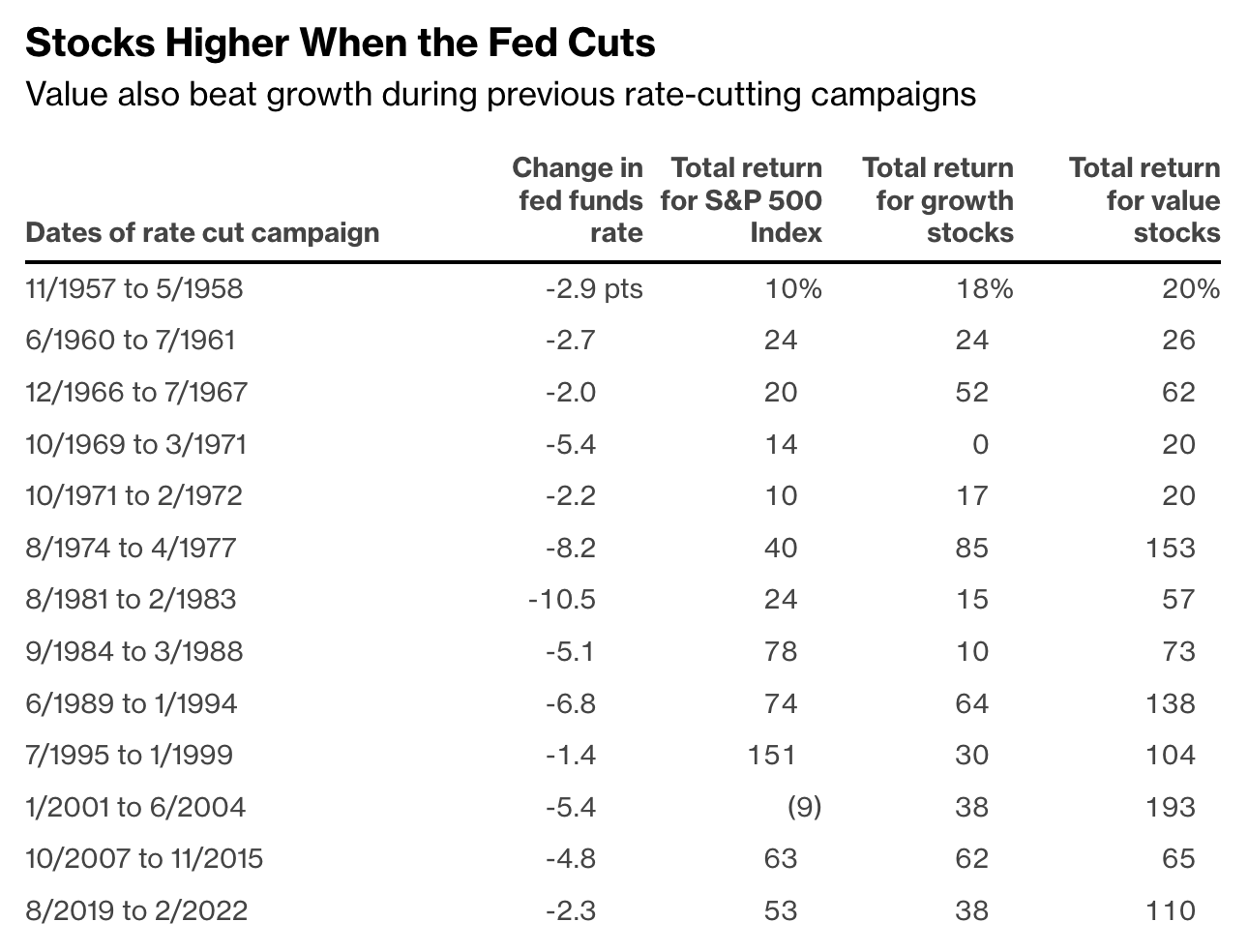

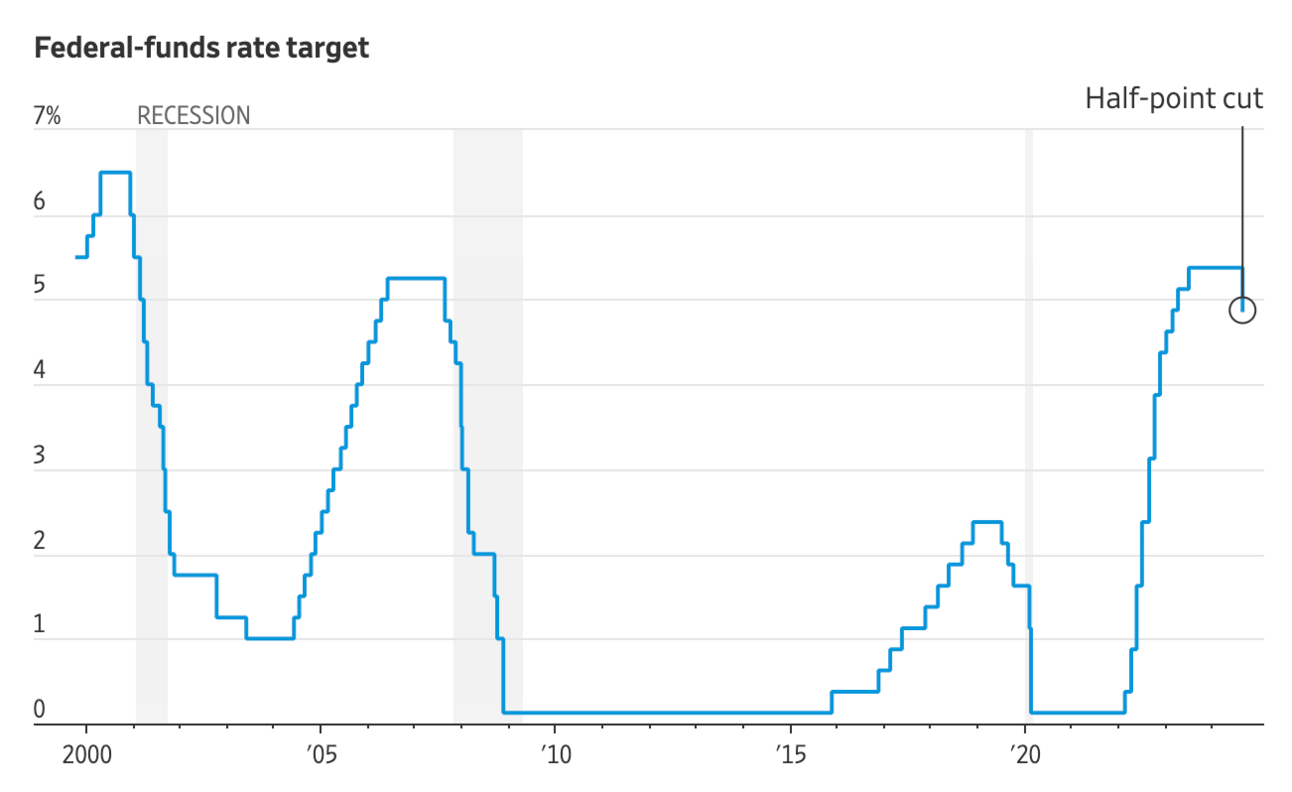

The Federal Reserve cut interest rates by half a percentage point on Wednesday, a bold start to its rate reduction campaign and its first cut since 2020.

After an all-out effort to mitigate runaway inflation, 11 of 12 Fed voters backed Wednesday’s cut, bringing the federal funds rate between 4.75% and 5%. Projections now show a narrow majority of officials see quarter-point rate reductions at the Fed meetings in November and December.

After taming inflation, the Fed is now tasked with ensuring that borrowing costs — which last year hit a two-decade high — don’t further hamper the U.S. labor market (and, to a degree, worsen housing affordability).

Stocks fell Wednesday afternoon into the close, though many analysts believe the interest rate reductions “should support risk-on asset allocation.”

“The committee has gained greater confidence that inflation is moving sustainably toward 2%, and judges that the risks to achieving its employment and inflation goals are roughly in balance,” the Fed said in its policy statement. The rate cut reflected “the progress on inflation and the balance of risks.”

Patience pays: In a press conference after the decision, Powell said, “Our patient approach over the past year has paid dividends.”

Inflation has fallen fast from the June 2022 peak. Improved supply chains post-pandemic have also aided in the recovery.

However, Powell noted that the Fed would remain patient and would not rush to ease the policy. He also said he doesn’t expect the era of cheap money to return.

“Intuitively, most — many, many people anyway — would say we are probably not going back to that era where there were trillions of dollars of sovereign bonds trading at negative rates, long-term bonds trading at negative rates,” he said. “My own sense is that we are not going back to that.”

Why it matters:

Consumers with credit card balances will immediately feel relief. As discussed Monday, long-term borrowing costs on mortgages and corporate debt have already fallen in anticipation of the rate cuts.

