- The Intrinsic Value Newsletter

- Posts

- 🎙️ Doximity: The LinkedIn For Doctors

🎙️ Doximity: The LinkedIn For Doctors

[Just 5 minutes to read]

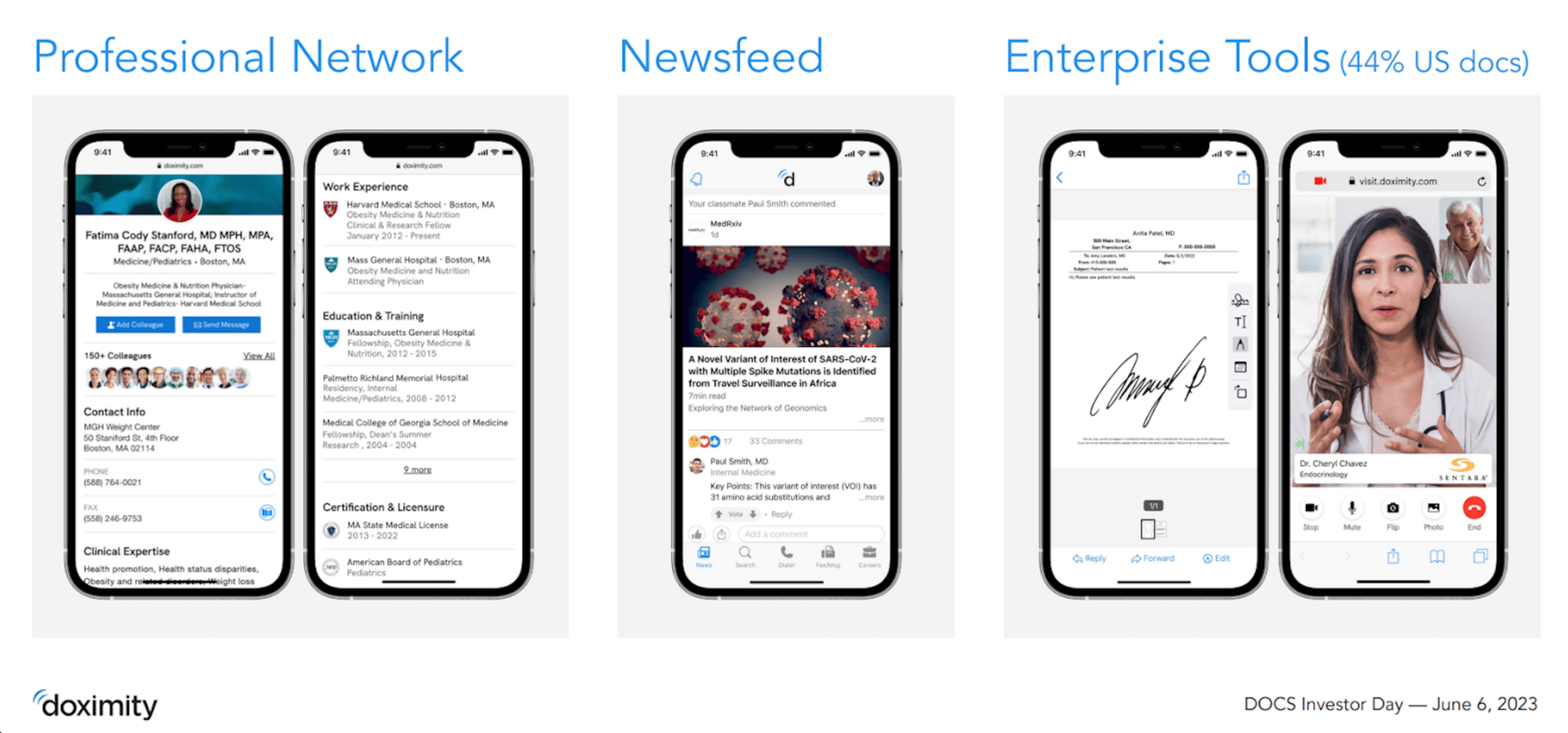

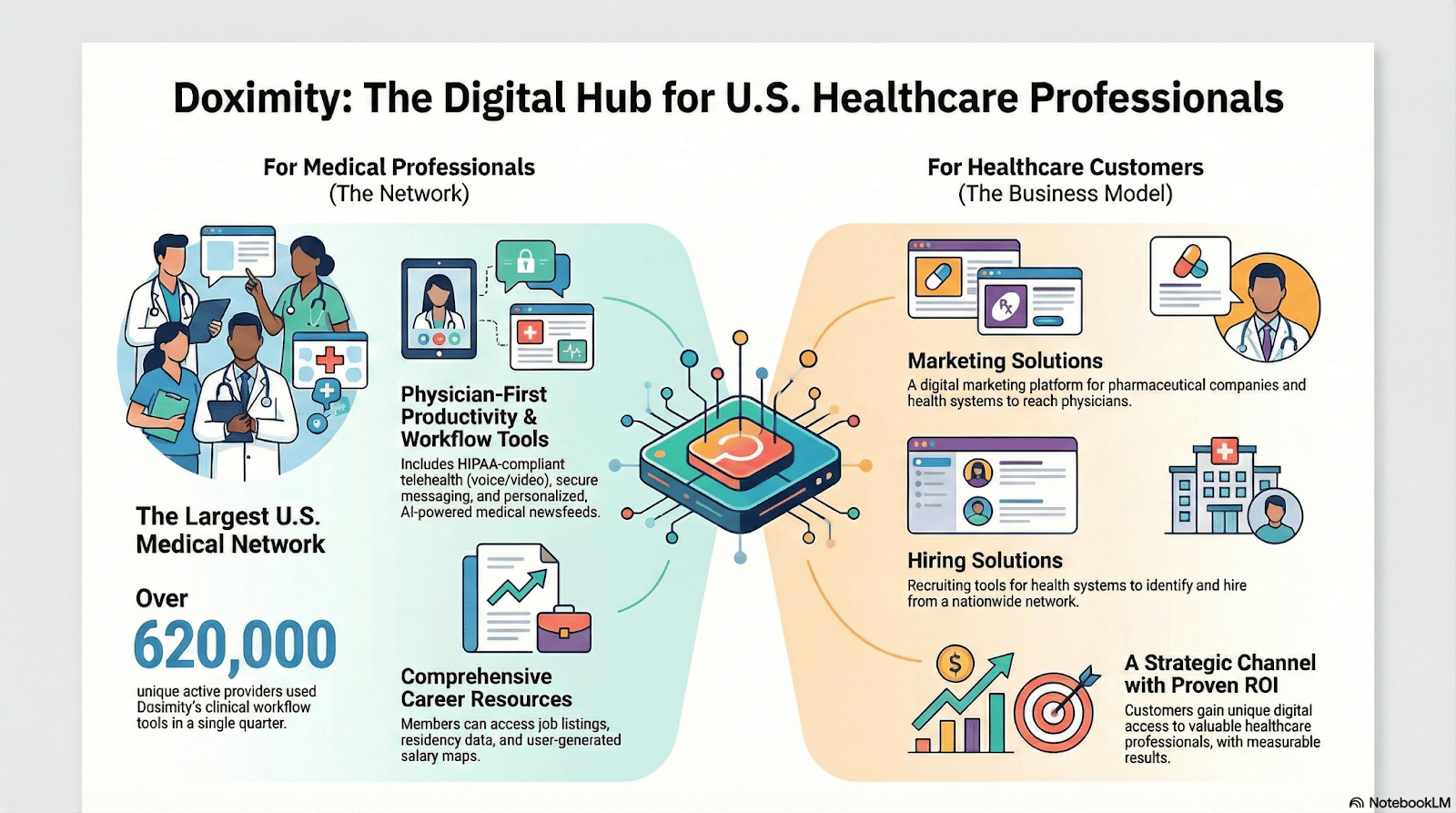

80% of U.S. doctors are on one platform that doubles as a social network (like “LinkedIn for doctors”) and a suite of productivity tools, including a HIPAA-compliant AI assistant for taking down patient notes, drafting prior authorization documents, insurance appeals, and so on.

This unique business is monetized through B2B advertising, selling access via subscriptions (not ad auctions) to what might be the single most valuable audience in the world: prescribing physicians.

The business, as we’ll cover today, is a mashup of LinkedIn, Zoom, DocuSign, and a little bit of Google Workspace, focusing, however, entirely on a single profession.

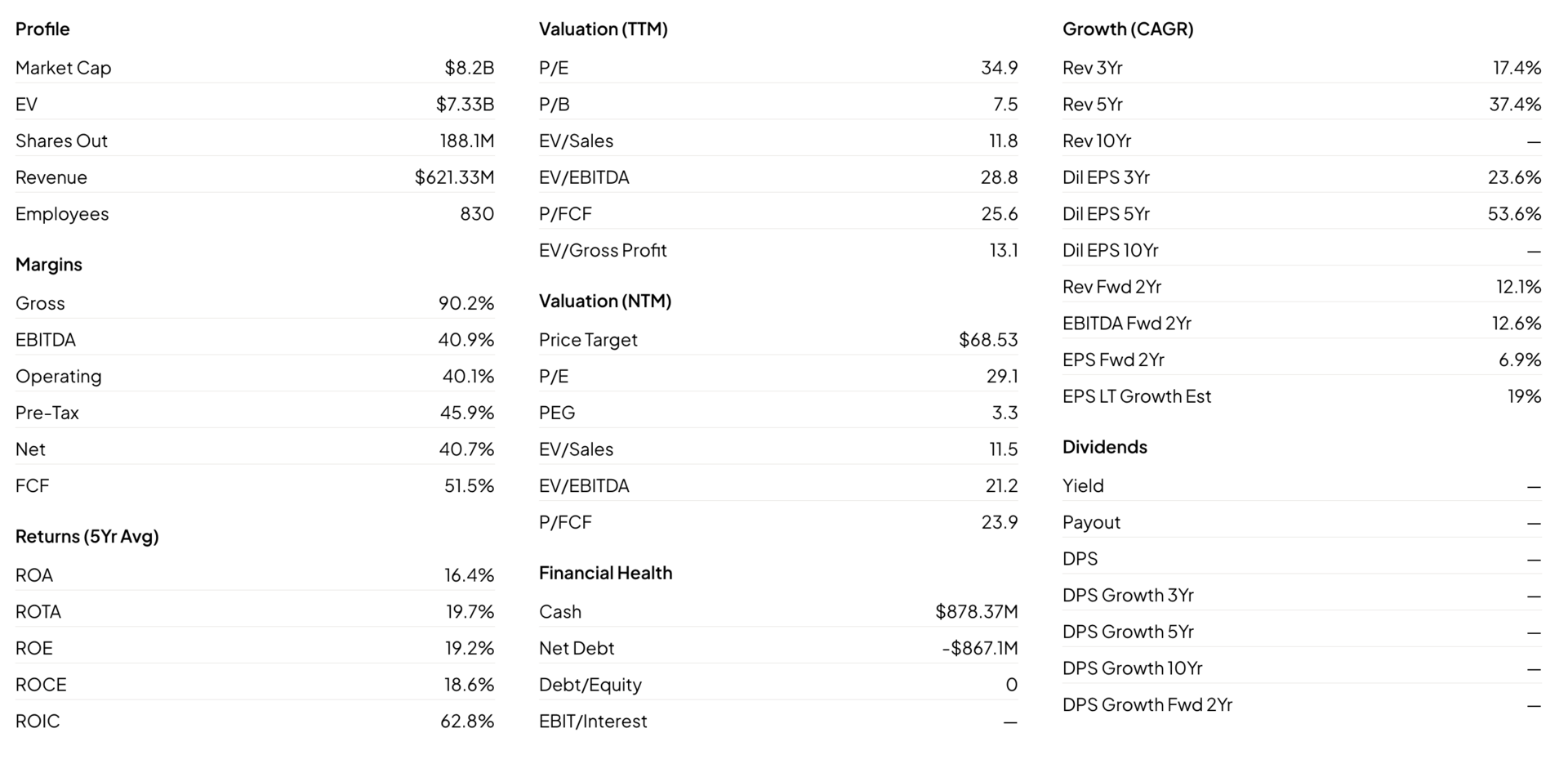

There are some yellow flags, which we’ll discuss, yet there’s a genuinely attractive business here, with 40% net income margins and returns on invested capital north of 60%, benefiting from the ever-growing pharmaceutical marketing industry’s transition to digital.

— Shawn

Applications Open: Join The Intrinsic Value Community

Each week, we publish this newsletter (and podcast) entirely for free, with limited to no ads, because, well, we care about delivering the highest-quality research with the least amount of friction possible.

Every few months, though, we let readers like yourself know that our Intrinsic Value Community — now up to ~75 vetted & sophisticated members(!) — is accepting applications to participate in the next cohort of new initiates to the group, and less than 10 spots remain.

Daniel and I believe that few things are more valuable in life and investing than having a trusted peer group to provide you feedback, ideas, and support, and so, that’s exactly what we endeavored to build.

Visit the link below to learn more and apply!

Doximity: The Profitable Social Network You’ve Never Heard Of

If you’ve never worked in health care, it’s easy to underestimate just how analog the industry still is behind the scenes.

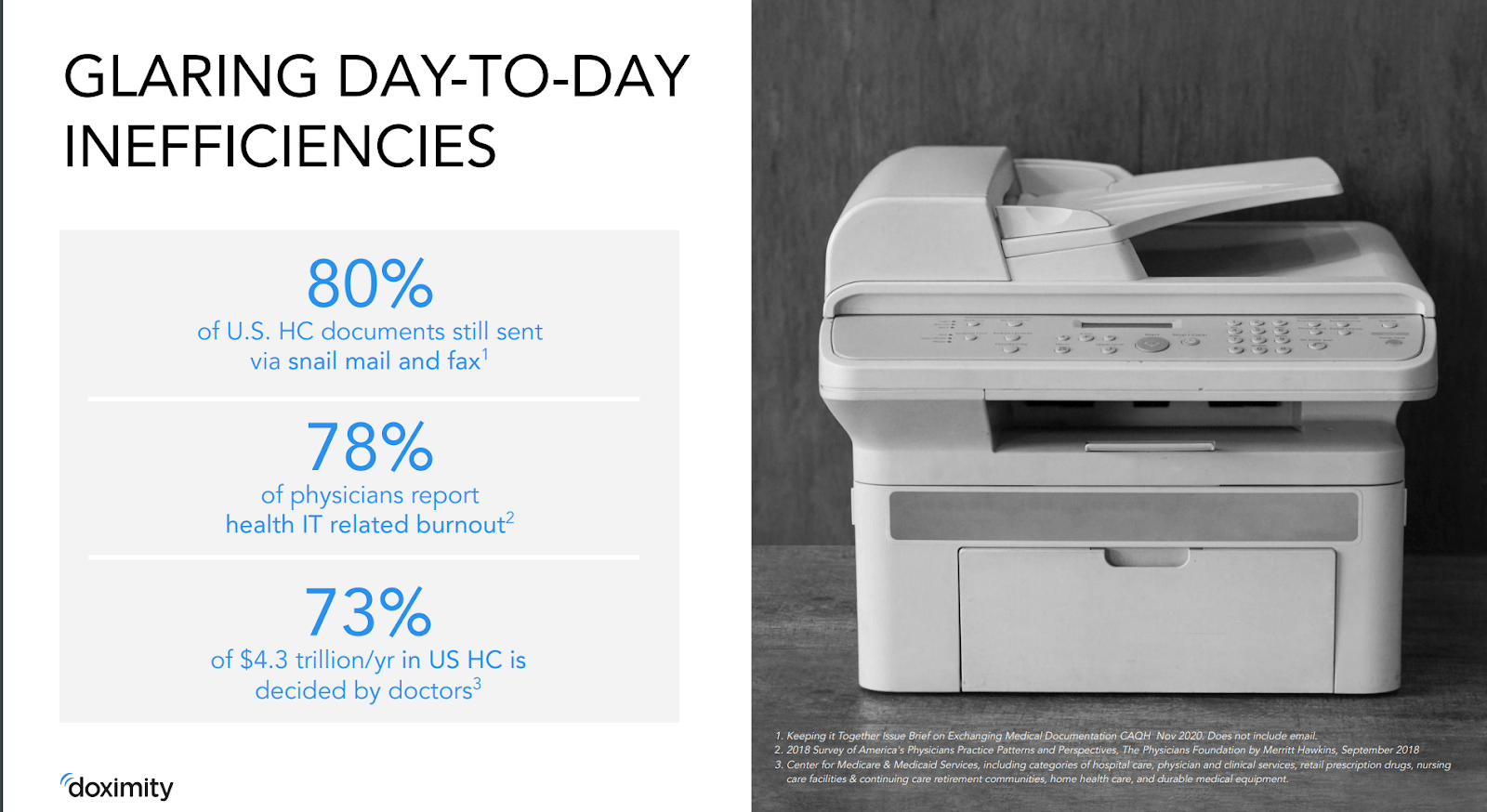

Per Doximity’s management team, roughly 70% of U.S. health care documents still move via snail mail or fax. And 78% of physicians say they’ve felt burned out specifically because of health-care IT systems. On that point, the average doctor spends, breathtakingly, nearly half of their working day on admin tasks rather than actually treating patients(!)

That is the backdrop for Doximity’s value proposition.

Doximity is, well, built for clinicians. It’s a professional network, a newsfeed, and a productivity toolkit. Doctors can keep up with specialty news that’s algorithmically aggregated to be highly relevant to their profession (i.e., an oncologist sees new studies on cancer breakthroughs), send secure faxes, sign documents, run telehealth visits, and call patients from their personal phones without exposing their personal numbers through a popular tool called Dialer.