Central bankers like Powell wanted to avoid the 1970s, when they took inadequate steps to lower demand, driving high prices to become self-fulfilling.

Rate cuts could help a solid but softening job market. The unemployment rate is up to 4.2%, up from 3.7% in January.

The Fed’s focus now? Keep inflation stable while ensuring jobless rates don’t inch higher.

“We’re trying to achieve a situation where we restore price stability without the kind of painful increase in unemployment that has come sometimes with disinflation,” he said, adding that investors should take the Fed’s 50 basis-point rate cut as a sign of its “strong commitment” toward achieving that goal.

“The U.S. economy is in good shape. It is growing at a solid pace. Inflation is coming down.”

More Headlines

🛍️ Retail sales rise in August as consumers keep spending

🪙 U.S. SEC to allow exchanges to quote sub-penny prices to boost competition

🧘🏼 Billionaire Steve Cohen steps away from trading for Point72 hedge fund

💻 BlackRock and Microsoft to launch $30 billion investment fund to build data centers

🌎 Ray Dalio names the top five forces shaping the global economy

💡 What’s Left to Be ETF’d?

Gif by pudgypenguins on Giphy

The Wall Street Journal’s veteran columnist Jason Zweig posed a simple question this week: What’s left to be ETF’d?

There’s an ETF (exchange-traded fund) for virtually anything one could imagine. There’s even an ETF for stocks that get kicked out of ETFs. Many funds, Zweig points out, have little or no reason to exist in the first place, and investors need to be on guard for them.

Simply put, “This new ETF highlights a broader lesson: Good new investing ideas are getting harder to come by.”

One researcher said ETFs are on the rise as investors look to invest in things that are difficult to invest in themselves. Plus, many market participants are seeking newer, better ways to stand out or beat their benchmarks. As she says, “There’s a list of financial assets that people are interested in, but [some of these] markets are difficult to get exposure to. Efficiency is one of the challenges.”

A big pool: Quality ETFs tend to have low fees and transparent trading, which allows investors the knowledge and trust they need to hold funds for the long haul.

The CEO of one firm that helps asset managers launch ETFs deadpanned: “We don’t see a lot of true innovations, man. If you want to put triple-levered Zimbabwe swaps in an ETF, that’s not innovation.”

You can already invest in ETFs focused on pet care, loans to veterans, stocks traded by members of Congress, companies aligned with biblical values, and a portfolio that does the inverse of whatever Jim Cramer recommends. Fifty-two ETFs — 52! — are linked to the returns of just one stock, including 10 for Tesla and nine for Nvidia. One ETF will deliver twice the opposite of each day’s return on gold-mining firms. Others double the gains (and losses) from cannabis stocks.

Why it matters:

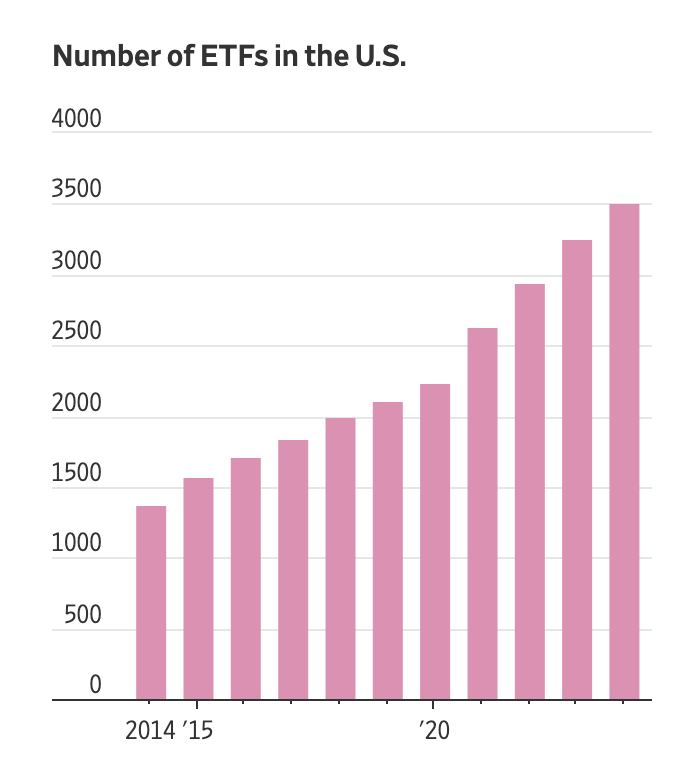

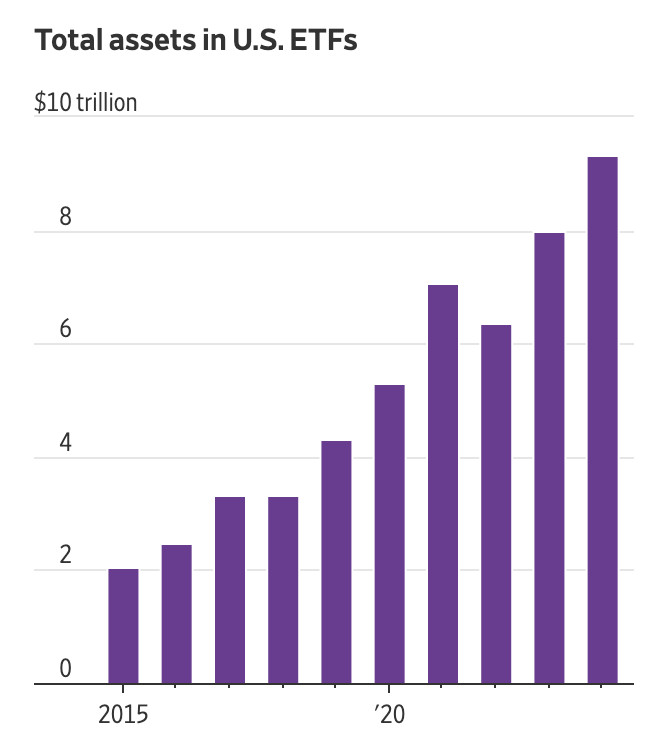

The growth in ETFs has been one of the more disruptive trends in asset management. The first ETF was launched in Canada in 1990, then the U.S. (S&P 500 ETF) in 1993. ETF assets under management (AUM) have exploded to nearly $10 trillion, growing at a roughly 15% compound annual growth rate (CAGR), about three times faster than traditional mutual funds. Active and passive ETFs have surged in popularity, with no signs of slowing down this decade.

Observed one analyst, “A driving force behind forecasted market growth is cost; ETFs, on average, tend to be cheaper than mutual funds.”

Zweig writes that, “I wouldn’t even dream of putting my money in such goofy funds,” but they do tend to attract amateur investors looking to make a quick buck.

Getting rarer: There are still some smart ETF ideas out there. Just this week, Tema ETFs filed a plan for a fund that hopes to emulate the returns of leading endowments and pension funds, aka “the endowment model,” which invests mostly in private equity, venture capital, real estate, and other non-traded assets.

We might soon see a single-state municipal-bond ETF with specific maturities and an ETF holding staggered maturities of Treasury inflation-protected securities. But it’s not easy to find quality in a sea of ETFs.

As Zweig concludes: “Remember: Good innovations are rare—and getting rarer all the time.”

Together With Nativepath

Hydration, Simplified

Keeping hydrated shouldn't be a hassle – that's where NativePath Hydrate comes in. Unlike other commercial hydration products, Native Hydrate contains high-quality amino acids that are proven to be the optimal way to hydrate, along with subtle yet effective amounts of electrolytes.

Most other hydration products contain way more sodium than you need, unless you’re working out for multiple hours every day. Native Hydrate contains the equivalent of a quarter teaspoon of salt for optimal hydration delivery without disrupting your health. It doesn’t undergo massive processing like most hydration supplements do, or have any added sugars.

With its unique blend of essential amino acids, branched-chain amino acids, electrolytes, and additional nutrients (like Calcium Carbonate, Choline Bitartrate, Riboflavin, Niacin, B6, Folate, B12, Biotin, Pantothenic Acid, Choline, and Zinc) Native Hydrate makes getting proper hydration easy and enjoyable all year long.