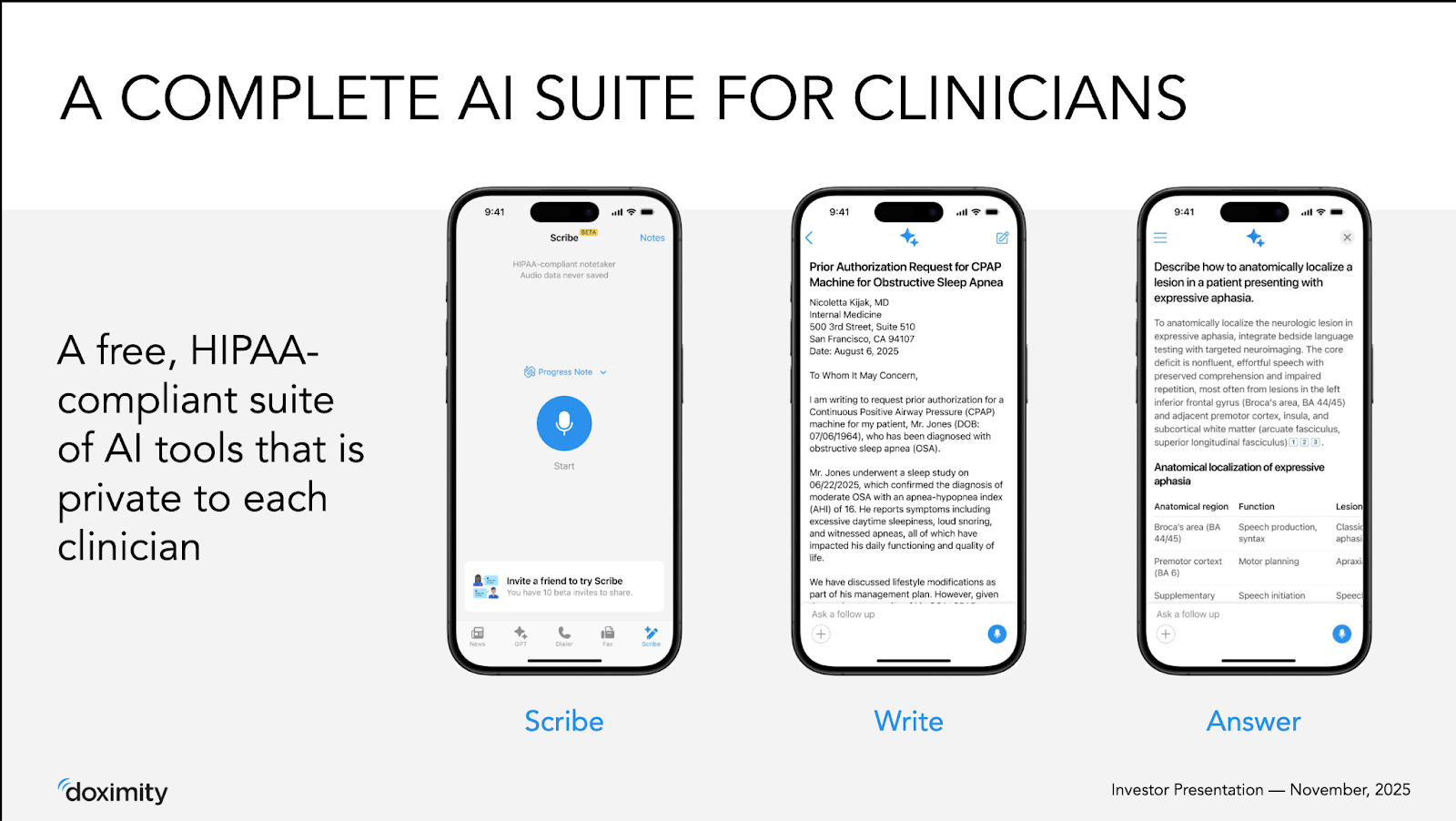

On top of all of that, Doximity has layered in DoxGPT, a HIPAA-compliant AI writing assistant that promises to claw back as much as 13 hours a week of admin time by helping draft insurance appeals, patient education materials, referral letters, and other paperwork that would otherwise eat into evenings and weekends. The key point there being “HIPAA-compliant” generative AI — doctors could (and do), of course, use ChatGPT, but it comes without the same certainty of remaining in compliance with patient privacy laws.

In a way, it reminds me of Adobe’s advantage in having an AI tool (Firefly) for creative professionals that’s 100% commercially safe, in terms of not being trained on materials that violate intellectual property rights.

Regular readers of this newsletter will know that Daniel and I seldom cover health care. In fact, this is the first stock devoted to health care that we’ve looked at. This hasn’t been an accident — we find pharmaceutical and health insurance companies to be mind-numbingly complex to an extent that we have generally no confidence in our ability to value these businesses.

Fortunately, Doximity is neither. While catering to physicians, Doximity is a technology platform with an advertising business, and over the last year, we have gained some insight into understanding these types of businesses.

A Tiny But Exceptionally Valuable Audience

As mentioned, the core of the business is advertising.

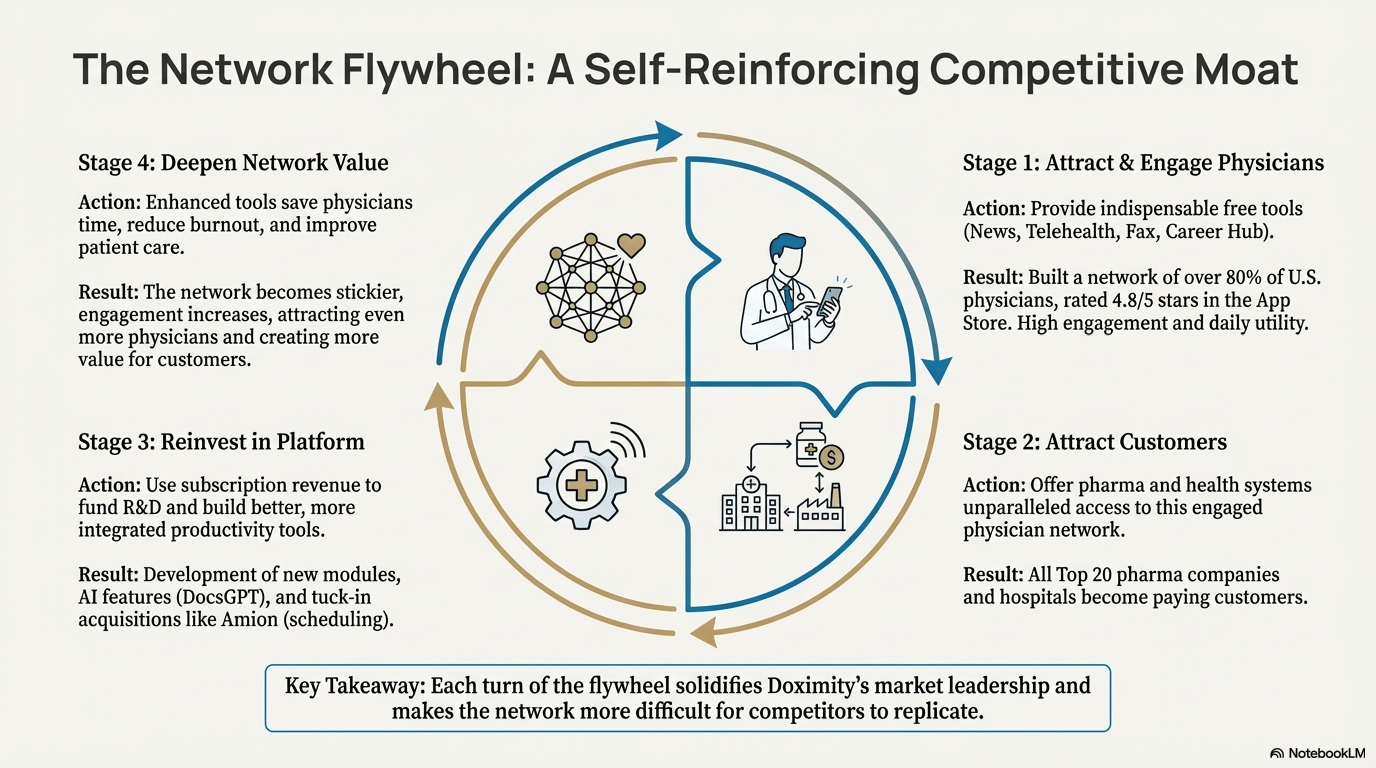

Doximity’s biggest revenue stream comes from selling access to its physician audience to pharmaceutical companies and health systems. The common shorthand is “LinkedIn for doctors,” but that understates how targeted this can be.

On the episode, I walked Daniel through a simple thought experiment. Imagine you’re a pharma company that has just developed a new treatment for Crohn’s disease, but not just any patient with Crohn’s. Your drug is meant for people who didn’t respond to first-line therapies. The doctors you care about, then, are gastroenterologists, inside the U.S., actively treating Crohn’s, and those specifically seeing patients whose existing treatments have stopped working.

Try reaching that exact target audience with ads on Facebook or Google. You would be essentially guessing, using rough interest categories and keywords in hopes that the right practitioners happen to see your ads. On Facebook and Google, you’ll also be paying to reach a lot of people who have nothing to do with your drug at all, as patients or prescribers.

But with Doximity, every user has a verified clinical identity, requiring sign-ups with medical licenses, NPI numbers, and hospital affiliations. The platform knows not just that someone is a physician, but what specialty they practice, where they work, and often what sub-specialty they focus on. So the same pharma company can pay to reach precisely “U.S. gastroenterologists who focus on autoimmune conditions like Crohn’s and are involved in second-line treatment decisions.”

When the drug you’re selling costs $10,000 or $20,000 per treatment and might be delivered every month for years, or even for the rest of a patient’s life, a single doctor deciding to switch regimens can be a decision worth millions to drug companies. Being able to precisely target these prescribing physicians is incredibly fertile marketing real estate for pharma companies.

On that note, you may think that Doximity lacks the scale to be a profitable business. Others like Pinterest and Snapchat certainly haven’t been able to make their social media businesses work, even at massive scale.

But in media, audience numbers aren’t quite everything. Having a concentrated, niche audience of HNW/influential people can be very, very profitable — more so than simply trying to get the most eyeballs possible. Not all digital impressions are equally valuable, in other words.

Think about Buzzfeed’s giant consumer audience versus the Wall Street Journal’s more focused readership of investors and executives. Even if Buzzfeed had 10x the traffic, the Journal can charge far higher rates per reader, because who those people are matters more than how many of them there are, in this case.

Doximity is an extreme version of that logic. It doesn’t need a billion users. It just needs the right 600,000 or so. Financially speaking, the business appears as high quality as any we’ve looked at:

Snapshot of Doximity’s Fiscal.ai profile

Advertising That Doesn’t Look Like Advertising

One of the more unusual decisions Doximity made early on was not to adopt the typical auction-based ad system associated with Facebook and Google.

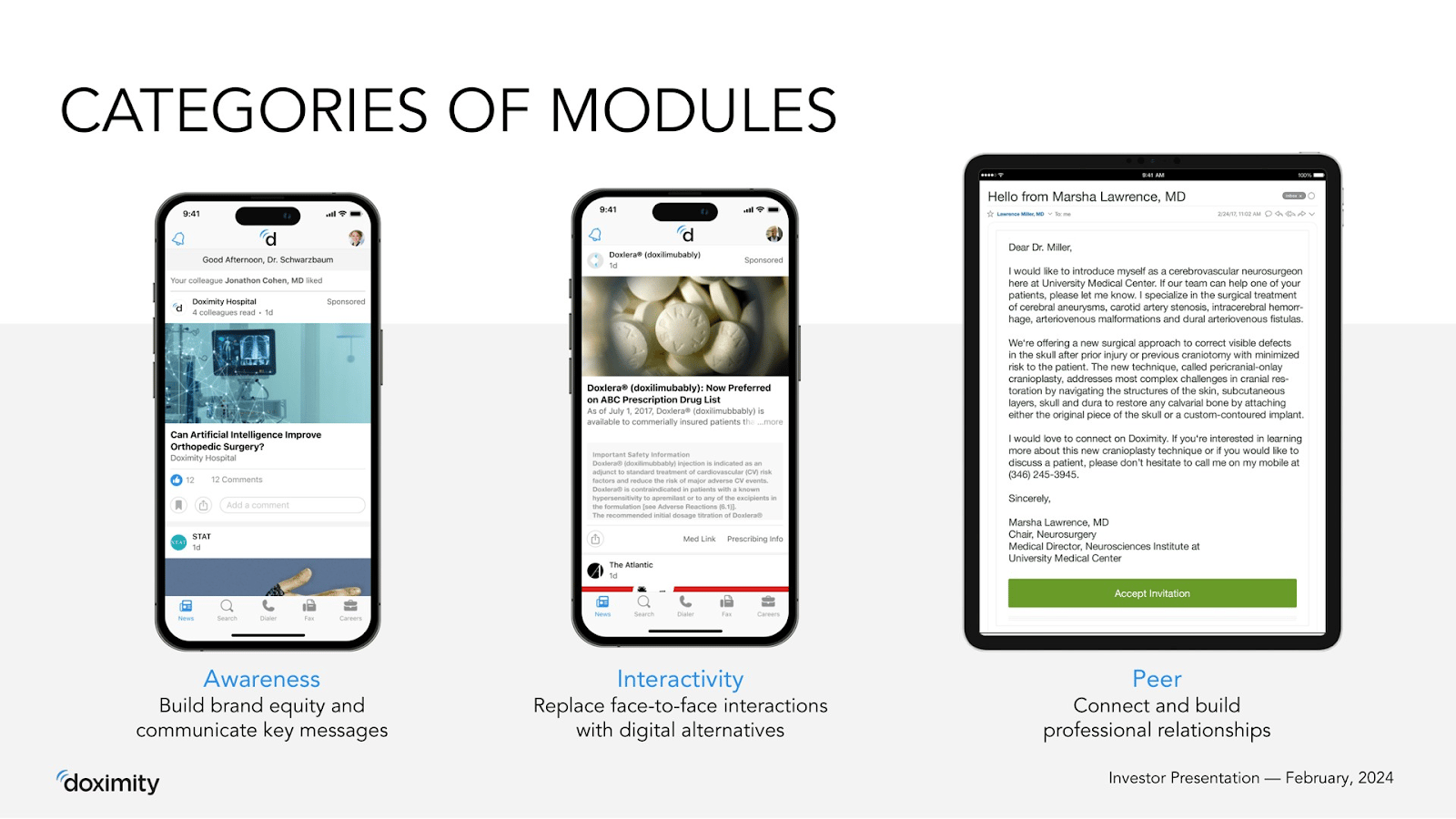

Instead, they sell “modules” on subscription.

Rather than bidding on keywords in a real-time auction, pharma companies and health systems sign up for contracts that specify three main things: which audience they want to reach, how large that audience should be, and what form the content will take. A module might be a sponsored clinical article in the newsfeed, a short educational video, a continuing-education (CME) course, or a workflow integration that surfaces during telehealth visits.

The key for advertisers is that delivery is guaranteed. If you buy a module aimed at oncologists and the contract says it will reach 5,000 oncologists over the course of a year, that’s what happens. Put differently, as an advertiser, you’re not anxiously hoping that auction-pricing dynamics don’t spike prices the week your campaign goes live.

This choice only really makes sense because the customer base is so concentrated. More than 80% of Doximity’s revenue comes from roughly 100 clients, mostly large pharmaceutical brands and major hospital systems. With so few buyers, a traditional auction would be thinly traded and noisy. A subscription model that feels more like a packaged, B2B media product fits reality better.

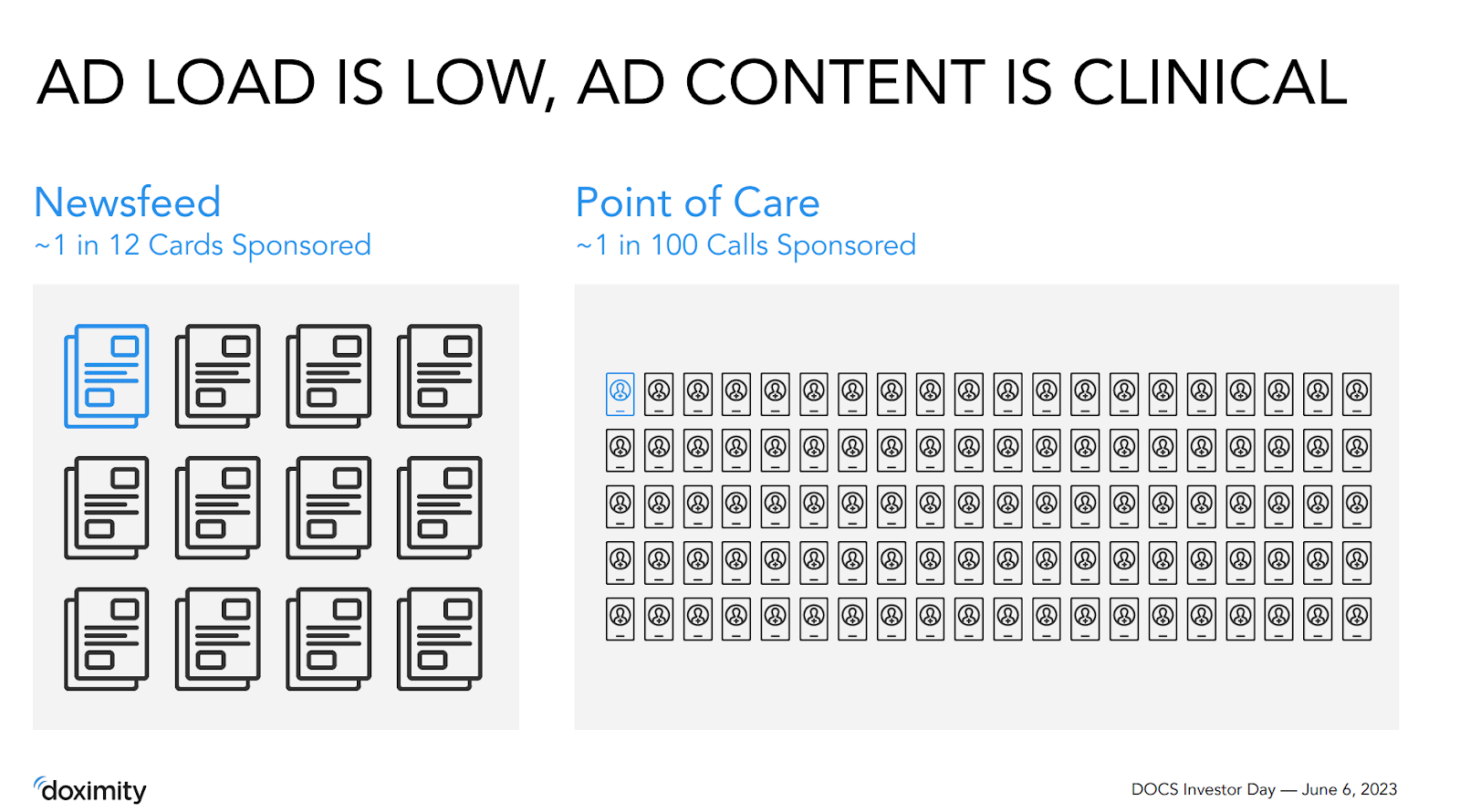

It also changes the design incentives inside the product. Traditional social networks are pressured to jam as many ad slots onto the screen as possible, because every marginal impression is revenue. Doximity’s curated module approach lets them keep ad density low and focused on content that feels clinically relevant. The ad load in the feed is modest, and the content is clinically-oriented, not consumer fluff, or “AI slop,” as the kids say.

In the newsfeed, sponsored modules might look like summaries of new clinical trials, video explainers from key opinion leaders, or continued-education content that happens to be underwritten by a drug maker.

In the workflow, modules can pop up in moments that would otherwise be dead time. Doximity’s telehealth tool, for instance, can show short updates on guideline changes or insurance coding while a doctor is waiting for a patient to join a virtual visit. Those updates may be sponsored, but they still aim to be useful.

There are also peer-to-peer modules around jobs and recruiting. Hospitals can pay to highlight staff openings to specific types of doctors, and because Doximity has high penetration among medical students and residents, those listings can matter a lot for early-career physicians.