Quick Poll

How has your use of ETFs changed over the past few years? |

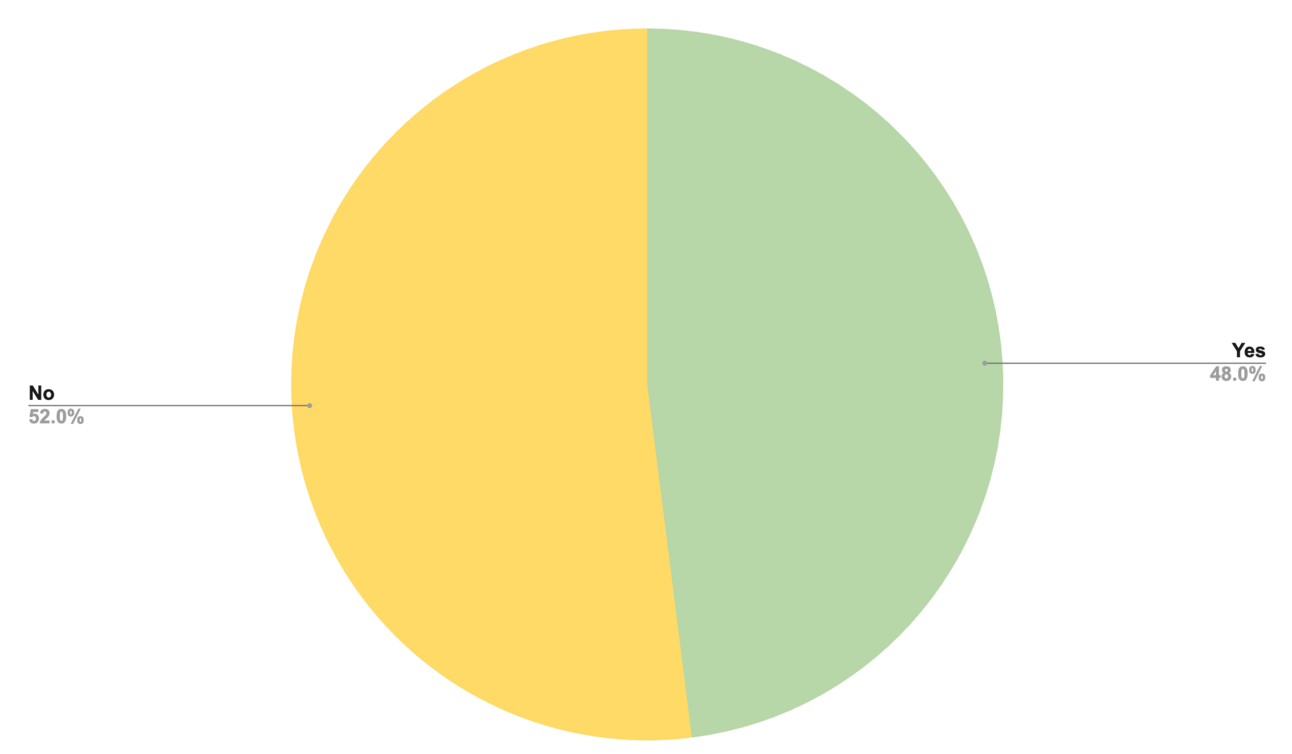

On Monday, we asked: Do you own Palantir stock? Why or why not?

— Respondents are split about 50/50 on Palantir. One shareholder said, “Hype made me do it a couple of years ago.” Another: “It’s been hard to bet against it.”

— Among those who don’t own it, answers ranged from not understanding enough about the business model to regarding it as overvalued.

— Wrote one investor: “I've been watching it from the sidelines for a while with growing interest. For a long time, it looked like an overpriced stock with limited growth potential due to its strong commitment to government clients. I think they're more than proving the skeptics wrong (including myself), but the valuation seems a bit high at the moment. Especially with an already tech-heavy portfolio.”

TRIVIA ANSWER

See you next time!

That's it for today on We Study Markets!

Enjoy reading this newsletter? Forward it to a friend.

Was this newsletter forwarded to you? Sign up here.

Use the promo code STOCKS15 at checkout for 15% off our popular course “How To Get Started With Stocks.”

Advertise with us.

Follow us on Twitter.

Keep an eye on your inbox for our newsletters on weekdays around 6pm EST and on weekends. If you have any feedback for us, simply respond to this email.

You can also leave your comments/suggestions/feedback anonymously here.

What did you think of today's newsletter? |

All the best,

P.S. The Investor's Podcast Network is excited to launch a subreddit devoted to our fans in discussing financial markets, stock picks, questions for our hosts, and much more!

Join our subreddit r/TheInvestorsPodcast today!

© The Investor's Podcast Network content is for educational purposes only. The calculators, videos, recommendations, and general investment ideas are not to be actioned with real money. Contact a professional and certified financial advisor before making any financial decisions. No one at The Investor's Podcast Network are professional money managers or financial advisors. The Investor’s Podcast Network and parent companies that own The Investor’s Podcast Network are not responsible for financial decisions made from using the materials provided in this email or on the website.