Underneath all of this is a simple idea: if the platform genuinely makes doctors’ professional lives easier, they’ll keep coming back, and advertising can ride on top of that engagement without poisoning the experience.

The Product That Keeps Doctors Coming Back

It’s one thing to sign up 80% of doctors for a profile; it’s another to become a tool they actually use.

Doximity’s strategy has been to bundle a set of small, practical utilities that all share two traits. First, they’re tailored to the specific frictions of medical practice. Second, they’re fully HIPAA-compliant, so physicians can, as mentioned, use them without worrying about patient privacy regulations.

On the more mundane end, there are secure document tools that let doctors e-sign forms and fax them directly from their phones. Despite how simple that sounds, it’s a non-trivial upgrade given how medical workflows still depend on physical printers and fax machines.

The fan-favorite, though, is Dialer.

Dialer lets a doctor call a patient from their personal phone while masking the number, with the patient seeing the clinic’s caller ID instead. Naturally, doctors don’t want patients having their personal cell numbers, and patients are more likely to answer when the clinic number pops up rather than an unknown caller.

Dialer also powers telehealth sessions, which became especially important during COVID. Doximity offers a paid version called Dialer Pro for individuals and has enterprise-level deals where hospitals can roll the tool out across their clinician base. Those enterprise subscriptions account for roughly 10–15% of revenue; the rest is almost entirely advertising.

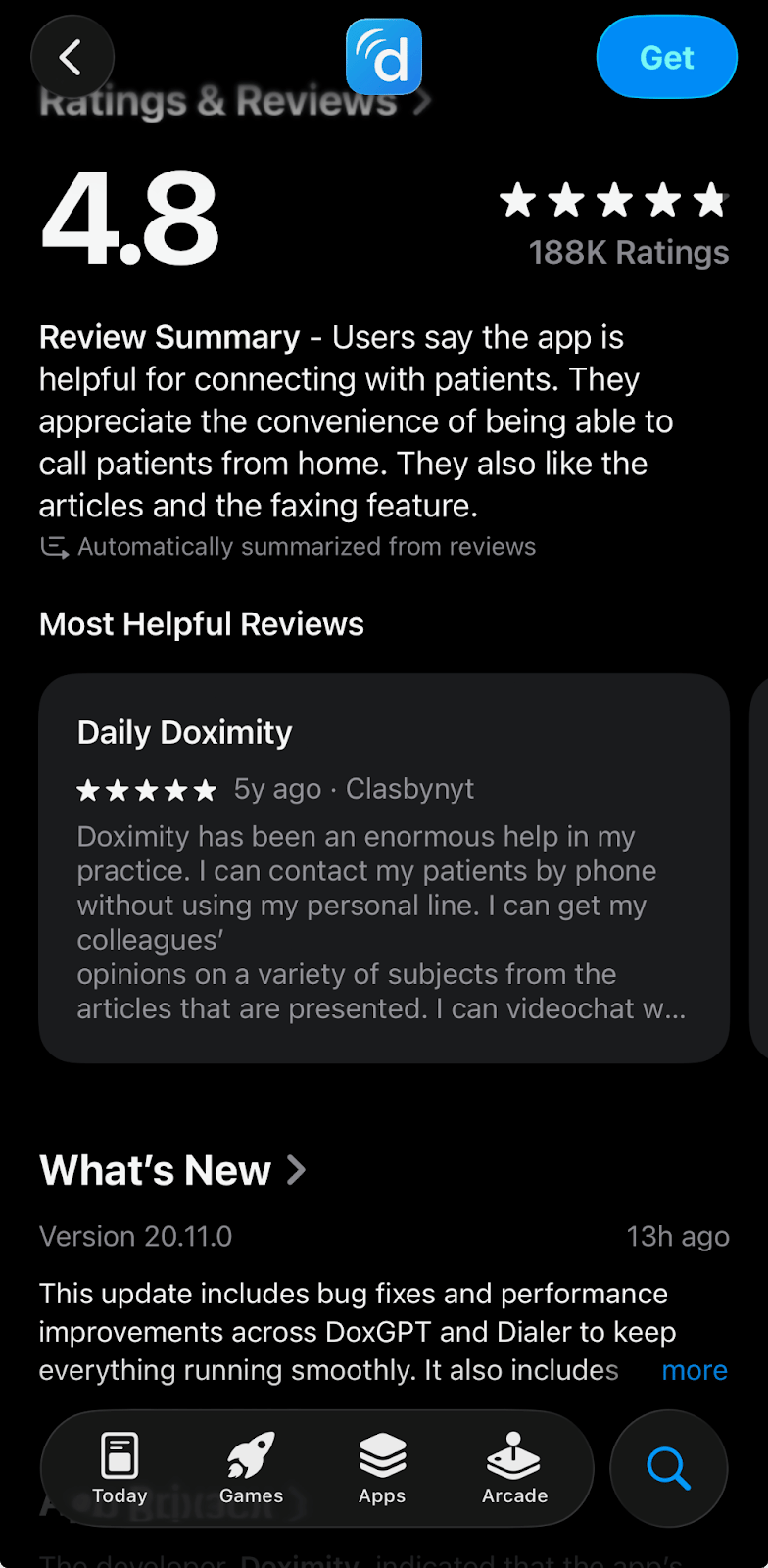

From a user-love standpoint, the app seems to resonate. On the Apple App Store alone, Doximity has close to 200,000 reviews and an average rating of 4.8 out of 5.

DoxGPT, which the company brands implicitly as “ChatGPT for doctors,” isn’t trying to win the LLM Olympics on raw model quality. Its edge is that it’s integrated into the tools doctors already use on Doximity.

To improve DoxGPT’s clinical depth, Doximity acquired a company called Pathways in 2025. Pathways built an AI model that scored 96%(!) on the U.S. Medical Licensing Exam, and its dataset is now being folded into DoxGPT. Combined with a partnership with Research Solutions, DoxGPT can surface full-text PDFs from more than 2,000 medical journals directly from the citations it generates. Doctors no longer have to juggle multiple logins or paywalls to verify a study.

Now, any physicians in our audience might be pulling out their hair right now, because the industry-leader in what we’re describing isn’t DoxGPT, but OpenEvidence, which has become something of a default LLM for young physicians. OpenEvidence is laser-focused on answering dense clinical questions with references to guideline-backed literature.

By contrast, DoxGPT’s strength, at least until the Pathways acquisition, is in being woven into one’s workflow. It may not be as sophisticated as OpenEvidence in pure Q&A, but it can draft an insurance appeal, attach the right citations, and then fax it out, all from within the same HIPAA-compliant ecosystem, which is immensely practical and useful. The comparison, roughly, that I make in my head is that OpenEvidence is like ChatGPT, in being this incredibly powerful standalone tool, whereas Alphabet’s Gemini model is advantaged by being woven into Google’s suite of productivity apps (Google Workspace), similar to DoxGPT.

Where The Growth Could Come From

Doximity estimates its total addressable market at about $18.5 billion. That figure aggregates three main categories of spending: pharma marketing to health care professionals, health system marketing for commercial and staffing purposes, and telehealth tools.

With roughly $600 million of revenue today, the company has captured only a small slice of that pie, even if we haircut their TAM math. Doubling revenue would still leave them at roughly 5% penetration.

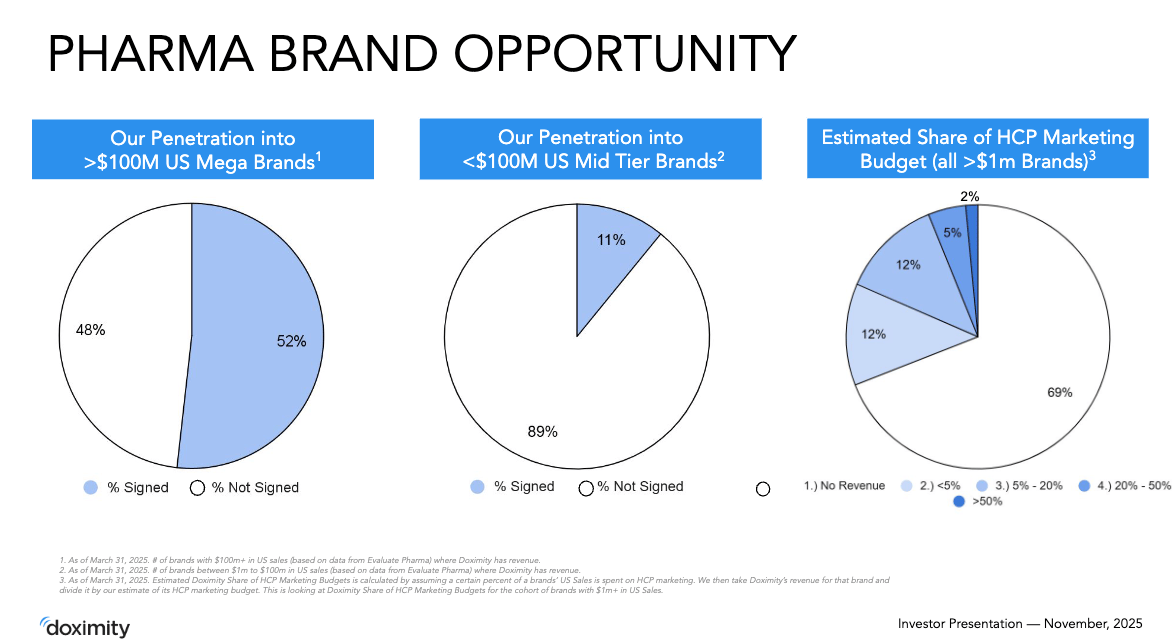

TAM discussions are always subjective, though, so the more interesting data to me is the wallet-share breakdown they provide for pharma brands.

Doximity buckets each U.S. pharma brand with more than $1 million in annual sales into groups based on how much of its marketing budget is spent on Doximity. For almost 70% of those brands, the answer today is effectively zero. Another 12% of brands spend less than 5% of their budgets with Doximity, and only 7% allocate more than 20% of their physician-targeted marketing to the platform.

See below:

So even among brands that are already using Doximity, most are barely experimenting.

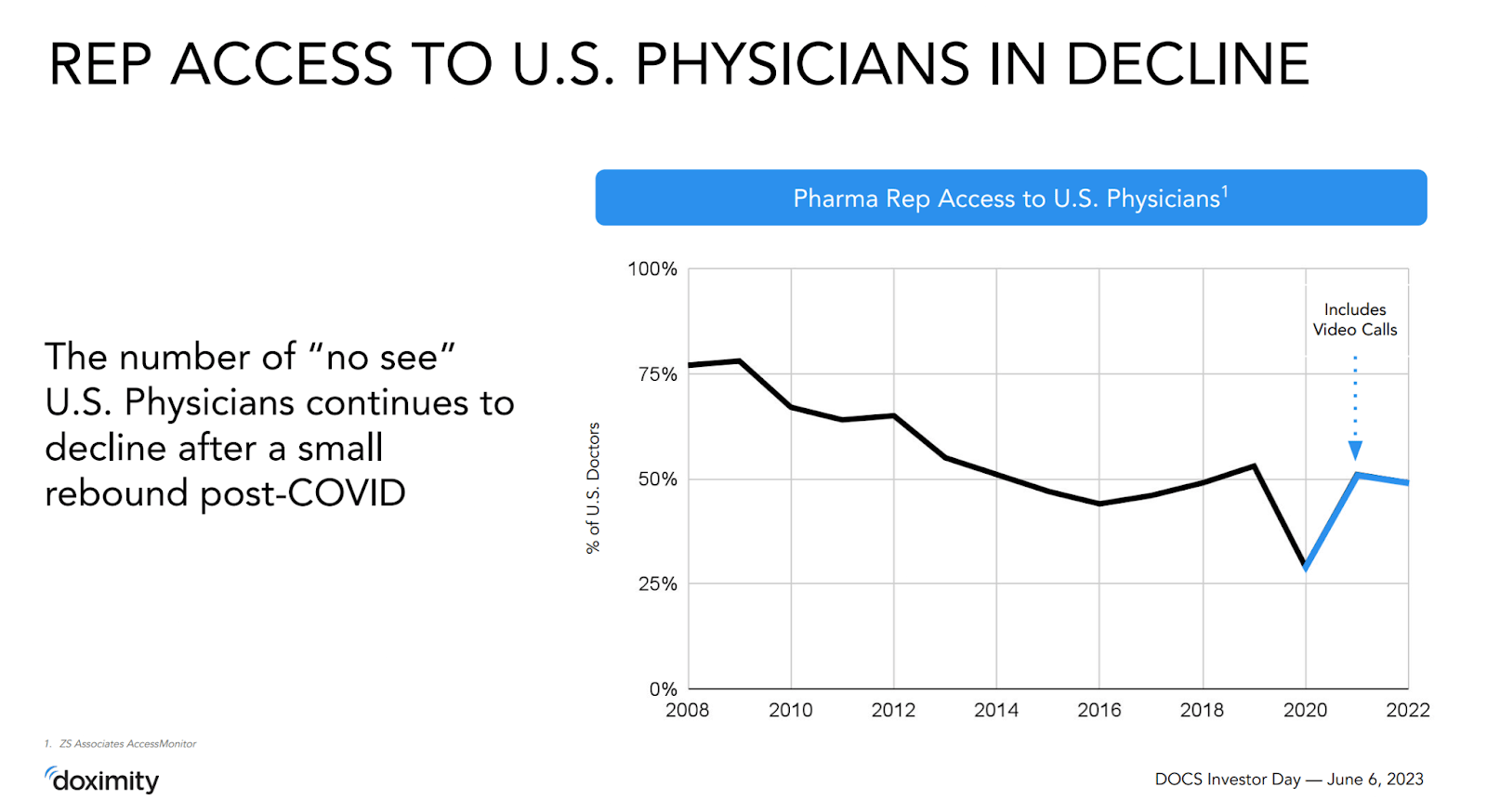

Given that pharma marketing overall tends to grow in the mid-single digits, the bigger opportunity is less about the industry expanding and more about budget shifting from traditional channels — sales reps, print journals, TV ads — toward digital channels where attribution is clearer. It’s similar to the digital advertising tailwinds supporting Roku we discussed a while back.

COVID accelerated this shift by making it harder for reps to get face time with doctors, fueling a growing share of “no-see” physicians who have little interest in being sold to in person (the prior industry standard).

Regulation may end up tilting the mix further. Recent FDA rules require longer disclosure of side effects and risks in direct-to-consumer TV ads, which not only makes those ads more expensive to run, but also less effective in practice. If consumer-facing channels become less attractive, it’s easy to imagine pharma reallocating more dollars toward professional channels like Doximity, where the audience is smaller but vastly more relevant.

On the workflow side, enterprise subscriptions are still a relatively small line item, but they can deepen the moat. When a hospital buys Dialer and related tools for its entire clinician base, Doximity isn’t just an optional app on a doctor’s phone anymore. It becomes embedded in the daily operations of the institution, which can lock in usage.

And then there’s AI. Again, I don’t want to build a thesis purely around DoxGPT, but if the Pathways acquisition and the Research Solutions partnership lead to deeper clinical adoption, it’s not hard to envision a future where Doximity becomes an important place for doctors to both handle paperwork and get quick, evidence-backed answers to care questions. Accordingly, more time on-platform translates into more opportunities to serve useful, high-value ad modules.

The Red Flags Around Engagement

At about this point in my research, I was beginning to think that Doximity could be a huge home run. A fast-growing, highly profitable network of physicians with promising potential to soak up a larger and larger share of Big Pharma’s ad budgets.

Unfortunately, the part that has made me most uncomfortable with Doximity is how little transparency management has provided around actual engagement, which is really foundational to the entire thesis.

For a business that has any kind of social or network-driven component, you’d expect to see basic stats on active users. Monthly active physicians, daily active users, average time spent, cohort retention, etc.

Doximity doesn’t really share any of that.

They like to talk about having 80% of U.S. physicians registered, and over 90% of medical students signed up. While that sounds impressive, “registered” is not the same as “active.” I’m a registered Facebook user, but I haven’t personally used it in any meaningful way in, I don’t know, maybe a decade? If Meta made a point of including me in some capacity in the key metrics they show investors, it would be incredibly misleading, because, despite having a profile, I don’t ever log-in!

The more I learned about the business, the weirder it got to me that they aren’t more transparent about engagement numbers. A member of our Intrinsic Value Community, who works in health care, helped me by canvassing colleagues across multiple hospitals, specifically asking who used Doximity regularly in their practice. The answer, in that small sample set, was essentially “almost no one.”

That’s anecdotal, but it does rhyme with what’s surfaced in recent legal filings.

Since April 2024, Doximity and several executives have been named in a securities class action alleging that they made materially misleading statements about “active” physician members and engagement rates. There are also derivative shareholder suits claiming gross mismanagement and breach of fiduciary duty. One survey that’s been cited suggests that roughly half of physicians either have never used Doximity or use it less than once per quarter. Yikes!

In allowing these cases to proceed, with trials scheduled for 2026, a judge believes the claims are valid enough to not be completely waved away.

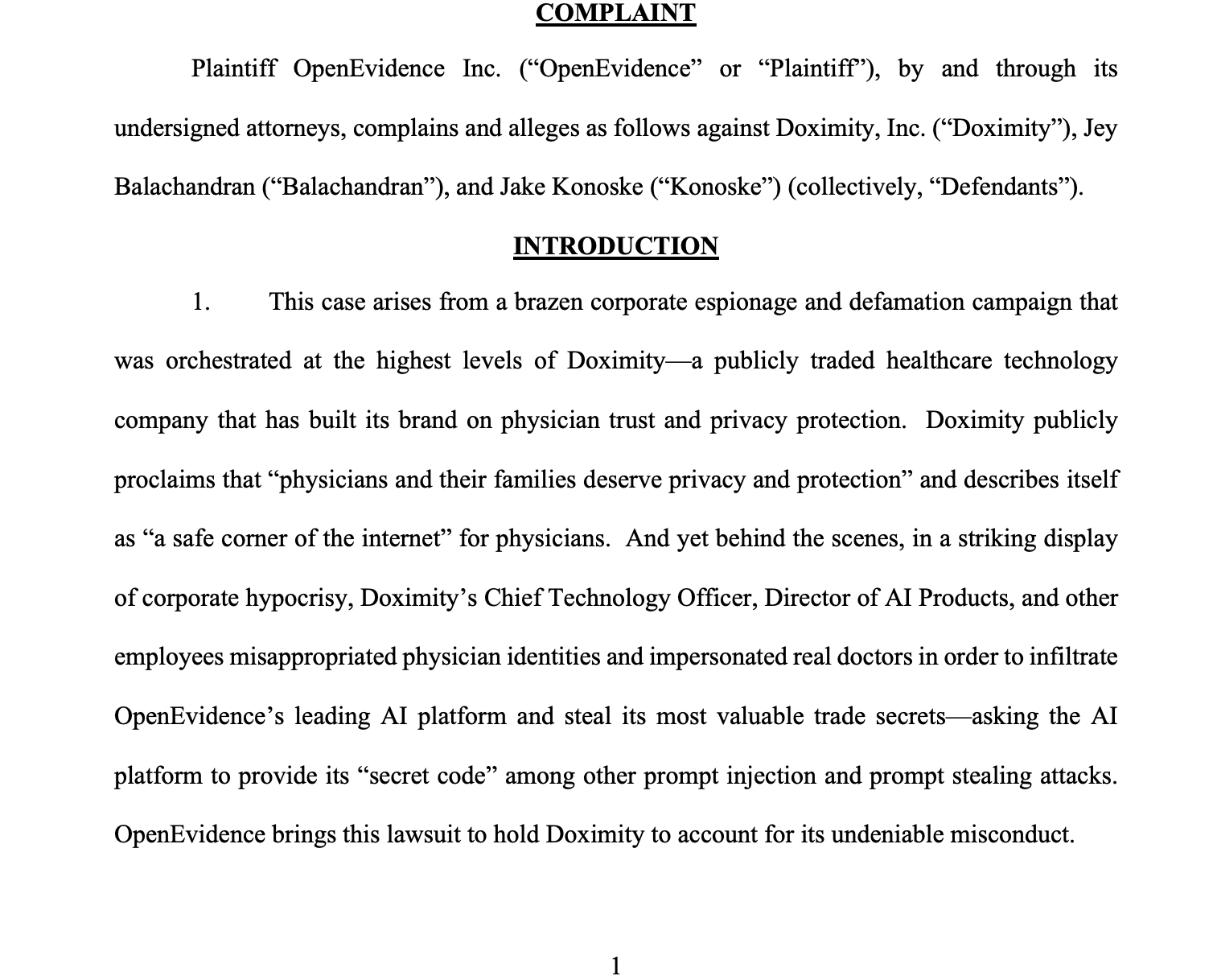

Overlay that with a separate suit brought by OpenEvidence, accusing Doximity of impersonating physicians to gain access to its LLM and stealing trade secrets about how the system works, and suddenly, the entire business looks…shady.

Here’s an excerpt from the first page of the lawsuit:

Page 1 of the OpenEvidence suit against Doximity

To be clear, OpenEvidence has its own agenda for framing Doximity’s actions in this way, and rigorously querying a free-to-use AI tool to better understand how its model works doesn’t strike me as imminently damning. If the model gives away details it shouldn’t, that sounds less like corporate espionage and more like incompetence on OpenEvidence’s side, but I’m no lawyer.

Nevertheless, my question is, how do you confidently underwrite growth in earnings per share when you’re not sure how many users there really are to monetize, or how engaged those users actually are?

I take some comfort in knowing the company is founder-run, with a CEO that has a very sizable personal stake in the business, yet, and I say this tongue-in-cheekly, FTX was also founder-run. Not to even remotely suggest that Doximity has fraudulently misrepresented its business (the courts will hopefully soon determine that) to the extent that Sam-Bankman Fried did, but the point is the more that we often put leaders on a pedastool who have acted as founders & CEOs, but there are certainly instances where that backfires.

Competitive Pressures In The Workflow

After reading through Doximity’s legal challenges and finding very little anecdotal evidence illustrating the picture that Doximity has painted to investors, my excitement waned, and I began to consider the competitive landscape, too.

Doximity is without a true peer (nobody else really does exactly what they do), but the player I worry about most is Epic Systems, through its MyChart platform.

EPic’s MyChart

Epic is a privately held company, so information on its operations is limited, but MyChart is the patient-facing portal many of us have used without thinking about it. It aggregates medical records, lets you message doctors, book appointments, and pay bills — it’s deeply embedded in hospital systems as part of the electronic health record (EHR) infrastructure.

These are mandatory, mission-critical systems, whereas Doximity is simply not.

Epic already has something called “Doximity Dialer integration,” which suggests that, today, they’re collaborating, but the worry is if Epic decides to replicate that functionality natively. If MyChart evolves to fully handle patient messaging, masked calling, and telehealth in a way that’s tightly integrated with its medical record,s the relative importance of Doximity’s Dialer & telehealth offerings diminishes.

While these subscriptions are only a small share of total sales, the bigger risk is that, if doctors no longer rely on Doximity for communication tools, their reasons to open the app in the first place shrink, which in turn reduces the inventory of attention that Doximity can monetize through advertising.

Then there’s OpenEvidence, which, according to its own legal filings, has roughly twelve times Doximity’s engagement among physicians on its platform. If clinicians start routing more of their medical questions and research time through OpenEvidence rather than DoxGPT, that’s another piece of the workflow that could shift away.

And we shouldn’t forget macro exposure, either. Doximity’s ad base is highly concentrated. That concentration is part of the appeal, but it also means Doximity is closely tied to Big Pharma's profitability and regulatory environment.

If future policy changes significantly compress drug margins, or if aggressive pricing reforms take hold, advertising and marketing budgets would be one of the first things cut, to Doximity’s detriment.

Valuation & Final Thoughts

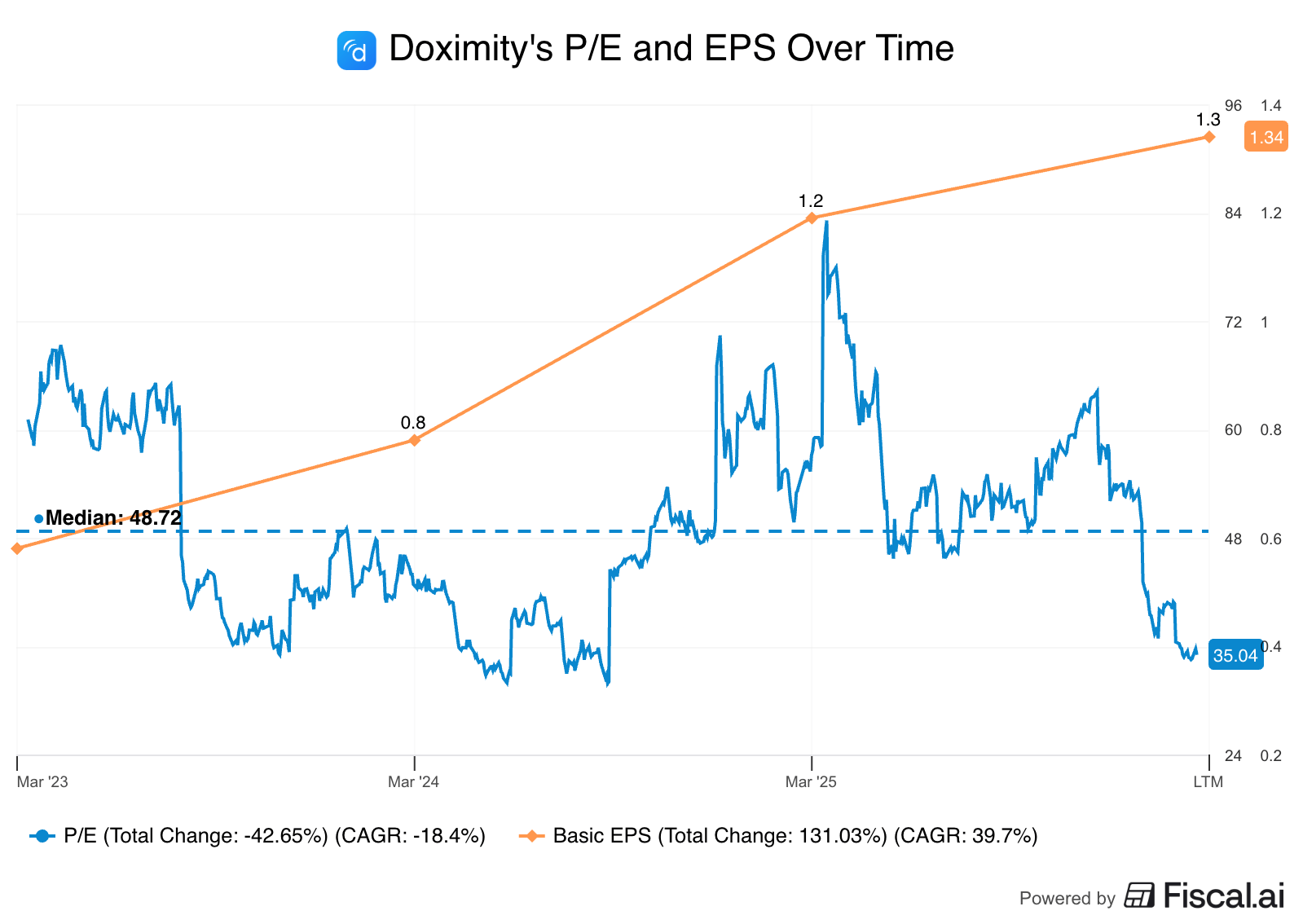

Historically, the market has paid as much as 80x earnings for this business, and that doesn’t surprise me, because the financials look so good. Today, the valuation multiple has compressed, but investors are still paying a premium to own Doximity.

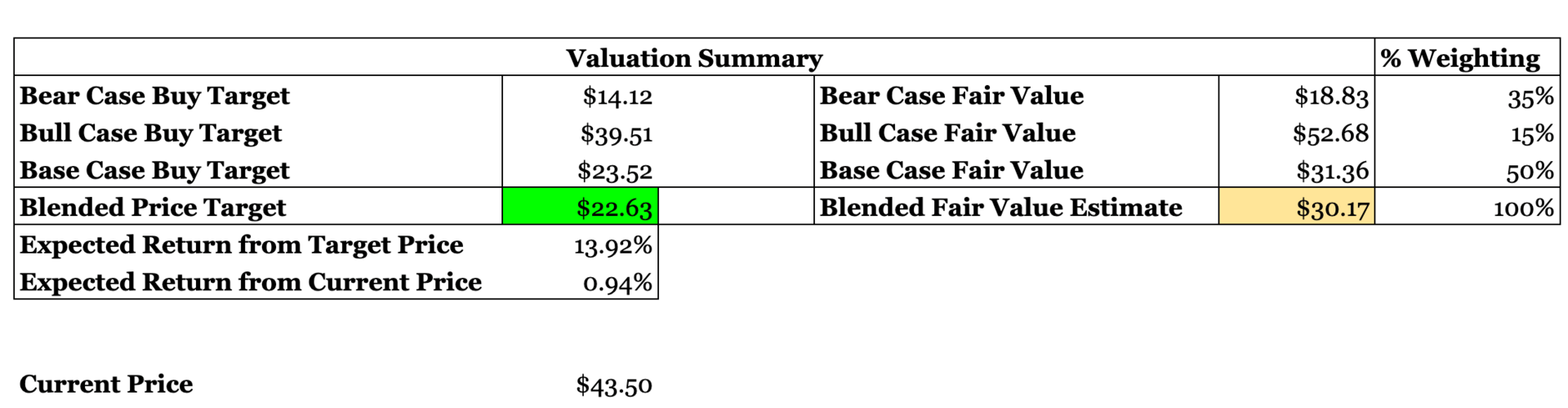

Yet, the base-case math I modeled says that if you believe the company can keep growing sales by low double digits and modestly grow its margins, with a mid-20s exit multiple, then the stock trades at a 30-50% premium to my estimate of its fair value.

More troubling is my minimal faith in even estimating a conservative fair value, since the lack of transparency on engagement, the lawsuits about how those engagement numbers were presented, and the risk of Epic and others eroding Doximity’s moat, all push me toward being wary of the bear case, I gave the bear case a 35% weighting in my blended valuation (more weight than I normally give to bear cases!)

Blending my bear, bull, and base case outlooks, I wouldn’t even begin to find the company’s valuation attractive until it was, say, sub $25 per share.

But I also would need a whole lot more certainty before ever bothering with owning Doximity. If the legal clouds clear and if we get better disclosure on actual engagement, I’d significantly revise my model here. If the results are positive, I could imagine wanting to own this business at a higher price, actually, once the fundamental uncertainty around users has faded. And if it hasn’t faded, then Daniel and I are happy to stay away from Doximity indefinitely.

It’s always a shame when the narrative sold by management is so genuinely exciting, only for you to come across a much blander reality as you dig beneath the surface.

Generally, I prefer businesses that actually undersell their strength, per the logic outlined by Peter Thiel in Zero to One, which roughly argues that powerful businesses try to understate their strength (to reduce regulatory attention), while weak businesses spend more time peacocking to investors. The former seems to be the case with Doximity.

Updates on Intrinsic Value Portfolio below!

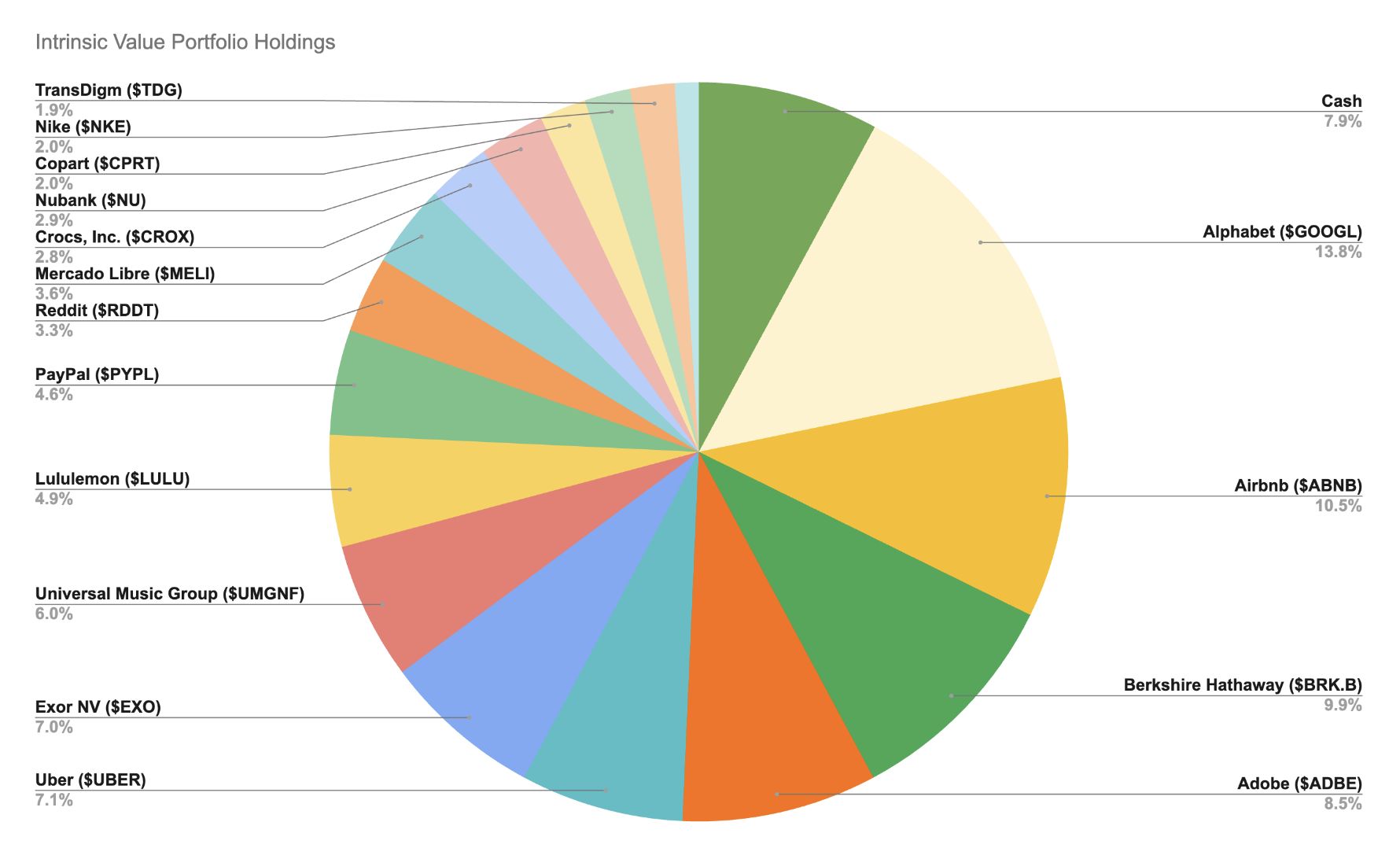

Weekly Update: The Intrinsic Value Portfolio

Notes

Adobe is, by far, the most contentious stock in our portfolio — across value investing circles, a blistering debate has erupted over the merits of the business and the attractiveness of its valuation in light of the disruption risks posed by AI tech. Our friend, Leandro of Best Anchor Stocks, put together an excellent reflection on why Adobe’s stock hasn’t matched the business’s growth. He describes Adobe now as a “coiled spring,” thanks to large buybacks and increased adoption of its own AI-based tools, just waiting for a shift in sentiment to explode to the upside, similar to how Alphabet went from being framed as one of the biggest losers in AI to being one of the biggest winners. We completely agree.

Next month, we’ll host a call in our Intrinsic Value Community with Leandro himself, and dive deeply into the investment case for $ADBE — if you’d like to participate, you’ll want to apply to join our Intrinsic Value Community here.

After being down in the dumps this time a year ago, now it seems only good headlines come from our other portfolio holding, Alphabet. On that note, this past week, Google’s DeepMind shared an update on Project Genie, where, with a prompt, or even just a picture, you can create an entire virtually navigable world(!) See the incredible demo for yourself here.

Quote of the Day

“In nothing do men more nearly approach the gods than in giving health to men.”

— Cicero

What Else We’re Into

📺 WATCH: How Aswath Damadoran is thinking about investing in the world of AI

🎧 LISTEN: Joyful Excellence with Brad Stulberg — the Richer, Wiser, Happier podcast

📖 READ: Why isn’t Adobe’s stock working?

You can also read our archive of past Intrinsic Value breakdowns, in case you’ve missed any, here — we’ve covered companies ranging from Alphabet to FICO, Transdigm, Lululemon, PayPal, DoorDash, Crocs, LVMH, Uber, and more!

Your Thoughts

Do you agree with the portfolio decision for Doximity?Leave a comment to elaborate! |

See you next time!

Enjoy reading this newsletter? Forward it to a friend.

Was this newsletter forwarded to you? Sign up here.

Join the waitlist for our Intrinsic Value Community of investors

Learn how to join us in Omaha for the 2026 Berkshire Hathaway shareholder meeting!

Shawn & Daniel use Fiscal.ai for every company they research — use their referral link to get started with a 15% discount!

Use the promo code STOCKS15 at checkout for 15% off our popular course “How To Get Started With Stocks.”

Read our full archive of Intrinsic Value Breakdowns here

Keep an eye on your inbox for our newsletters on Sundays. If you have any feedback for us, simply respond to this email or message [email protected].

What did you think of today's newsletter? |

All the best,

© The Investor's Podcast Network content is for educational purposes only. The calculators, videos, recommendations, and general investment ideas are not to be actioned with real money. Contact a professional and certified financial advisor before making any financial decisions. No one at The Investor's Podcast Network are professional money managers or financial advisors. The Investor’s Podcast Network and parent companies that own The Investor’s Podcast Network are not responsible for financial decisions made from using the materials provided in this email or on the website.